S. 2113: End the Fed’s Big Bank Bailout Act

This bill, titled the "End the Fed’s Big Bank Bailout Act," aims to amend the Federal Reserve Act regarding how Federal Reserve banks handle earnings on balances maintained by depository institutions. The key points of the bill are as follows:

Prohibition on Earnings

The bill proposes to stop Federal Reserve banks from paying any earnings on the balances that depository institutions (like banks) hold at these Federal Reserve banks. Currently, these banks often earn interest on their reserves stored with the Federal Reserve, which can affect their profitability and overall financial operations.

Impact of the Bill

- Depository Institutions: If passed, banks and other depository institutions would no longer receive interest or earnings on the balances they maintain at the Federal Reserve. This would alter their financial strategies and potentially affect their liquidity and profit margins.

- Federal Reserve Policy: The amendment could influence how the Federal Reserve conducts monetary policy, as it changes the incentives for banks to hold reserves with the Federal Reserve.

Objective of the Bill

The main objective of the bill is to eliminate what its proponents see as a bailout mechanism for big banks, arguing that paying interest on reserves essentially supports these institutions at the expense of taxpayers and smaller banks. This reflects a broader sentiment among some lawmakers who wish to reform how the Federal Reserve operates in relation to depository institutions.

Legislative Process

The bill was introduced to the Senate on June 18, 2025, by Senator Paul and referred to the Committee on Banking, Housing, and Urban Affairs for further consideration. This makes it a part of the ongoing legislative process where it will be evaluated, possibly amended, and debated before any potential voting occurs.

Relevant Companies

- JPM (JPMorgan Chase & Co.): As one of the largest banks in the U.S., changes in earnings from Federal Reserve balances could significantly affect its financial strategies and income.

- BAC (Bank of America Corp.): Similar to JPMorgan, Bank of America holds substantial balances at the Federal Reserve, and the bill could impact its earnings from these reserves.

- C (Citigroup Inc.): Citigroup may also be affected by the elimination of earnings on Federal Reserve balances, as it would need to adapt to reduced income streams from this source.

This is an AI-generated summary of the bill text. There may be mistakes.

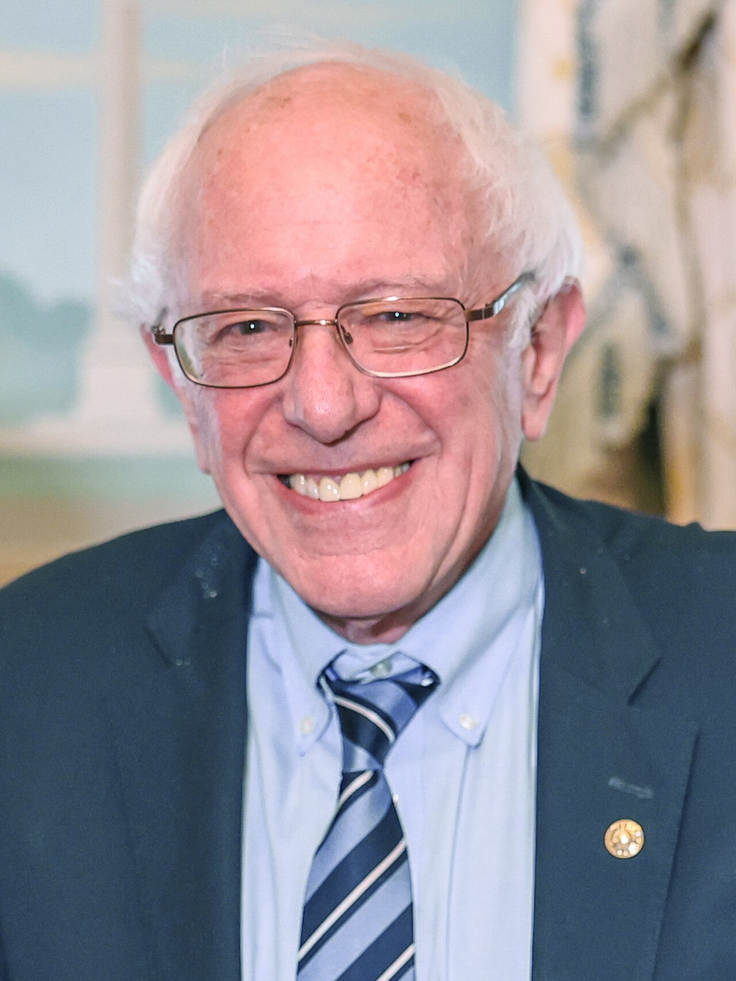

Sponsors

2 bill sponsors

Actions

3 actions

| Date | Action |

|---|---|

| Dec. 11, 2025 | Committee on Homeland Security and Governmental Affairs. Hearings held. |

| Jun. 18, 2025 | Introduced in Senate |

| Jun. 18, 2025 | Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.