S. 2792: Closing the Meal Gap Act of 2025

The Closing the Meal Gap Act of 2025

aims to update the calculations used for benefits under the Supplemental Nutrition Assistance Program (SNAP), which helps eligible individuals and families afford food. Here is a breakdown of the key components of the bill:

Changes to Benefit Calculations

The bill modifies how SNAP benefits are calculated, shifting from the current thrifty food plan

to a low-cost food plan

. This new calculation will:

- Determine the cost of a healthy diet suitable for a typical four-person family, including specific age demographics.

- Require reevaluation every five years to adjust the cost based on current food prices and guidelines.

- Allow adjustments for household size and specific regional costs, particularly in Hawaii and Alaska.

Value of SNAP Allotments

The amount allocated to households under SNAP benefits will be based on the low-cost food plan instead of the thrifty food plan. Additionally:

- The percentage used to adjust these benefits will increase from 8% to 10%.

Quality Control Enhancements

The act stipulates updates to the quality control system, ensuring that the low-cost food plan is accurately adjusted in relation to current data and pricing, with a new implementation date set for 2025.

Deduction Adjustments

The bill introduces changes regarding how income deductions are calculated for SNAP eligibility:

- It establishes a standard medical expense deduction for elderly or disabled members at $140 for fiscal year 2025, with adjustments based on inflation thereafter.

- It removes the cap on excess shelter expenses, making it easier for families with high housing costs to qualify for assistance.

Eliminating Time Limits

The legislation removes any existing time limits that restrict the duration for which some participants could receive benefits. This aims to provide continued support for those in need without pre-set limits.

Implementation and Adjustments

The bill includes technical amendments to various sections of the Food and Nutrition Act of 2008 to reflect these changes. Overall, it seeks to enhance the nutritional support provided to families using SNAP by ensuring that benefits are more accurately aligned with contemporary food costs and needs.

Relevant Companies

- ADM (Archer Daniels Midland Company) - As a major supplier and provider of food ingredients, ADM may see changes in demand patterns influenced by changes in SNAP benefits that could affect food purchasing power among lower-income families.

- SYRS (Syracuse Research Corporation) - Companies in the food supply chain could find themselves impacted by alterations in SNAP benefit structures and the market adjustments resulting from the increased purchasing power of recipients.

This is an AI-generated summary of the bill text. There may be mistakes.

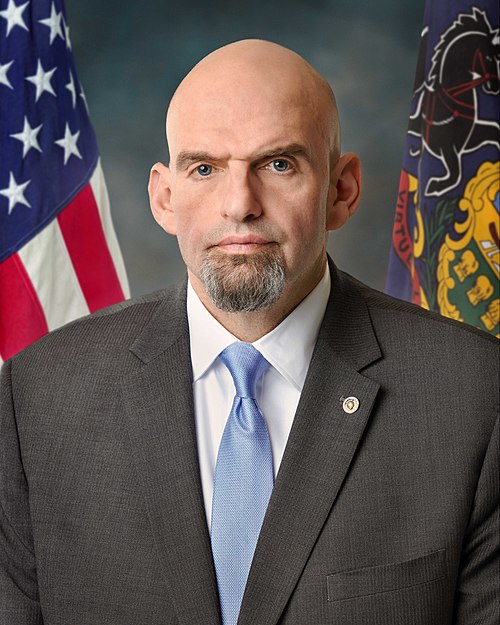

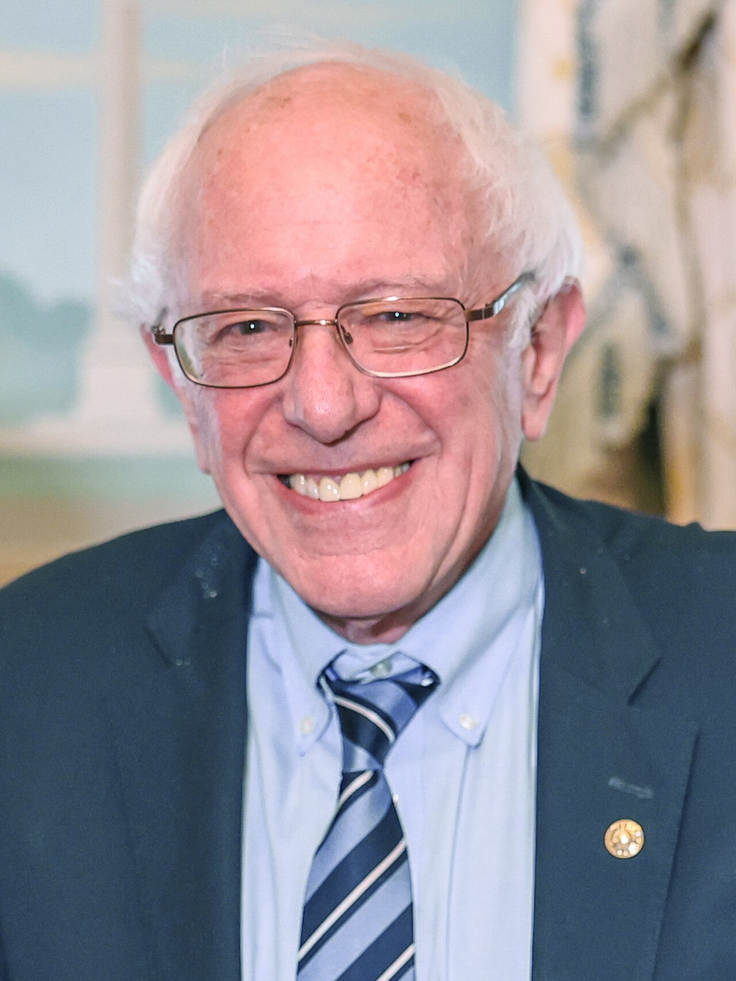

Sponsors

4 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 11, 2025 | Introduced in Senate |

| Sep. 11, 2025 | Read twice and referred to the Committee on Agriculture, Nutrition, and Forestry. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.