H.R. 5112: Tipped Worker Protection Act

The Tipped Worker Protection Act aims to amend the Fair Labor Standards Act of 1938 by eliminating the separate minimum wage for tipped employees. Here’s a breakdown of the key provisions of the bill:

Repeal of Separate Minimum Wage for Tipped Employees

The bill proposes to repeal the current provision that allows for a lower minimum wage for tipped employees. Instead, the wage that must be paid to tipped employees will match the standard minimum wage outlined in the Fair Labor Standards Act.

Transition Period and Wage Increases

- The minimum wage for tipped employees will not be instantly raised but will follow a scheduled increase:

- For the first year after the legislation passes, the minimum wage for tipped employees will be set at $3.60 an hour.

- Subsequently, it will increase by $1.50 for each following year until it equals the standard minimum wage.

Defining Tipped Employees

The bill modifies the definition of 'tipped employee.' An employee who does not receive tips exceeding the gap between their cash wage and the standard minimum wage, or who spends more than 20% of their working hours on non-tipped duties, may not be classified as a tipped employee.

Retention and Pooling of Tips

The bill includes provisions for the treatment of tips:

- All tips must be retained by employees; employers cannot keep any part of the tips given to employees, regardless of any tip credit taken.

- Employers must inform employees and customers about any mandatory charges added to customer bills and specify if any part of that charge will go to employees.

Establishing Tip Pools

The act outlines the process for establishing or modifying systems to pool tips:

- At least 30% of non-supervisory employees must request a vote to establish or modify a tip pool.

- A majority vote (51% or more) from the participating non-supervisory employees is required to create or change the pool system.

- The system must be visible, voluntary for participants, and administrated without coercion from the employer.

Prohibitions on Employers

Employers are explicitly prohibited from keeping any portion of the tips intended for employees. They cannot use employees’ tips to cover transaction fees, nor can they compel employees to share tips with management.

Disclosure Requirements

Any employer imposing a mandatory customer charge must:

- Disclose the reason and the portion of the charge directed to employees' compensation.

- Ensure that the disclosed portion is paid to employees promptly after the charge is collected.

Penalties and Compliance

The bill outlines specific penalties for non-compliance, reinforcing that employers may face repercussions for unlawfully keeping tips or misleading employees regarding compensation practices.

Effective Date

The amendments would take effect upon the enactment of the act and would apply to all tips received from that date onward.

Relevant Companies

- DEN - A restaurant chain that employs numerous tipped employees and could be significantly impacted by changes in minimum wage and tip retention policies.

- RCL - A cruise line company that also employs staff in roles receiving tips, possibly affecting their compensation structure.

- DAL - Delta Airlines staff including flight attendants who also receive tips, which could be influenced by new regulations regarding tip pooling and retention.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

12 bill sponsors

-

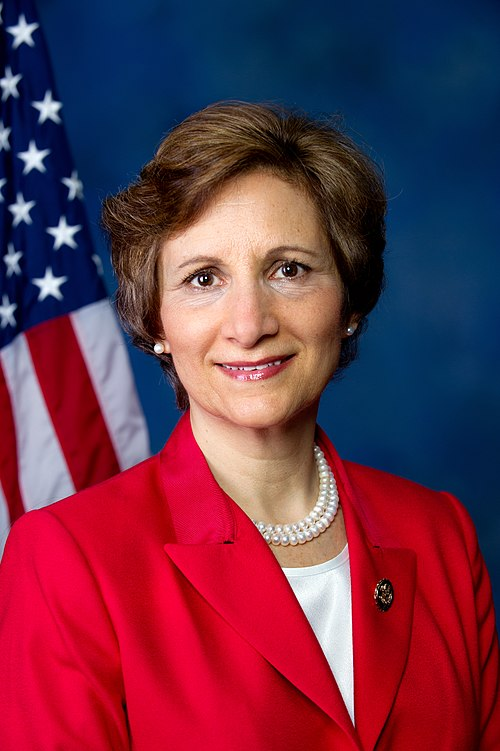

TrackJahana Hayes

Sponsor

-

TrackAlma S. Adams

Co-Sponsor

-

TrackYassamin Ansari

Co-Sponsor

-

TrackSuzanne Bonamici

Co-Sponsor

-

TrackAndré Carson

Co-Sponsor

-

TrackJonathan L. Jackson

Co-Sponsor

-

TrackSummer L. Lee

Co-Sponsor

-

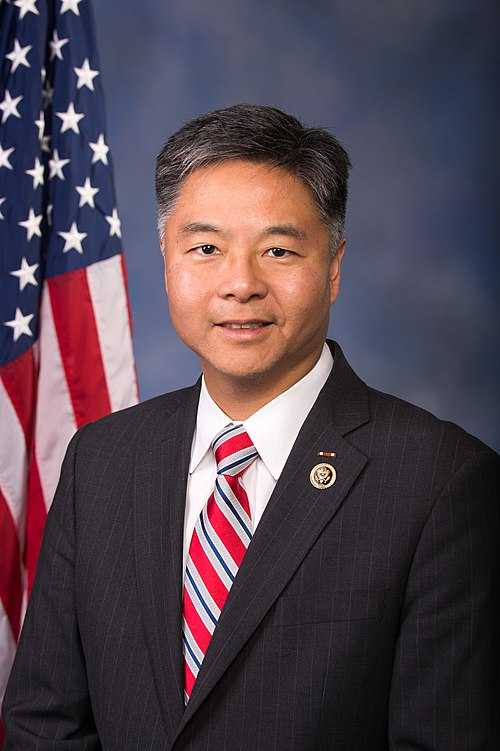

TrackTed Lieu

Co-Sponsor

-

TrackEmily Randall

Co-Sponsor

-

TrackAndrea Salinas

Co-Sponsor

-

TrackShri Thanedar

Co-Sponsor

-

TrackDina Titus

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 03, 2025 | Introduced in House |

| Sep. 03, 2025 | Referred to the Committee on Education and Workforce, and in addition to the Committee on Ways and Means, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.