S. 2400: Art Market Integrity Act

This bill, titled the Art Market Integrity Act, aims to update regulations regarding the art market to enhance oversight and transparency. It primarily amends existing laws related to the reporting of transactions involving works of art, particularly aimed at preventing money laundering and the financing of illicit activities within this sector.

Key Provisions

- Definition of Art Market Participants: The bill specifies that certain individuals and entities engaged in the buying, selling, or trading of works of art—such as dealers, galleries, auction houses, and consultants—will be required to keep records and report transactions under new guidelines, unless they meet specific exemption criteria.

- Earnings Thresholds for Exemptions: A person or entity will be exempt from reporting requirements if:

- They did not engage in transactions over $10,000 involving art during the previous year.

- They did not total more than $50,000 in art transactions over the past year.

- They are only selling works of art created by themselves.

- Clarification of 'Work of Art': The bill clarifies what constitutes a 'work of art', defining it to include original paintings, sculptures, and similar forms of artistic expressions, but excluding mass-produced and applied art like product designs or decorative items.

Regulatory Updates

The Secretary of the Treasury is mandated to:

- Issue updated guidance within 360 days of the law's enactment regarding the risks associated with high-value art transactions, particularly those involving parties under sanctions.

- Coordinate with other federal agencies to ensure that the updated guidance is comprehensive and effective.

- Propose rules within 180 days for enforcing the new reporting requirements, which will detail who is subject to the regulations and any potential exemptions.

Implementation Timeline

The amendments will take effect based on whichever comes earlier:

- The issuance of rules by the Secretary of the Treasury.

- 360 days after the bill's enactment.

Technical Amendments

There are also technical updates to conform other parts of the U.S. Code related to money laundering regulations, adjusting definitions and requirements involving the art market and those who operate within it.

Relevant Companies

- BID - Sotheby's: As a major auction house, Sotheby's could be significantly impacted by the new reporting requirements on high-value transactions and may need to adapt its operations to comply with the new regulations.

- CHCO - Chilmark Art Advisors: If engaged in art transactions over the specified limits, they will have to adhere to the reporting requirements and maintain detailed records for compliance.

This is an AI-generated summary of the bill text. There may be mistakes.

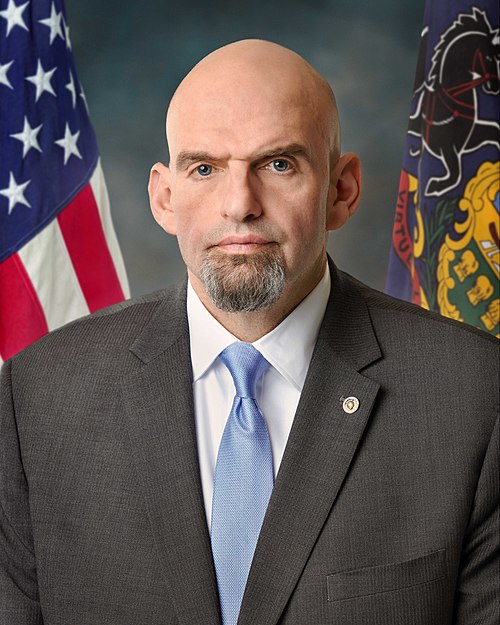

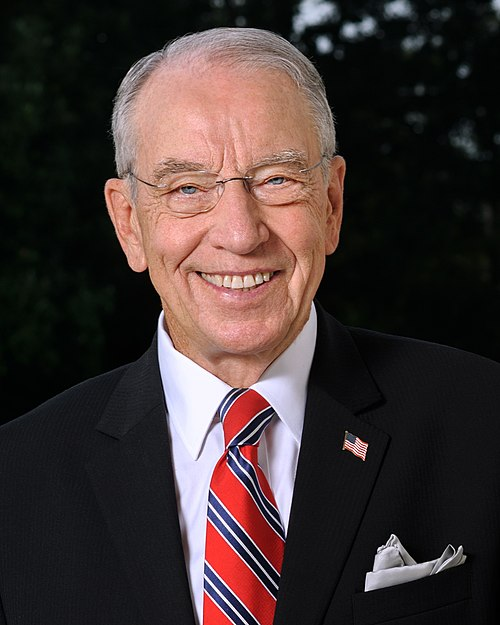

Sponsors

6 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 23, 2025 | Introduced in Senate |

| Jul. 23, 2025 | Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.