S. 2304: Methane Reduction and Economic Growth Act

This bill, titled the Methane Reduction and Economic Growth Act, aims to amend an existing tax provision regarding methane capture. The key elements of the bill include:

Creation of the Mine Methane Capture Incentive Credit

The bill introduces an incentive credit for capturing methane from mining operations. Specifically, it establishes guidelines for taxpayers to earn tax credits based on the amount of methane they successfully capture and utilize. Here are the main points of how this will work:

- Qualified Methane: The bill defines "qualified methane" as methane that is captured from various mining activities (including underground and surface mines) that would otherwise be released into the atmosphere.

- Tax Credit Amount: The incentive credit allows taxpayers to receive a credit for every metric ton of captured methane equivalent to the emissions' negative impact on climate, calculated in terms of carbon dioxide equivalent (CO2e).

- Methane Capture Equipment: To qualify for the credit, facilities must have specific equipment to capture methane and connect to pipelines that adhere to safety and integrity standards.

Requirements for Facilities

To be eligible for this tax credit, certain criteria must be met:

- Construction Timeline: The construction of the facility to capture methane must begin before January 1, 2036.

- Production Minimum: The facility must capture at least 2,500 metric tons of CO2e equivalent of methane during a taxable year.

- Verification: The captured methane must be measured at the source and verified at the point of use or injection into the energy systems.

Effective Date

The provisions in this bill will take effect for methane captured after December 31, 2024.

Summary of Benefits

The bill is designed to promote the reduction of methane emissions from mining activities, thus contributing to environmental goals. By providing a tax incentive, it encourages the implementation of technologies and practices that can capture and utilize methane, potentially turning a harmful greenhouse gas into a resource for energy production or heating.

Relevant Companies

- CHK - Chesapeake Energy Corporation: As a company involved in natural gas and oil production, Chesapeake may be affected by the regulations around methane capture in their operational practices.

- AR - Antero Resources Corporation: This company focuses on natural gas production and could benefit from the methane capture incentives as part of their environmental compliance efforts.

- CLNE - Clean Energy Fuels Corp: Involved in providing natural gas fuel for vehicle fleets, Clean Energy may find opportunities to utilize captured methane in their energy solutions.

This is an AI-generated summary of the bill text. There may be mistakes.

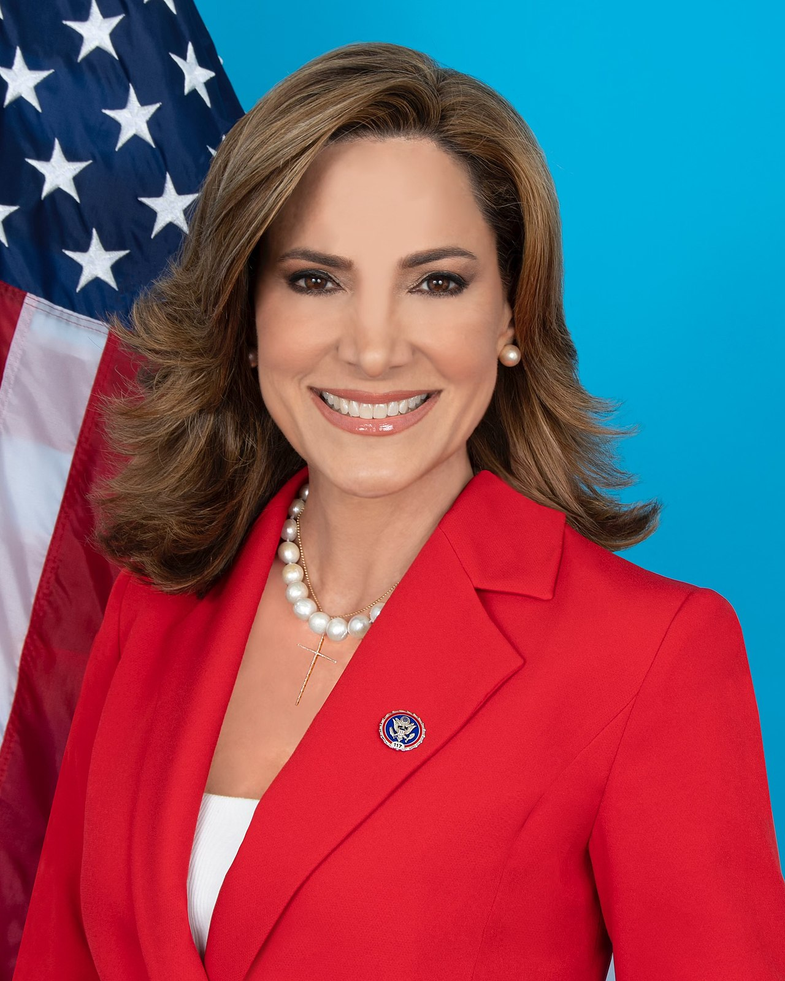

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 16, 2025 | Introduced in Senate |

| Jul. 16, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.