S. 2475: American Worker Rebate Act of 2025

The bill titled the American Worker Rebate Act of 2025

aims to provide financial relief to working individuals by allowing them to receive tax rebates funded through revenue generated from tariffs on foreign imports. The key components of the bill include:

Policy Statement

The bill declares that the government should utilize revenues from tariffs on imports to offer immediate tax rebates to working-class individuals.

Tax Rebates for Individuals

Individuals who qualify will be eligible for a tax credit for the taxable year 2025, which is calculated based on the total amount collected from tariffs.

Rebate Amounts

The basic rebate amount will be at least $600 per eligible individual. For those filing a joint tax return, the amount doubles to $1,200.

Additionally, eligible individuals can receive extra funds for each qualifying child they have, further increasing the rebate amount.

Calculation of Applicable Amount

The actual rebate may be determined based on the total revenue from qualifying tariff proceeds divided by the number of eligible individuals and their qualifying children. This ensures that the rebate amount could increase depending on total tariff revenue.

Eligibility and Limitations

To be eligible for the rebate, individuals must not be nonresident aliens, and they should not be claimed as dependents by another taxpayer.

The rebate amount will be reduced for taxpayers whose adjusted gross income exceeds certain thresholds:

- $150,000 for joint returns

- $112,500 for heads of household

- $75,000 for all other individual filers

Advance Refunds and Payments

The bill allows for advance refunds for those who qualified in previous tax years (starting from 2024), with the Secretary of the Treasury required to process and deliver payments electronically when possible. There is also a mandate for timely notification to individuals regarding the payment details.

Identification Requirements

Individuals must provide valid identification numbers (such as Social Security numbers) when filing taxes to qualify for the rebates.

Administration and Implementation

The bill includes provisions for the Secretary of the Treasury to regulate the details of the implementation, including ensuring that multiple credits are not granted erroneously. It also emphasizes the need for the government to educate the public about these rebates.

Payments to U.S. Territories

The act stipulates that U.S. territories with mirror code tax systems will receive payments equivalent to the losses experienced due to these amendments, ensuring their residents benefit similarly.

Exemptions

Credits awarded under this act will not be subject to offset against federal debts, protecting the rebate amounts from being reduced due to other financial obligations.

Public Awareness Campaign

A public awareness campaign is mandated to inform potential beneficiaries about the credits and rebates as well as assistance for individuals who may not have filed tax returns in prior years.

Relevant Companies

- TSLA - Tesla, Inc.: Tariffs on imported components could impact manufacturing costs and pricing strategy.

- AAPL - Apple Inc.: Increased tariffs on imported electronics could affect product pricing and supply chain costs.

- GM - General Motors: Tariffs on auto parts could potentially raise production expenses, altering pricing and margins.

This is an AI-generated summary of the bill text. There may be mistakes.

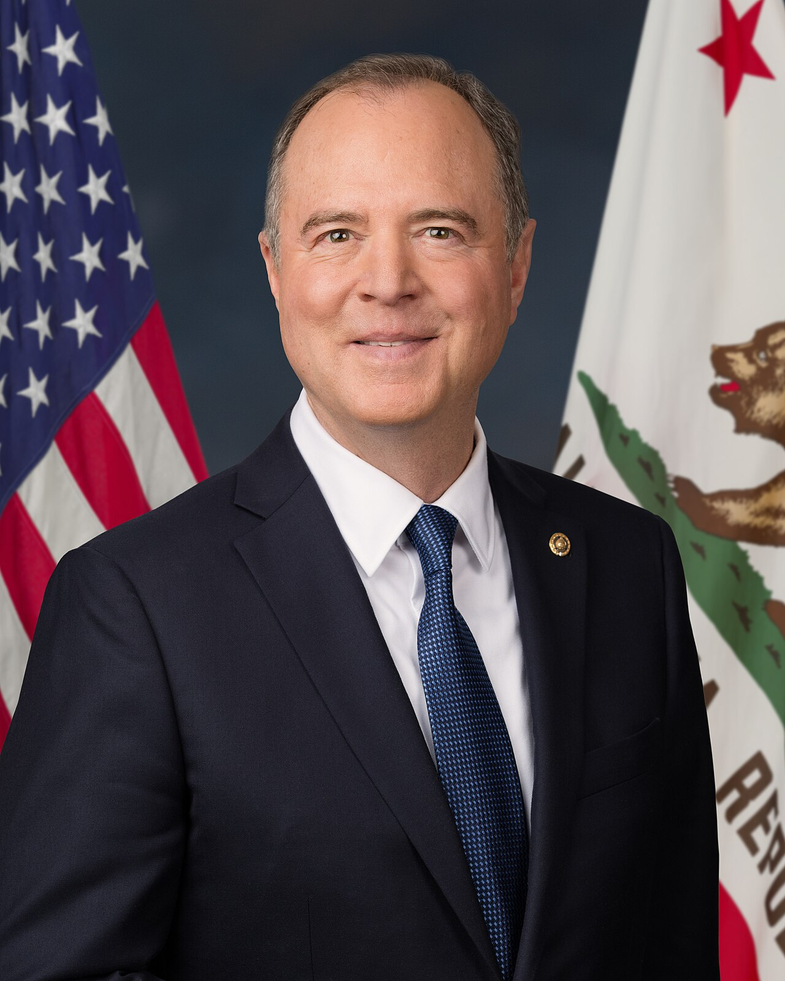

Sponsors

1 sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 28, 2025 | Introduced in Senate |

| Jul. 28, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.