S. 2444: End Polluter Welfare Act of 2025

The "End Polluter Welfare Act of 2025" is legislation designed to phase out government support for fossil fuel industries. The bill encompasses several key provisions aimed at curtailing subsidies, reducing dependence on fossil fuels, and encouraging a transition to cleaner energy sources. Below are the main aspects of the bill:

Elimination of Fossil Fuel Subsidies

The bill seeks to eliminate various subsidies for fossil fuel production. This includes the removal of tax breaks and other forms of government funding for projects that support fossil fuels. By modifying existing laws, the intention is to decrease reliance on fossil fuels while promoting the use of cleaner energy alternatives.

Tax Code Amendments

The legislation amends the Internal Revenue Code to terminate key tax benefits for companies involved in oil, natural gas, and coal production. Some notable changes include:

- Ending the last-in, first-out inventory method, which benefits fossil fuel companies in terms of tax calculations.

- Stopping the percentage depletion deduction that currently helps oil and gas companies.

- Setting specific effective dates for these changes, which will take place after the bill is enacted.

Mining and Drilling Cost Deductions

Specific provisions allow certain costs related to mining exploration to be amortized over a period of 84 months. Additionally, the legislation includes new rules for deducting intangible drilling costs associated with oil and gas wells, which will also follow an amortization schedule.

Updates on Clean Hydrogen Production

The bill also addresses the production of clean hydrogen by updating tax definitions and compliance requirements. It establishes new provisions concerning clean hydrogen production and ensures that they align with the broader goal of eliminating fossil fuel subsidies. Specific past legislation related to fossil fuel subsidies is repealed to reinforce environmental compliance and accountability.

Environmental Compliance and Reporting

The act emphasizes the need for enhanced environmental compliance and reporting requirements for any remaining fossil fuel subsidies. This aims to ensure that fossil fuel companies are held accountable for their environmental impacts.

Relevant Companies

- XOM - Exxon Mobil Corporation: This company may see significant impacts due to the removal of tax benefits that have historically supported its oil production operations.

- CVX - Chevron Corporation: As another major player in the fossil fuel sector, Chevron could also be affected by changes in tax regulations that impact profitability.

- COP - ConocoPhillips: The termination of specific tax breaks might alter the financial landscape for ConocoPhillips in terms of operational costs.

This is an AI-generated summary of the bill text. There may be mistakes.

