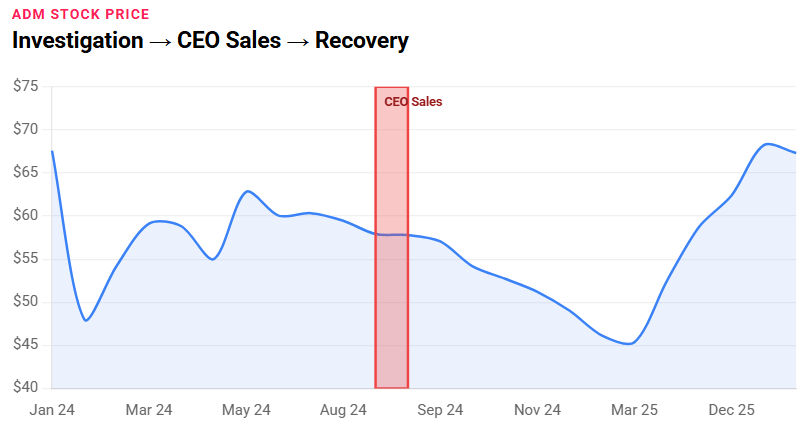

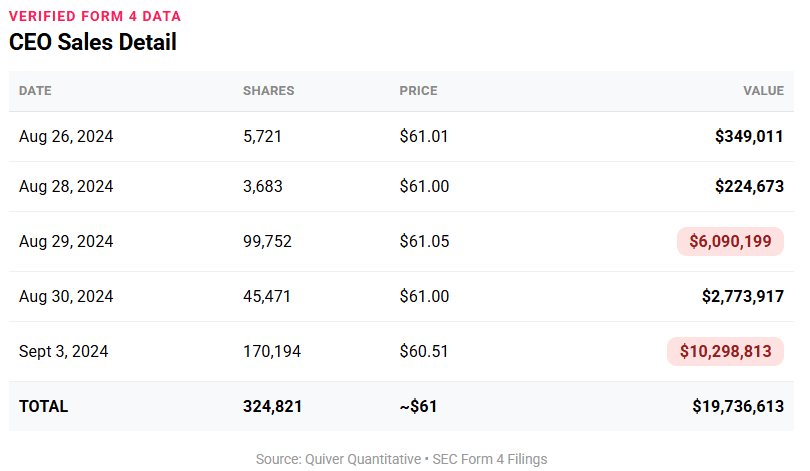

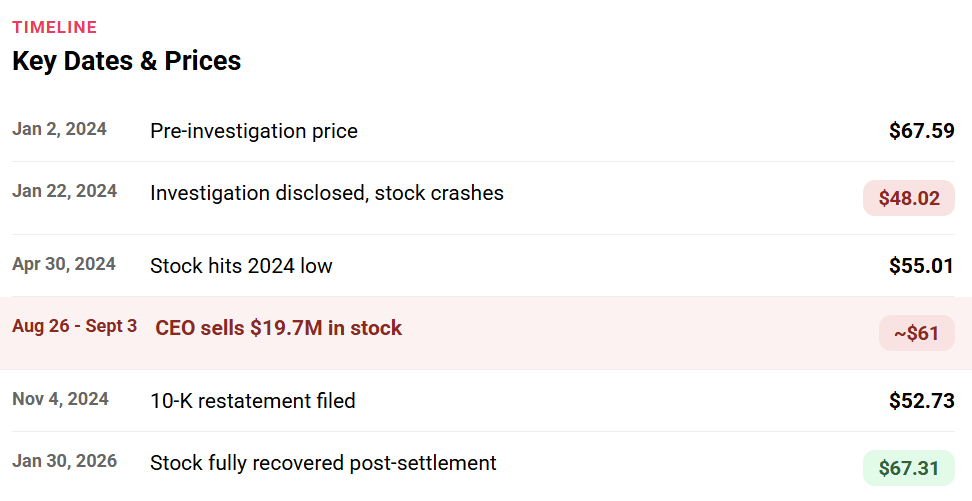

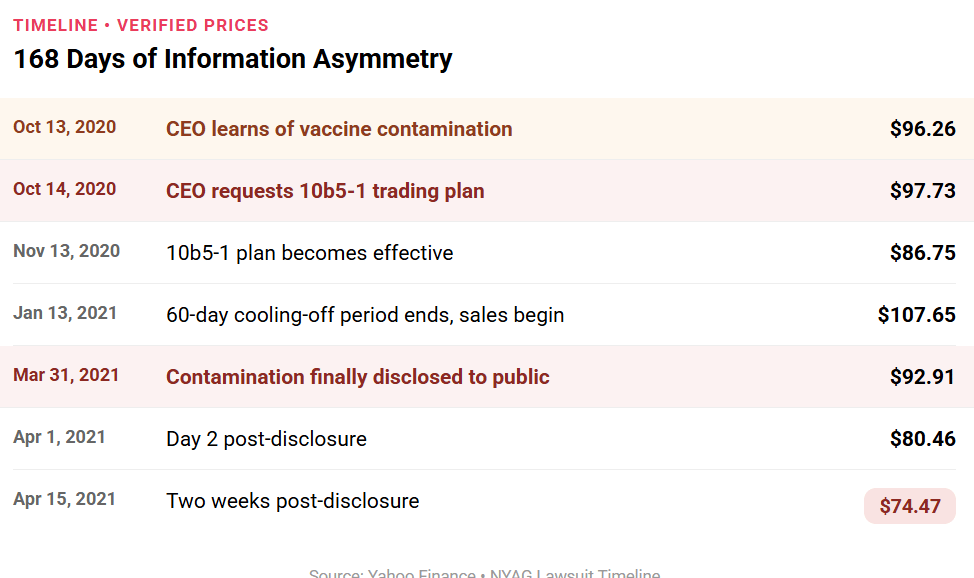

I'm thrilled to announce the launch of the Editorial Quant newsletter - where data meets dollars and cents. Have questions? Spotted an interesting data trend? Just want to chat about what we're building? → Drop me a line at [email protected] If you find value in what we're doing, please share with your network (yes, even your mom who keeps asking what stocks to buy). There's a certain poetry to the language arc of accounting fraud. Archer-Daniels-Midland executives started by calling their $20 million revenue manipulation a "rebate." When that sounded too much like what it was, they rebranded it as "risk sharing." The SEC, perhaps lacking the same creative writing budget, eventually settled on "accounting fraud" and a $40 million fine, (about 0.12% of market cap), or what the stock moves on a slow Tuesday. The word "fraud" is now in the official record, which I suppose is something. The CEO sold at an average of $60.76 per share, collecting nearly $20 million. The stock then dropped to $47.53 by mid-December—another 21.8% decline from his exit. If you'd shorted at his sale price and covered at the December low, you'd have made $4.3 million in four months. By selling in August, the CEO converted uncertain equity into certain cash. Shareholders who held the same 324,821 shares rode the whole trip—$67 to $48 to $67—and ended up roughly where they started, having absorbed all the volatility. The CEO captured the recovery from April lows (+10.4%) and skipped the subsequent drawdown (-21.8%) by letting someone else provide the liquidity. The DOJ closed its criminal probe