H.R. 6412: Independence Investment Fund Act

The Independence Investment Fund Act establishes a fund under the Department of the Treasury aimed at facilitating investments in companies that are developing critical and emerging technologies, with a particular focus on enhancing national security and economic security in the United States.

Objectives of the Fund

The Fund has several primary objectives:

- To invest in companies working on technologies that improve national or economic security.

- To signal technology priorities to private investors, encouraging more private capital flow into these sectors.

- To generate financial returns that can sustain the Fund over time.

- To provide an alternate source of funding for companies that might be at risk of adversarial investment, which refers to foreign acquisitions of U.S. companies that could pose security risks.

- To give the government insights into trends in critical and emerging technology markets.

Investment Strategy

The Fund is primarily focused on making seed and mid-stage equity investments in U.S.-headquartered technology companies. It aims for investments ranging from $1 million to $10 million. Biotechnology is specifically highlighted as a priority area for investment.

Management and Oversight

The Secretary of the Treasury, in consultation with the Secretaries of Defense and Commerce, will oversee the Fund. An advisory board will be established to assist with recommendations on the Fund's strategies and operations. This board will consist of individuals with relevant expertise, including a representative focused on biotechnology.

After the advisory board concludes its work, a supervisory board will be formed to provide ongoing oversight of the Fund's activities.

Directions for Fund Management

The Fund will be managed by an independent entity selected through a competitive process. This managing entity will be responsible for developing an investment strategy that addresses U.S. national and economic security needs. It will also provide support to portfolio companies, helping them navigate industry challenges.

Reporting and Accountability

Annual reports will be submitted to Congress, detailing the Fund's operations, investment impacts, and performance measurements. Additionally, the Fund will be exempt from certain administrative requirements, such as the Paperwork Reduction Act, to facilitate its operations.

Funding Authorization

The bill authorizes approximately $975.5 million for the first fiscal year of operation (2025), with specific amounts designated for biotechnology investments and administrative costs. Conditional authorization for further appropriations is also outlined for future years if the Fund's biotechnology investment balance falls below a certain threshold.

Restrictions on Investments

The Fund will not make investments in foreign entities of concern and is expected to have policies in place to prevent conflicts of interest. Portfolio companies may have restrictions related to foreign investments, particularly those that might compromise U.S. interests.

Relevant Companies

- AMGN (Amgen Inc.): As a biotechnology company, Amgen could be directly impacted by investment opportunities created by the Fund aimed at fostering advancements in biotechnology.

- REGN (Regeneron Pharmaceuticals, Inc.): Regeneron, also focused on biotechnology, may benefit from funding and partnerships facilitated by the Fund.

- VRTX (Vertex Pharmaceuticals Incorporated): Vertex could see opportunities for collaborations or funding through the priorities set by the Fund, particularly in biotechnology.

This is an AI-generated summary of the bill text. There may be mistakes.

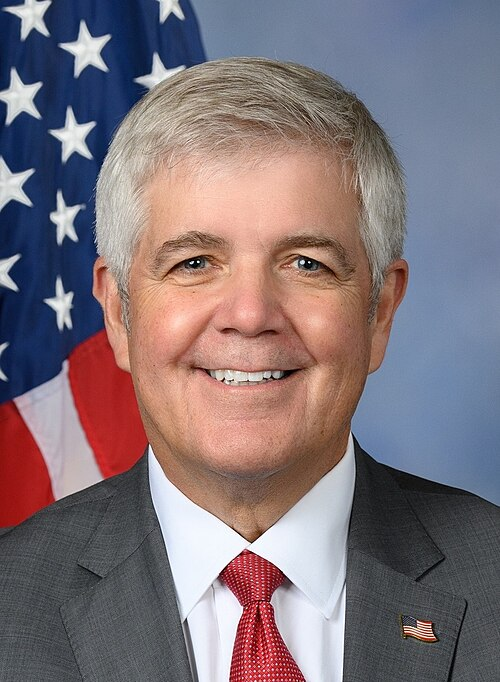

Sponsors

6 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Dec. 03, 2025 | Introduced in House |

| Dec. 03, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.