S. 2746: Produce Epstein Treasury Records Act

This bill, titled the Produce Epstein Treasury Records Act

, aims to require the Secretary of the Treasury to produce specific financial records related to Jeffrey Epstein and his associates, as well as entities that conducted transactions with him. The key provisions of the bill include:

Timeline for Record Submission

The bill specifies that within 30 days of becoming law, the Secretary of the Treasury must provide physical copies of certain records to two Senate committees: the Committee on Finance and the Committee on Banking, Housing, and Urban Affairs.

Suspicious Activity Reports

The records that need to be submitted are defined as all suspicious activity reports related to:

- Jeffrey Epstein

- His co-conspirators (indicted or unindicted)

- Any third-party individuals or entities transacting with Epstein or entities he owned or controlled

Identified Individuals and Entities

The individuals and entities specified in the bill include, but are not limited to:

- Jeffrey Epstein

- Ghislaine Maxwell

- Co-conspirators like Darren K. Indyke and Richard D. Kahn

- Financial institutions including J.P. Morgan Chase Bank, Deutsche Bank, Bank of America, and others

- Various trusts and LLCs associated with Epstein

Required Reports from Financial Institutions

In addition to providing records, the Secretary of the Treasury is also required to submit:

- A list of all financial institutions that filed the reports mentioned

- A list of all individuals and entities flagged in those reports

- The total dollar value of transactions organized by financial institution

Investigations Report

Furthermore, within 60 days of enactment, a detailed report must be submitted outlining any investigations by the Department of the Treasury into violations of financial laws related to the identified accounts.

Overall Purpose

The main focus of the bill is to ensure transparency regarding financial activities connected to Jeffrey Epstein and his associates. The hope is to scrutinize the financial institutions involved and assess their compliance with laws regarding suspicious transactions.

Relevant Companies

- JPM (J.P. Morgan Chase Bank, N.A.): May be scrutinized for its past interactions and transactions with Epstein.

- DB (Deutsche Bank): Similar to JPMorgan, Deutsche Bank may be reviewed for its dealings with Epstein.

- BAC (Bank of America): Could be impacted by reports related to their financial activities involving Epstein.

- BK (Bank of New York Mellon Corporation): Also likely to face scrutiny due to reported financial ties.

- UBS (UBS Financial Services): Involved due to potential service to Epstein and related entities.

- WFC (Wells Fargo): May be included in the reporting for its financial transactions related to Epstein.

This is an AI-generated summary of the bill text. There may be mistakes.

