S. 1550: Improving SCRA Benefit Utilization Act of 2025

The Improving SCRA Benefit Utilization Act of 2025 aims to enhance financial protections for servicemembers under the Servicemembers Civil Relief Act (SCRA). It focuses on several key areas to ensure that those in military service are better informed about their financial rights and benefits.

Financial Literacy Training

The bill mandates the inclusion of information about financial protections provided by the SCRA in financial literacy training programs for members of the Armed Forces. This includes:

- Understanding interest rate limits on certain debts.

- Awareness of consumer financial protections that apply to servicemembers and their dependents.

Notification of Benefits

The legislation requires that servicemembers be notified of their rights under the SCRA when they first enter military service. This notification is also extended to members of the reserve component, ensuring they are informed when they begin their service or are called to active duty for more than 30 days.

Interest Rate Protections

The bill amends existing provisions in the SCRA regarding the maximum rate of interest that can be charged on debts incurred by servicemembers before they entered military service. Key points include:

- Creditors must apply the interest rate limit from the date the servicemember is called to active duty.

- All obligations or liabilities of the servicemember must be treated consistent with the interest rate protections, regardless of whether they were explicitly mentioned by the servicemember.

Submission of Documents

The bill also establishes that creditors must provide multiple ways for servicemembers to submit any necessary documents to qualify for the interest rate limitations. This can be done online, by mail, or by fax, as chosen by the servicemember. This provision aims to simplify access to protections under the SCRA.

Summary

The Improving SCRA Benefit Utilization Act of 2025 seeks to improve the awareness and functionality of financial protections available to servicemembers, ensuring they have clear guidance and access to their rights under the SCRA related to financial matters.

Relevant Companies

- JPM - JPMorgan Chase: As a major lender, any changes in regulations regarding interest rates on debts could impact their loan terms and processes for servicemembers.

- USB - U.S. Bancorp: Similar to JPMorgan, U.S. Bancorp might have to adjust their policies on how they handle interest rates and obligations for servicemembers.

This is an AI-generated summary of the bill text. There may be mistakes.

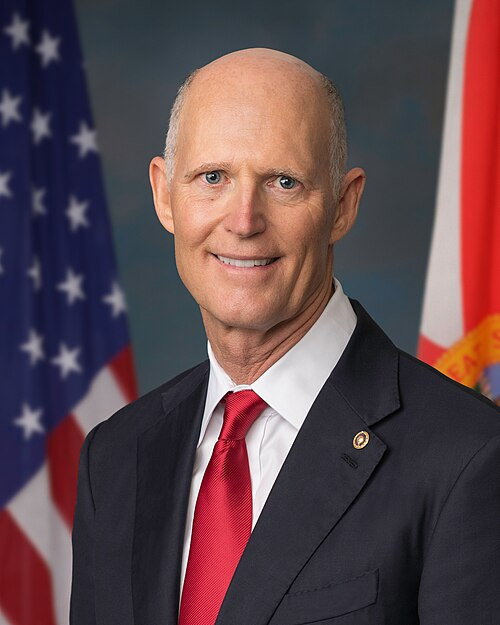

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| May. 01, 2025 | Introduced in Senate |

| May. 01, 2025 | Read twice and referred to the Committee on Armed Services. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.