S. 1459: Historic Tax Credit Growth and Opportunity Act of 2025

This bill, titled the Historic Tax Credit Growth and Opportunity Act of 2025, proposes amendments to the Internal Revenue Code to enhance the historic rehabilitation tax credit. Here are the main elements of the bill:

Full Credit in Year of Service

The bill allows taxpayers to claim the full historic rehabilitation tax credit in the year a qualifying building is placed in service. This means that taxpayers can receive immediate tax benefits for rehabilitating historic structures.

Increased Credit for Small Projects

For qualifying small rehabilitation projects, the bill increases the credit rate from 20% to 30% for projects with costs up to $3.75 million. Additionally, projects in rural areas can qualify for an increased credit threshold of $5 million.

- Qualifying Small Project: A project must be placed in service after the bill is enacted and cannot have received credit in the two previous years.

- Transfer of Credit: Taxpayers can transfer some or all of the rehabilitation credit to another taxpayer, subject to specific certification and reporting requirements.

Expanded Eligibility

The bill broadens the types of buildings eligible for rehabilitation tax credits. It amends the criteria to include a greater percentage of the adjusted basis of a property, now allowing up to 50% of the adjusted basis to be considered for credit purposes.

Elimination of Rehabilitation Credit Basis Adjustment

The legislation modifies existing rules to eliminate the adjustment of credit based on the basis of the property for the historic rehabilitation credit, simplifying tax calculations.

Modifications for Tax-Exempt Use Property

It also changes regulations concerning properties used by tax-exempt entities, specifying that certain rules apply only in cases where the property is leased by government entities.

Effective Dates

Most amendments specified in this bill will apply to properties placed in service after the enactment of the legislation.

Overall Impact

The amendments aim to encourage the rehabilitation of historic buildings by providing greater financial incentives and simplifying the tax process for developers and taxpayers involved in these projects.

Relevant Companies

- UAL (United Airlines Holdings, Inc.): Potential impact through renovation of historic airport terminals and properties.

- HTZ (Hertz Global Holdings, Inc.): Possible benefit from refurbishment of historic rental locations.

- MGM (MGM Resorts International): Likely impact through renovations of historic hotels and resorts.

This is an AI-generated summary of the bill text. There may be mistakes.

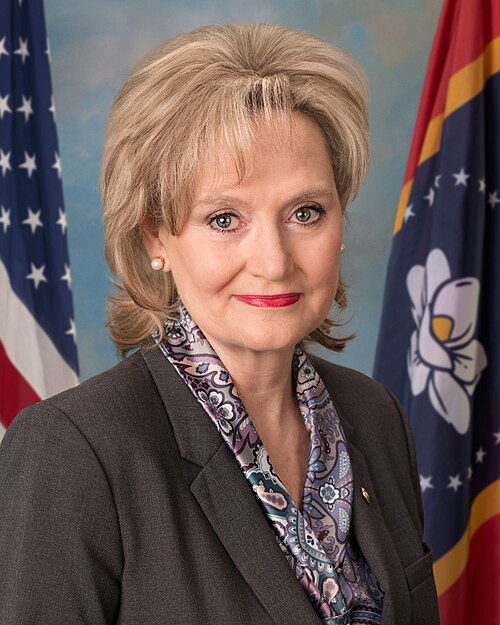

Sponsors

8 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 10, 2025 | Introduced in Senate |

| Apr. 10, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.