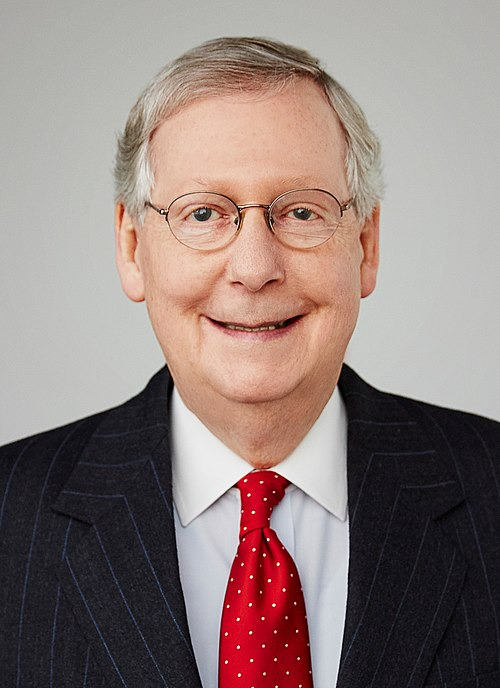

Sponsors

11 bill sponsors

-

TrackRon Wyden

Sponsor

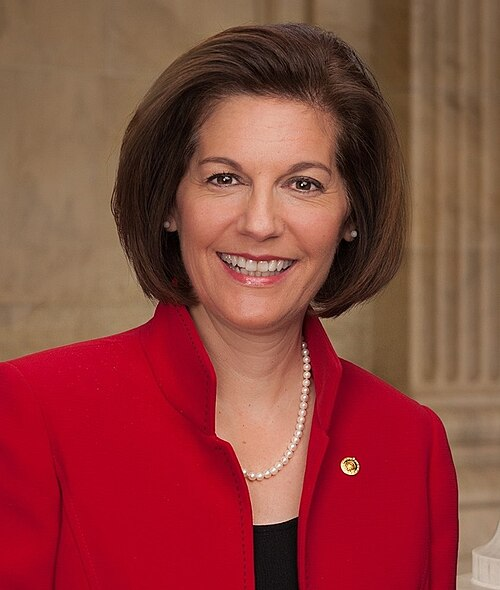

-

TrackCatherine Cortez Masto

Co-Sponsor

-

TrackAndy Kim

Co-Sponsor

-

TrackAmy Klobuchar

Co-Sponsor

-

TrackBen Ray Lujan

Co-Sponsor

-

TrackJeff Merkley

Co-Sponsor

-

TrackBrian Schatz

Co-Sponsor

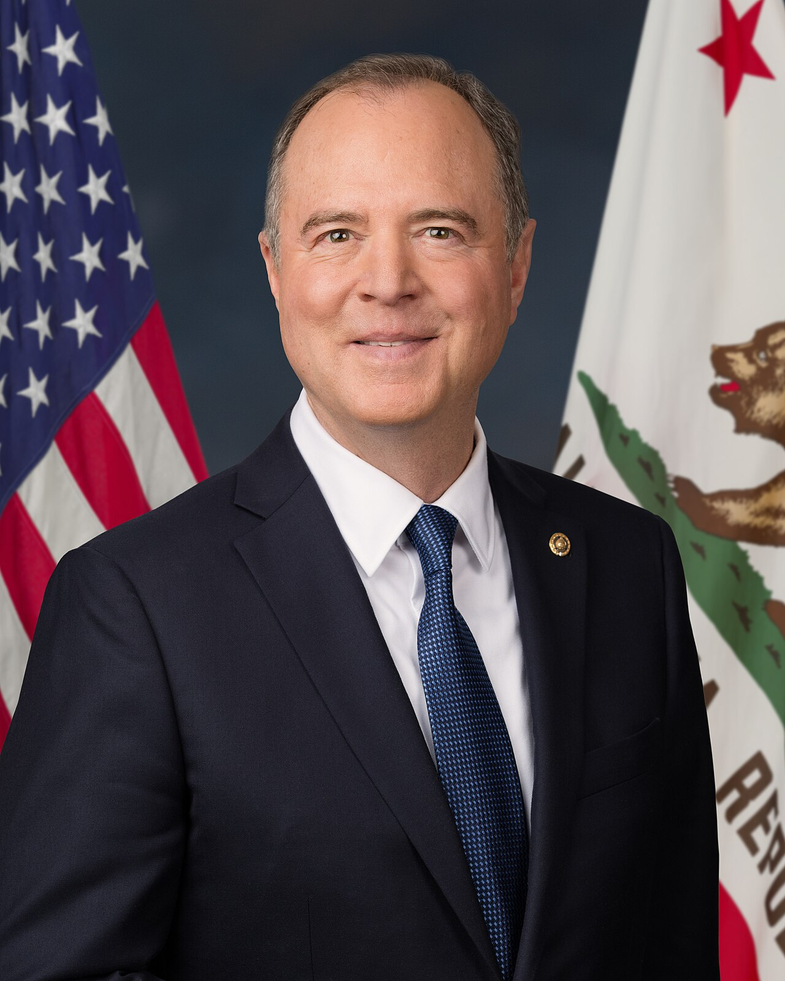

