We have received text from H.R. 4274: REMIT Act of 2025. This bill was received on 2025-07-02, and currently has 8 cosponsors.

Here is a short summary of the bill:

The REMIT Act of 2025 aims to alter the financial landscape surrounding money transmitting businesses, focusing specifically on the regulation and taxation of remittances. Here’s a breakdown of the main components:

Overview

This legislation is designed to limit the federal government's ability to impose excise taxes and fees on businesses that transmit money. This includes both formal businesses and informal systems that help send money across borders.

Key Findings

- Importance of Remittances: Remittances are crucial financial flows, particularly for individuals from diaspora communities who send money back to their home countries. These transactions, while often small (a few hundred dollars), collectively amount to a significant global market.

- Impact of Fines: Previous attempts to regulate remittances through fines have not stopped the flow of money. Instead, they have pushed consumers to use unregulated methods.

- Risks of Informal Systems: Informal value transfer systems (IVTS) can be appealing due to their lack of documentation and anonymity, but they also pose risks related to money laundering and terrorism financing.

- Criminal Activity Concerns: Reports have indicated that some IVTS are linked to criminal organizations and are used to facilitate money laundering and the funding of terrorist activities.

Excise Taxes and Fees on Money Transmitting Businesses

The bill establishes new requirements governing the imposition of excise taxes and fees on money transmitting businesses:

- The federal government cannot require such businesses to pay taxes or fees unless the Secretary of the Treasury certifies to Congress that the proposed tax or fee will not:

- Increase opportunities for money laundering or other illicit financial activities.

- Place an undue burden on the businesses that transmit money.

Definition of Money Transmitting Business

This legislation defines a "money transmitting business" as any licensed sender of money or any entity that engages in the transmission of currency, funds, or any value substitution. This includes formal and informal systems for transferring money, whether domestically or internationally, outside the usual financial institutions.

Implications

By limiting the government's ability to impose taxes and fees, the bill seeks to ensure that money transmitting businesses can operate more freely, potentially increasing their use and mitigating reliance on informal systems that pose financial crime risks. It addresses both the necessity of remittances for economic stability in receiving countries and the challenges posed by illegal financial activities.

Relevant Companies

- MA (Mastercard): Might be affected due to changes in the regulatory landscape for money transfers, potentially enhancing their competitiveness against informal and unregulated systems.

- V (Visa): Similar to Mastercard, Visa could experience impacts in terms of transaction volume and regulation, as remittance-related fees are prominent in operational discussions.

- WU (Western Union): As a major player in the remittance market, the company may face direct effects due to new regulations impacting its business model and market position.

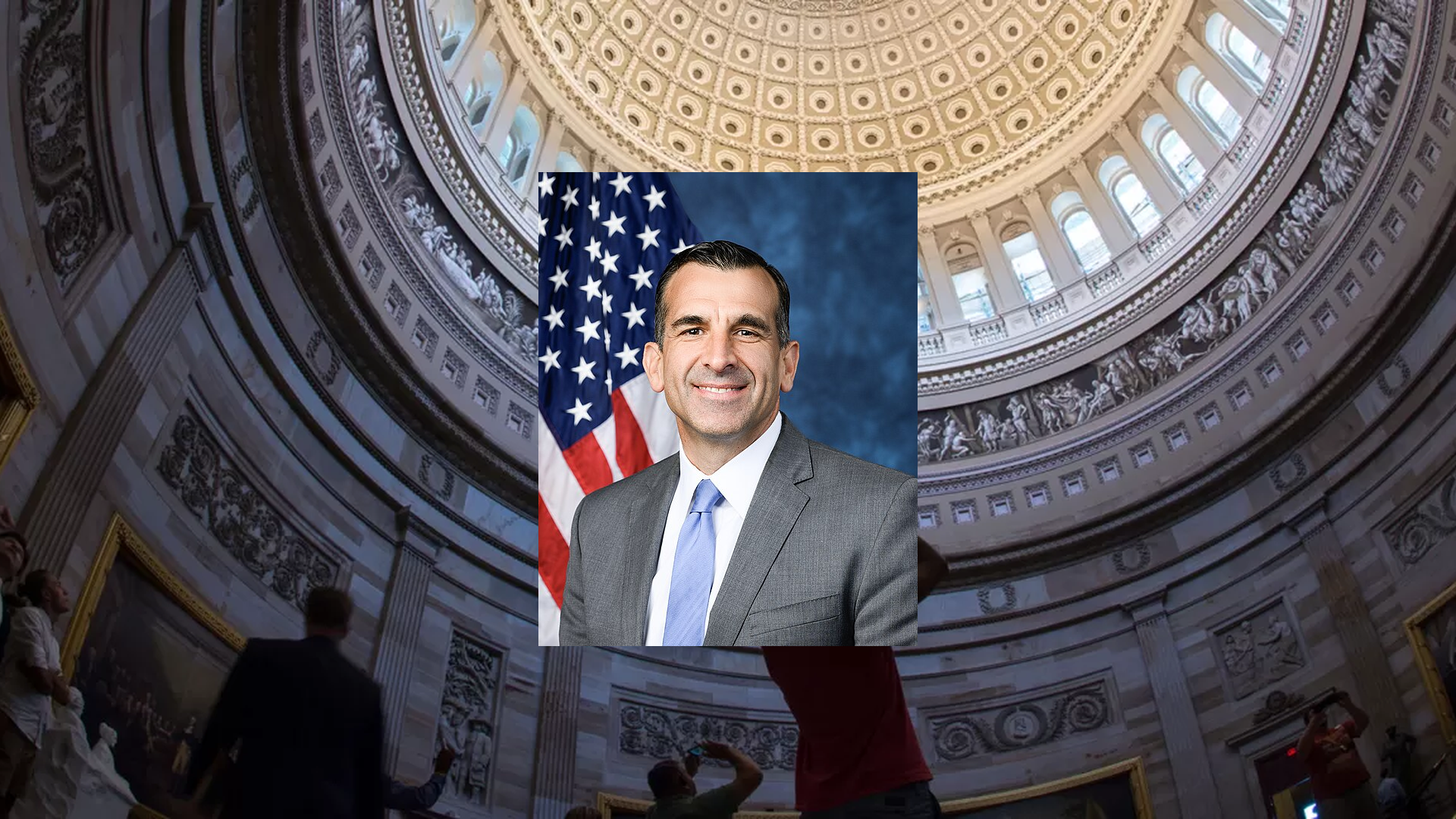

Representative Sam Liccardo Bill Proposals

Here are some bills which have recently been proposed by Representative Sam Liccardo:

- H.R.4479: To amend the National Housing Act to direct the Secretary of Housing and Urban Development to establish a program to insure certain second liens secured against property for the purpose of financing the construction of an accessory dwelling unit, and for other purposes.

- H.R.4274: To limit the imposition of excise taxes and fees on money transmitting businesses, and for other purposes.

- H.R.3454: Protecting Our Constitution and Communities Act

- H.R.2371: Scarper Ridge Golden Gate National Recreation Area Boundary Adjustment Act

- H.R.1712: MEME Act

You can track bills proposed by Representative Sam Liccardo on Quiver Quantitative's politician page for Liccardo.

Representative Sam Liccardo Net Worth

Quiver Quantitative estimates that Representative Sam Liccardo is worth $8.1M, as of July 22nd, 2025. This is the 109th highest net worth in Congress, per our live estimates.

Liccardo has approximately $605.2K invested in publicly traded assets which Quiver is able to track live.

You can track Representative Sam Liccardo's net worth on Quiver Quantitative's politician page for Liccardo.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.