H.R. 2940: Advancing Water Reuse Act

This bill, known as the Advancing Water Reuse Act, proposes an amendment to the Internal Revenue Code to provide a tax credit for certain water reuse projects. Here is a summary of its main points and provisions:

Investment Credit for Water Reuse Projects

The bill allows for a tax credit equivalent to 30% of the qualified investment made in specific water reuse projects. This credit would apply to any taxable year in which a qualifying project is undertaken.

Definition of Qualified Investment

A qualified investment includes the cost associated with tangible property placed into service as part of a water reuse project. This property must:

- Be tangible (not intangible assets).

- Have depreciation or amortization that can be applied.

- Be either constructed, reconstructed, or erected by the taxpayer or acquired if the original usage starts with the taxpayer.

Types of Qualifying Water Reuse Projects

The bill outlines three main types of qualifying water reuse projects:

- Installing, replacing, or modifying an onsite water recycling system within industrial, manufacturing, data center, or food processing facilities.

- Replacing the use of freshwater with recycled water from a municipal provider for the production of goods or provision of services.

- Building or expanding a municipal water recycling system to secure recycled water for similar purposes.

Special Provisions for Property Transferred to Utilities

If a person transfers qualified property to a utility, that property can still be treated as qualified property for tax credit purposes under certain conditions, provided that both the person and the utility enter a binding agreement regarding the credit. This provision ensures that the transfer does not disqualify the property from being eligible for the tax benefits.

Termination of Benefits

The tax credit will not apply to any property where construction begins after December 31, 2032. This provision establishes a time limit for the applicability of the credits.

Amendments to Existing Law

The bill includes necessary amendments to the Internal Revenue Code to incorporate the new provisions related to the qualifying water reuse project credit, which is expected to support the growing focus on water conservation and recycling efforts.

Effective Date

The amendments would take effect for taxable periods following the date of their enactment, ensuring that the tax credits are available to eligible projects undertaken after the bill becomes law.

Relevant Companies

- AWR - American States Water Company: This company could see increased investments or projects related to water recycling due to the potential tax credits.

- XYL - Xylem Inc.: As a water technology company, Xylem may benefit from increased demand for water reuse technologies as a result of this legislation.

- GLW - Corning Inc.: Corning produces materials used in various water filtration and recycling applications and could see an uptick in business if companies pursue qualifying projects to access tax incentives.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

19 bill sponsors

-

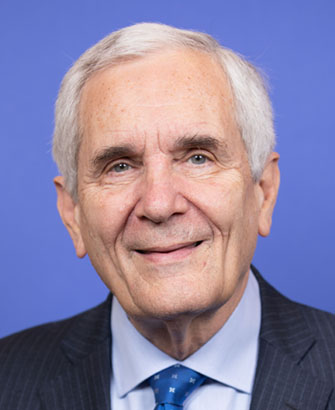

TrackDarin LaHood

Sponsor

-

TrackSean Casten

Co-Sponsor

-

TrackKathy Castor

Co-Sponsor

-

TrackJim Costa

Co-Sponsor

-

TrackJoe Courtney

Co-Sponsor

-

TrackBrian K. Fitzpatrick

Co-Sponsor

-

TrackPat Harrigan

Co-Sponsor

-

TrackSusie Lee

Co-Sponsor

-

TrackRyan Mackenzie

Co-Sponsor

-

TrackSarah McBride

Co-Sponsor

-

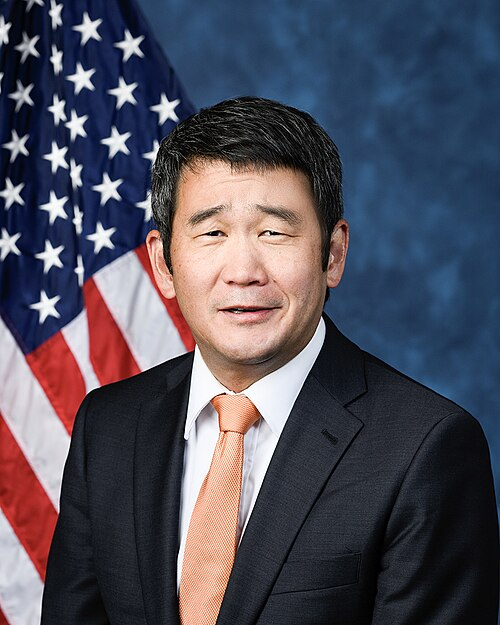

TrackDave Min

Co-Sponsor

-

TrackKelly Morrison

Co-Sponsor

-

TrackBradley Scott Schneider

Co-Sponsor

-

TrackHillary J. Scholten

Co-Sponsor

-

TrackLinda T. Sánchez

Co-Sponsor

-

TrackClaudia Tenney

Co-Sponsor

-

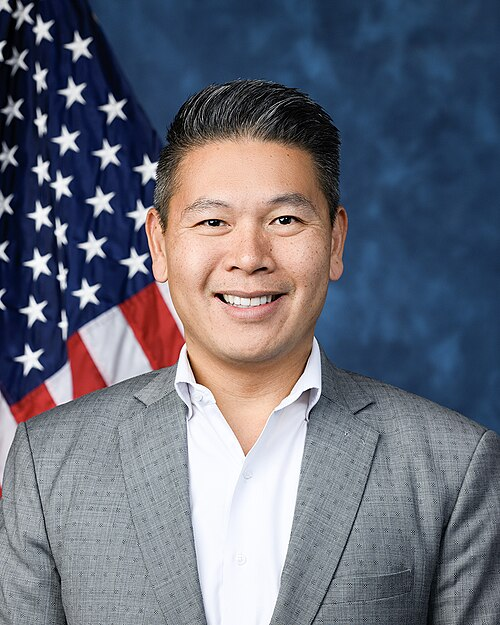

TrackDerek Tran

Co-Sponsor

-

TrackEugene Vindman

Co-Sponsor

-

TrackRobert J. Wittman

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 17, 2025 | Introduced in House |

| Apr. 17, 2025 | Referred to the House Committee on Ways and Means. |