-

TrackAdam B. Schiff

Co-Sponsor

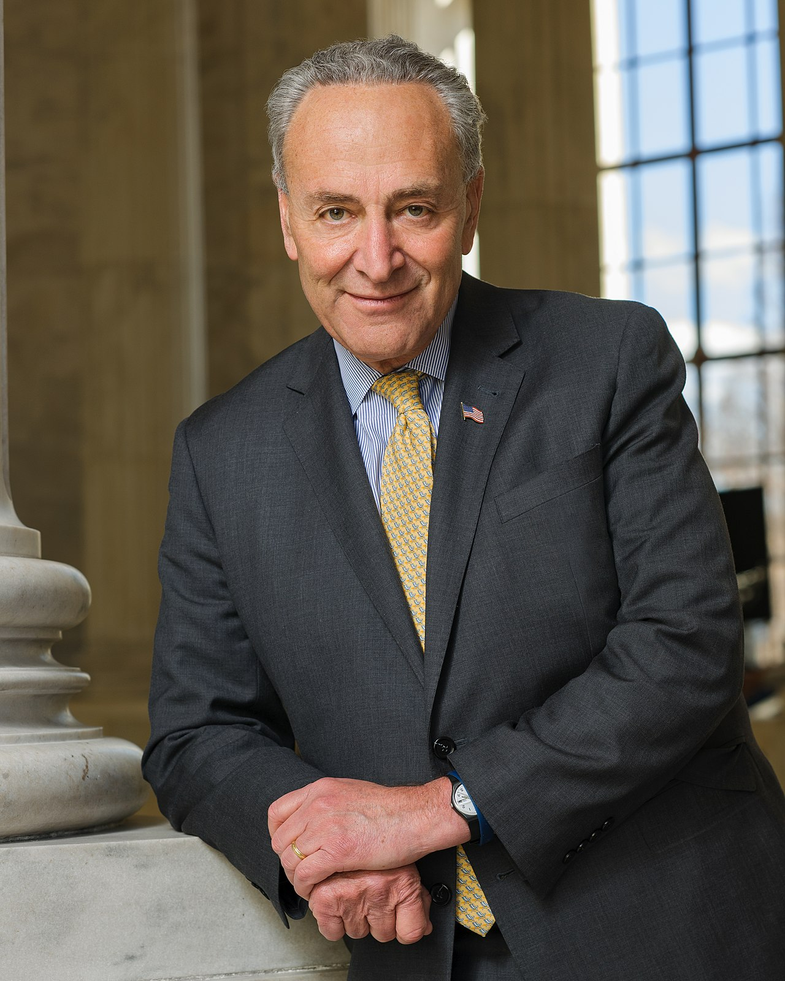

-

TrackCharles E. Schumer

Co-Sponsor

-

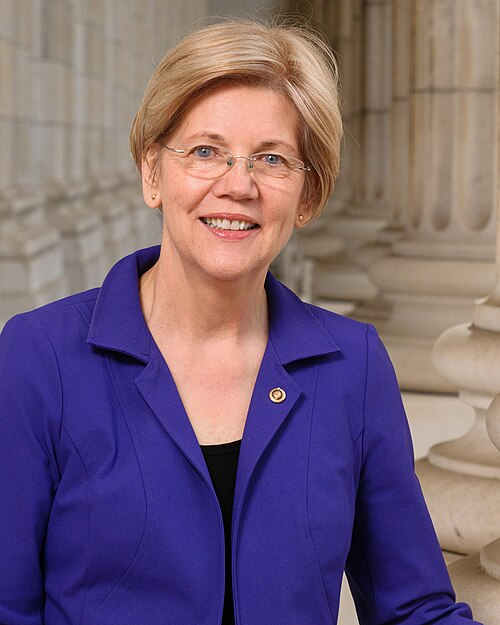

TrackElizabeth Warren

Co-Sponsor

-

TrackSheldon Whitehouse

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 09, 2025 | Introduced in Senate |

| Sep. 09, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.