without charges. The company paid $40 million from corporate cash. If you backtested "sell during accounting investigations, buy after settlements," the returns would be uncomfortable for anyone who thinks markets efficiently price executive information advantages. The risk, as it turns out, was shared mostly with shareholders who provided the liquidity View ADM insider data → A 10b5-1 plan is supposed to be set up when you don't have material information, then it trades automatically. Executives who want to sell stock face a timing problem sell before bad news and it looks like insider trading. So, the SEC created 10b5-1 plans: set up a trading schedule when you don't have inside information, and the trades execute automatically. Courts protect these plans because, in theory, you couldn't have timed the market. Legal safe harbor. The New York AG wasn't persuaded when Emergent BioSolutions CEO Robert Kramer set up his plan one day after learning about vaccine contamination at the Baltimore facility.

The CEO sold while the stock was trading between $86 and $122. Everyone who bought from him during those 168 days was on the wrong side of an information trade they didn't know they were making.

The NYAG sued the company as a co-conspirator, not a victim, because the company came out ahead. The safe harbor was designed to align executive and shareholder interests. Instead, it provided a mechanism for value extraction with built-in legal cover. The harbor, it turns out, was quite safe for the CEO. View EBS Insider Data →

The DOJ announced a new National Fraud Division on January 8, which raises the question of what the previous fraud investigators were doing. The $250 million Minnesota child-nutrition fraud case offers some context.

