H.R. 2912: Oligarch Act of 2025

The Oligarch Act of 2025 seeks to introduce a new wealth tax in the United States, targeting high-net-worth individuals and certain trusts. Below are the key components of the proposed bill:

Imposition of Wealth Tax

The bill amends the Internal Revenue Code to impose a tax on the net value of all taxable assets held by applicable taxpayers on the last day of each calendar year. This applies to:

- Individuals exceeding a specified asset threshold.

- Trusts, which are taxed at a fixed rate.

Tax Rates and Thresholds

The tax rates for individuals are structured progressively based on the value of their taxable assets exceeding a set threshold, which is 1,000 times a baseline figure (initially set at $50,000 or the median household wealth, whichever is greater).

- 2% on assets exceeding the threshold but not exceeding ten times the threshold.

- 4% on the next tier, exceeding ten times but not exceeding one hundred times the threshold.

- 6% on the next tier, exceeding one hundred times but not exceeding one thousand times the threshold.

- 8% on assets above one thousand times the threshold.

Applicable Taxpayers

An applicable taxpayer is defined as any individual or trust (excluding certain tax-exempt trusts). Married individuals are treated as a single taxpayer for assessment purposes.

Net Value of Taxable Assets

The net value of taxable assets is calculated as the total value of all properties owned by the taxpayer, minus any debts owed. Certain properties valued under $50,000 or categorized as personal items may be excluded from the taxable asset calculation.

Reporting and Enforcement

The bill mandates annual reporting of assets to the Secretary of the Treasury, aimed at enforcing the new tax. The Secretary is also required to audit a percentage of taxpayers annually to ensure compliance.

There are provisions for applying penalties in cases of significant underreported asset values.

Special Provisions

The legislation contains specific regulations for deceased individuals, non-resident aliens, and trusts with common beneficiaries. It also allows for potential extensions of tax payment deadlines for taxpayers facing severe financial constraints.

Effective Date

The wealth tax provisions would take effect for income and assets starting from the calendar year following the enactment of the Act.

Relevant Companies

- BRK.A - Berkshire Hathaway: The wealth tax could impact shareholders and the valuation of the diversified holdings of this company.

- AAPL - Apple Inc: Significant asset owners may be subject to the new tax based on their market investments, impacting stock value trends.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

