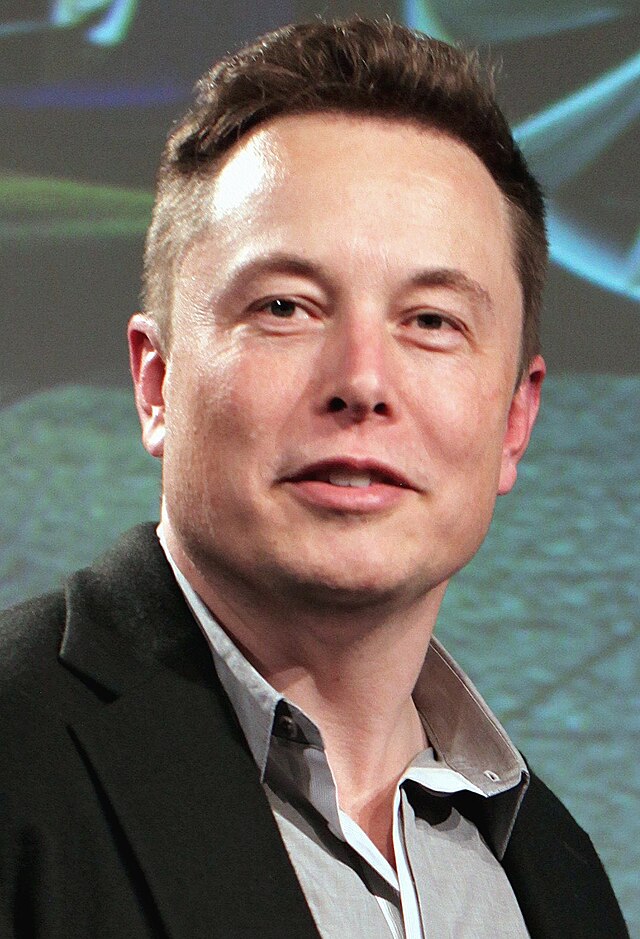

Elon Musk’s vision of transforming Tesla (TSLA) into a leader in autonomous transportation with a robotaxi fleet is proving to be a double-edged sword. While this bold pivot aims to position Tesla at the forefront of automotive innovation, it has also introduced significant turmoil within the company. As Tesla's stock price has plunged by over 40%, and strategic shifts have sidelined the development of a more affordable $25,000 electric vehicle, Musk’s management style—marked by drastic directional changes and large-scale layoffs—has come under intense scrutiny. The pressure is compounded by heightened competition in key markets like China and delayed plans for expansion into India, indicating potential cracks in Tesla’s previously unassailable growth trajectory.

In the face of declining sales and operational profits, which are down 40%, Tesla is navigating its most challenging period in recent years. The company’s shift to focus on the development of a robotaxi over more immediately lucrative projects has led to the departure of key managers and a general unease among the staff. The recent cancellation of a meeting with India’s Prime Minister and efforts to reinstate a $56 billion compensation package for Musk, previously voided by a judge, reflect a leadership grappling with internal and external pressures. These developments raise questions about the company’s strategic priorities and the feasibility of its long-term goals.

Market Overview:

-Tesla's stock price has plummeted over 40% amidst declining sales, product confusion, and a leadership shakeup.

-The company's dominant position in China's EV market faces increasing competition, and a planned investment announcement in India fell through.

Key Points:

-Facing a 40% drop in operating profit and its first revenue decline in four years, Tesla has undergone its largest layoffs ever.

-CEO Elon Musk has prioritized a next-generation "robotaxi" concept over a planned $25,000 electric car, unsettling investors and employees.

-Musk believes a new camera-based approach to Tesla's Full Self-Driving software will revolutionize autonomy, but regulatory hurdles and past accidents cast doubt.

-The focus on robotaxis comes at the expense of the cheaper car project, leaving investors who craved affordability concerned.

Looking Ahead:

-Tesla's success hinges on navigating regulatory complexities and achieving true autonomy with its FSD technology.

-Musk's leadership style and recent layoffs have created discord within the company.

-Investors are looking for reassurance, with Tesla needing to prove the viability of its robotaxi vision and deliver a more affordable car in the coming years.

Tesla's operational shifts are a gamble that robotaxis will eventually dominate the transportation sector, driving future profits and restoring investor confidence. However, the current reality presents a stark contrast, with Tesla facing operational headwinds and a significant downturn in its market valuation. The recent layoffs, described by insiders as the largest in the company’s history, signify a major restructuring aimed at reducing costs and reallocating resources towards autonomous vehicle technology. This move has not only affected Tesla's workforce but also its stock market standing, as evidenced by the significant reduction in its market cap.

The realignment of Tesla’s strategic focus away from more traditional, and currently more profitable, vehicle models to an uncertain future dominated by autonomous vehicles is fraught with risk. Investors and analysts are increasingly skeptical, with some, like Deutsche Bank’s Emmanuel Rosner, downgrading Tesla’s stock due to these concerns. As Tesla continues to push for innovation, the broader automotive industry watches closely, waiting to see if Musk’s ambitious bet on robotaxis will secure Tesla’s position as a leader in the next era of transportation or if it will serve as a cautionary tale of overreach and mismanagement.