H.R. 5881: Double Dependents Relief Act

The Double Dependents Relief Act aims to provide a tax credit for individuals who are caregivers for qualified dependents. Below is a summary of the key provisions of the bill:

Tax Credit Overview

This bill introduces a new section to the Internal Revenue Code that allows eligible caregivers to receive a tax credit. The key features include:

- Credit Amount: Eligible caregivers can claim a tax credit equal to 30% of their qualified expenses, provided these expenses exceed $2,000 for the taxable year.

- Maximum Credit: The total credit is capped at $10,000 per taxable year, with adjustments for inflation starting in 2027.

Eligibility Criteria

To qualify for the credit, individuals must meet specific criteria:

- They must have a qualifying child as a dependent.

- They need to incur expenses related to providing care for a qualified care recipient during the taxable year.

- They must have earned income exceeding $7,500 in that year.

Qualified Care Recipients

A "qualified care recipient" is defined as:

- A spouse of the caregiver or someone related to the caregiver who is determined by a healthcare professional to have significant long-term care needs.

- The care recipient must meet specific medical criteria, such as being unable to perform at least two daily activities of living without assistance.

Qualified Expenses

Qualified expenses that caregivers can claim for the credit include:

- Expenditures for services and supports that assist care recipients in daily activities.

- Costs related to respite care, counseling, or training for caregivers.

- Lost wages due to taking unpaid time off work to care for the recipient.

- Travel costs incurred while providing care.

Income Phase-Out

The credit amount may be reduced based on the caregiver's income:

- The credit is reduced by $100 for every $1,000 over a threshold income, which is set at $150,000 for joint filers and $75,000 for single filers.

- These thresholds will be indexed for inflation in future years.

Documentation Requirements

Caregivers must document their expenses to claim the credit, which includes providing the name and taxpayer identification number of the care recipient and evidence of certification from a licensed healthcare provider regarding the care recipient's needs.

Effective Date

The provisions established in this act will be effective for taxable years beginning after December 31, 2025.

Relevant Companies

- AMGN (Amgen Inc.): As a biotechnology company developing therapies for critical care, Amgen may be indirectly impacted due to potential increased spending on healthcare products or services by caregivers claiming this new tax credit.

- ABT (Abbott Laboratories): As a healthcare company, Abbott may see a shift in demand for its products related to caregiving and home healthcare support as caregivers seek to optimize their expenses under this new credit.

This is an AI-generated summary of the bill text. There may be mistakes.

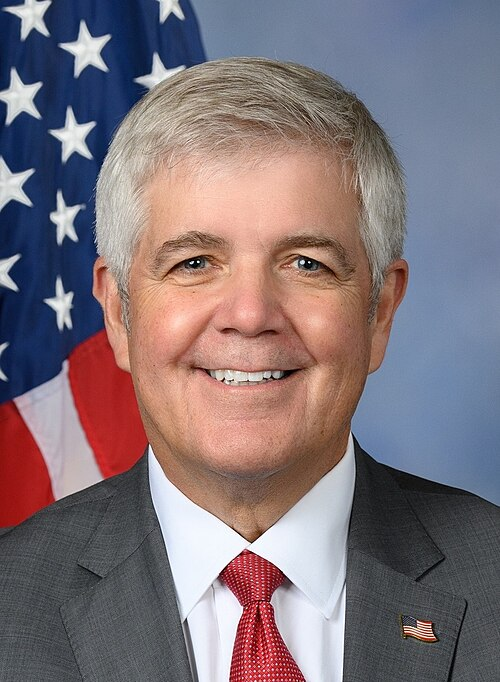

Sponsors

1 sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Oct. 31, 2025 | Introduced in House |

| Oct. 31, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.