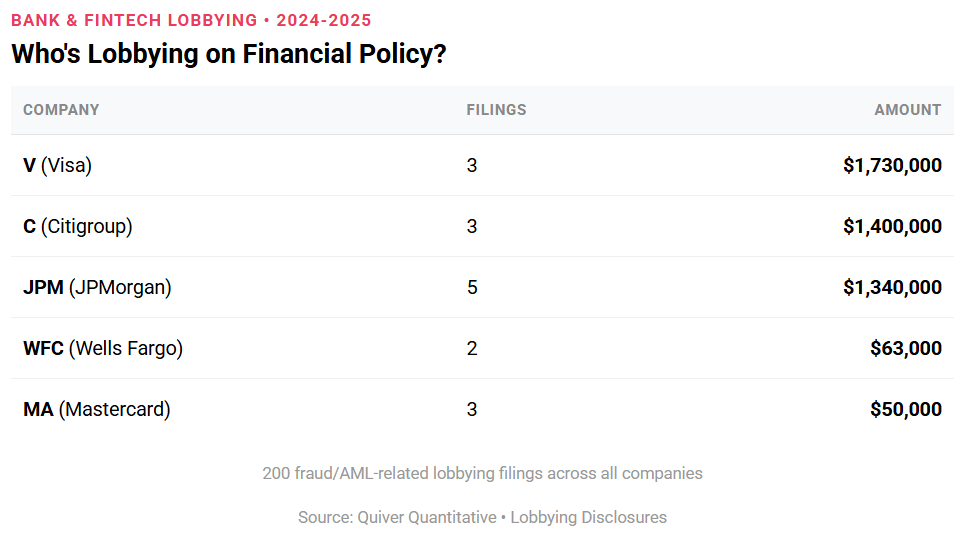

Treasury is flagging banks and fintechs as enforcement targets entities with balance sheets, unlike the actual fraudsters who have fled.

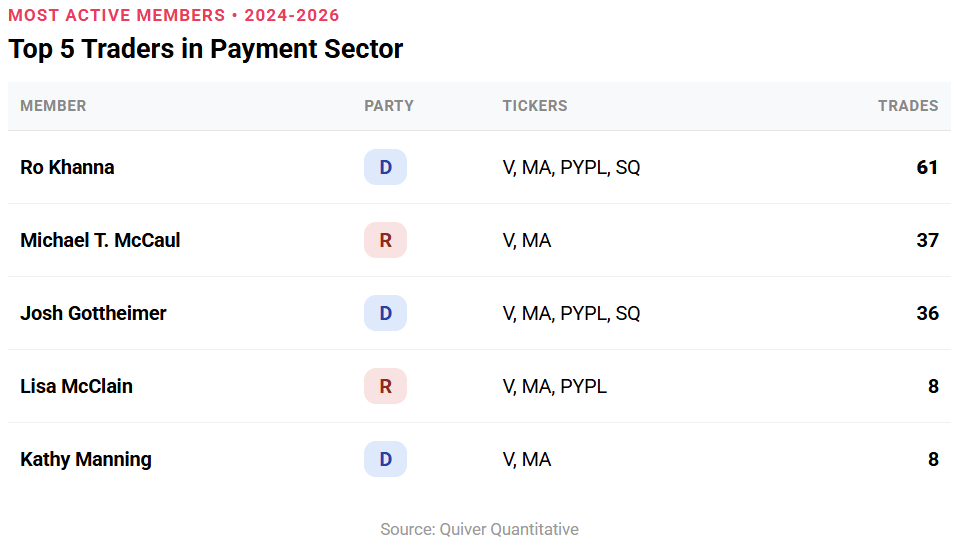

Meanwhile, Congress made 233 trades in payment processors over the past two years: 117 buys, 116 sells. Visa: 108 trades from 28 members (buy/sell ratio 0.86x—slightly bearish). Mastercard: 67 trades, 15 members. PayPal: 43 trades, 15 members. Block: 15 trades from 4 members (ratio 2.75x—notably bullish, though small sample).

I'm not claiming causation. I'm just noting that the people who write financial regulations seem very interested in owning the companies those regulations affect See Lobbying Data →