S. 2230: Facilitating Useful Loss Limitations to Help Our Unique Service Economy (FULL HOUSE) Act

The "Facilitating Useful Loss Limitations to Help Our Unique Service Economy (FULL HOUSE) Act" is a bill aimed at modifying how losses from wagering transactions are treated for tax purposes under the Internal Revenue Code of 1986. Here are the key points of what the bill proposes:

Reinstatement of Wagering Loss Rules

The bill proposes to reinstate specific rules regarding the deductibility of wagering losses, which were previously in place. Under the current law, losses incurred from gambling activities can only be deducted to the extent that they do not exceed the gains from those activities. In simpler terms, if a person engages in gambling, they can only deduct their losses up to the amount they have won from gambling transactions in that same year.

Details of the Amendment

- Loss Calculation: The loss from wagering transactions that can be deducted includes any deductions that would normally be allowed under the relevant tax chapter when conducting gambling activities.

- Effective Date: The changes proposed in this bill would apply to taxable years starting after December 31, 2025.

Impact of the Changes

The bill aims to clarify and potentially simplify the current tax treatment of gambling losses for individuals engaged in such activities. The intent is to ensure that taxpayers are able to properly account for their gambling activities when filing their taxes, following a format that recognizes gambling as an income-generating activity rather than solely a loss-incurring venture.

Relevant Companies

- MLCO (Melco Resorts & Entertainment): A company involved in the casino and hospitality industry that may be affected by changes in gambling tax regulations.

- CZR (Caesars Entertainment): One of the leading casino and entertainment companies in the U.S., potentially impacted by changes affecting their gaming customers and overall financial reporting.

- SHFL (Scientific Games Corporation): A company that provides gaming products and technology, which may be relevant to the broader context of gambling and wagering losses.

This is an AI-generated summary of the bill text. There may be mistakes.

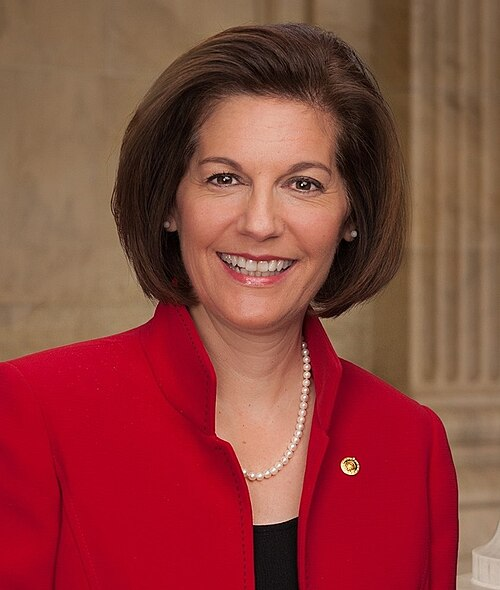

Sponsors

4 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 09, 2025 | Introduced in Senate |

| Jul. 09, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.