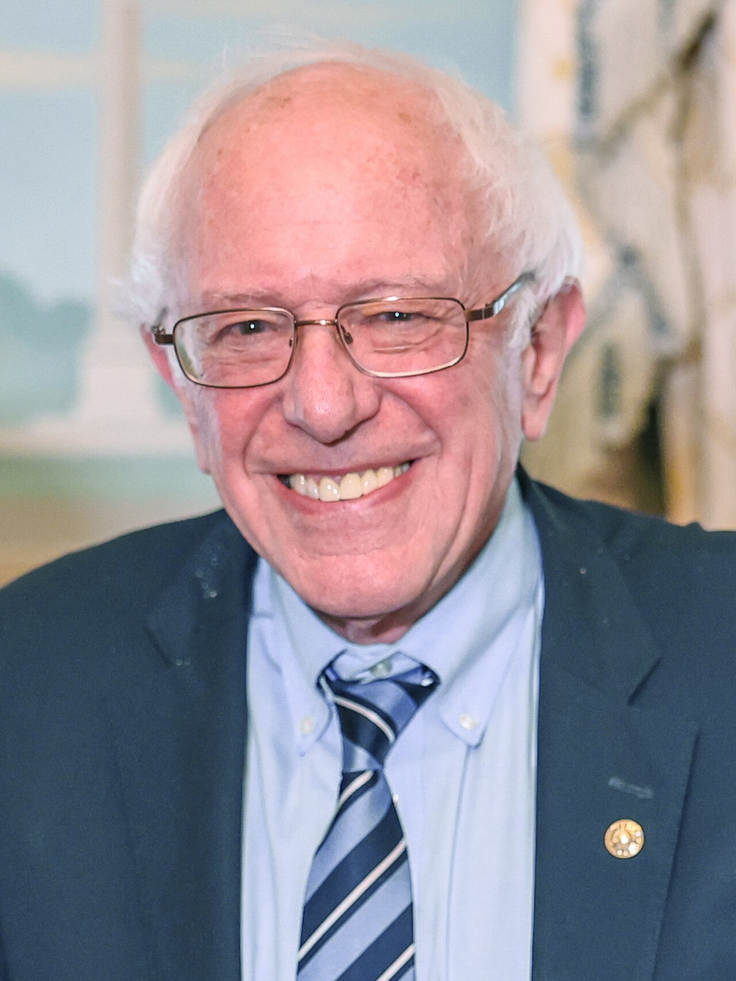

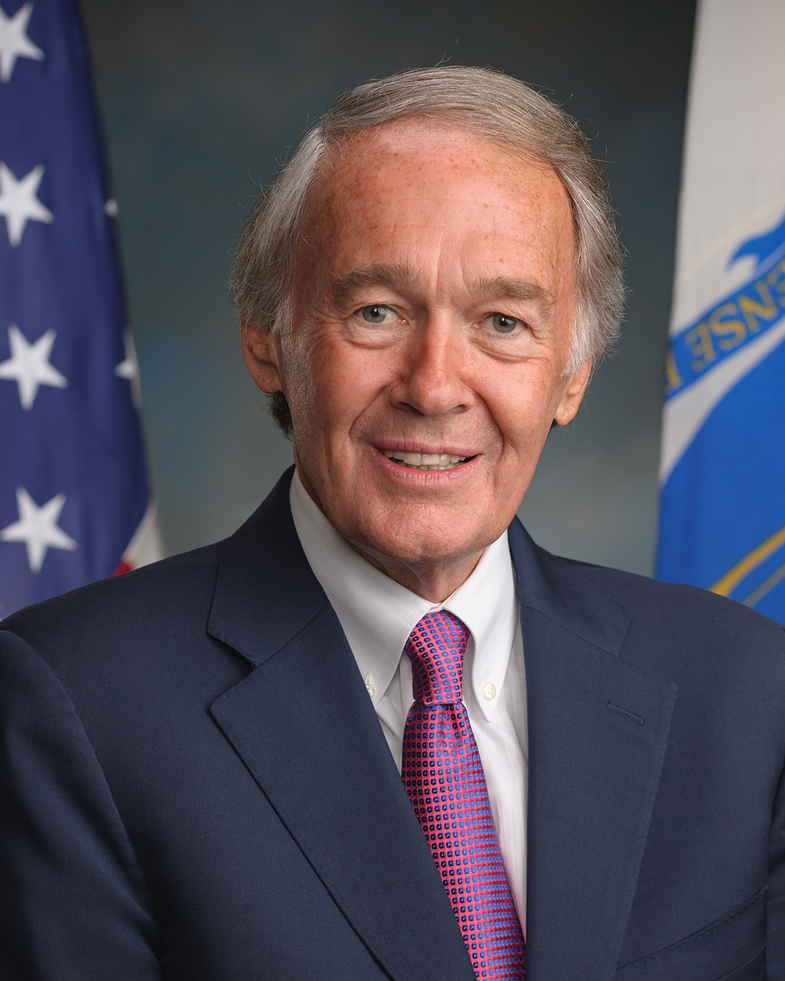

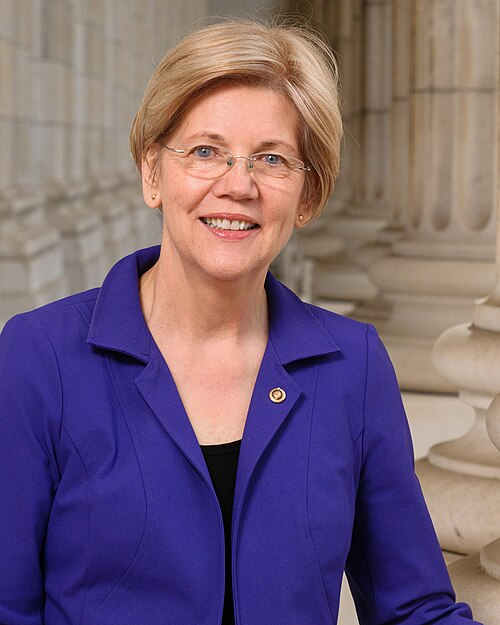

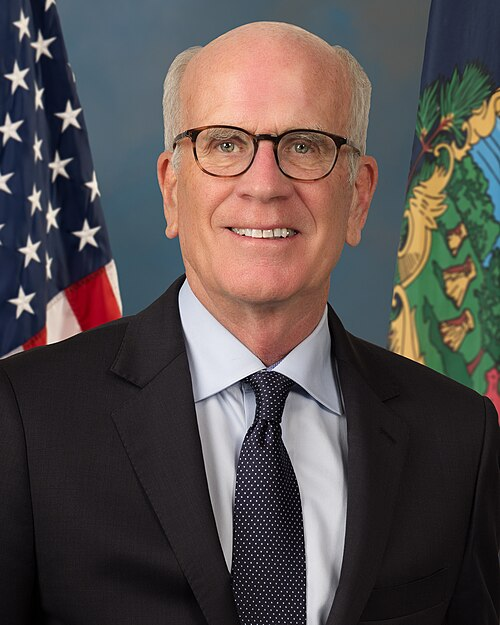

Sponsors

7 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 24, 2025 | Introduced in Senate |

| Jul. 24, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.