13 bill sponsors

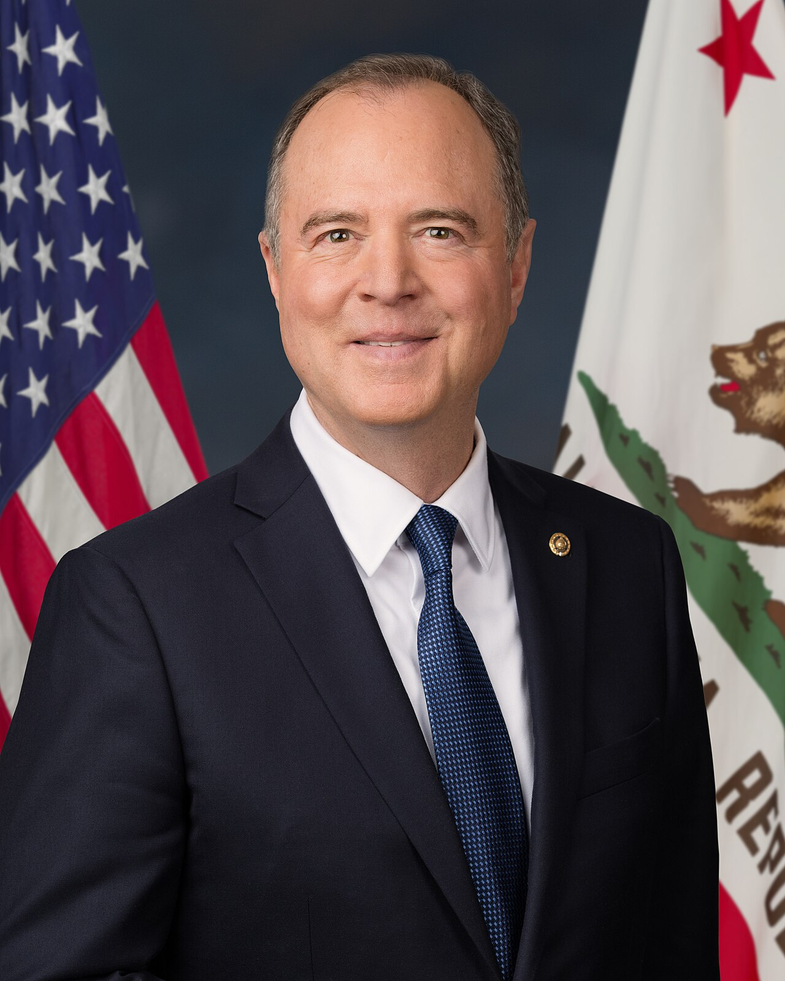

-

TrackSummer L. Lee

Sponsor

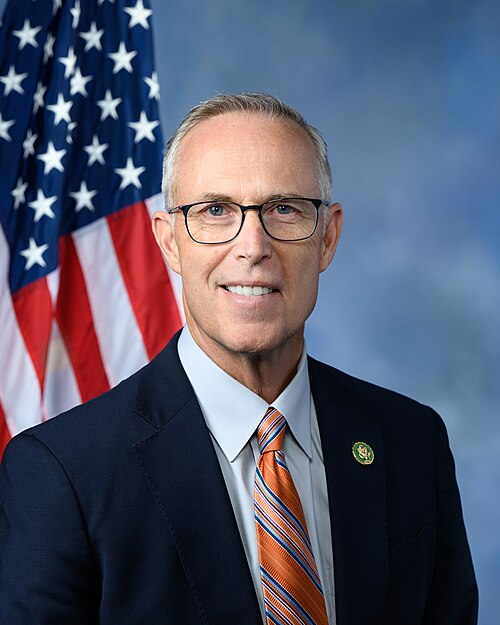

-

TrackGreg Casar

Co-Sponsor

-

TrackMadeleine Dean

Co-Sponsor

-

TrackValerie P. Foushee

Co-Sponsor

-

TrackMaxwell Frost

Co-Sponsor

-

TrackJesús G. "Chuy" García

Co-Sponsor

-

TrackJared Huffman

Co-Sponsor

-

TrackJames P. McGovern

Co-Sponsor

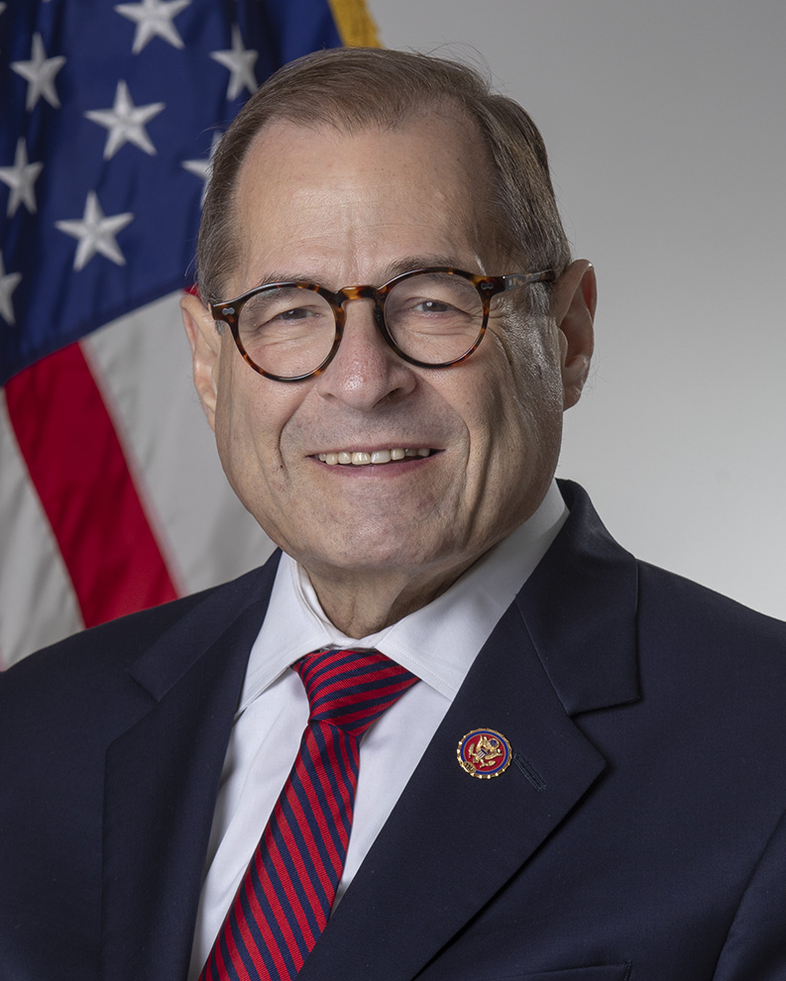

-

TrackJerrold Nadler

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackDelia C. Ramirez

Co-Sponsor

-

TrackRashida Tlaib

Co-Sponsor

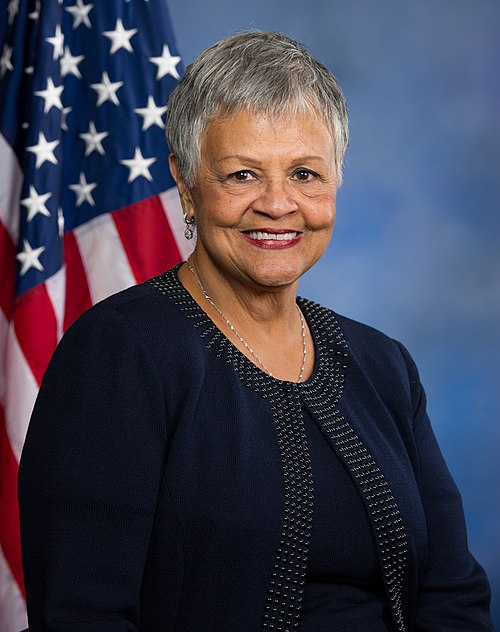

-

TrackBonnie Watson Coleman

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 14, 2025 | Introduced in House |

| Apr. 14, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.