H.R. 1181: Protecting Privacy in Purchases Act

This bill, titled the Protecting Privacy in Purchases Act, aims to regulate the classification of merchants, specifically firearms retailers, by payment card networks and other related entities. Here’s a breakdown of what the bill entails:

Prohibitions on Merchant Category Codes

The bill prohibits payment card networks from requiring firearms retailers to use a specific merchant category code that distinguishes them from general merchandise or sporting goods retailers. This means:

- Firearms retailers cannot be assigned a separate code that identifies them as a different type of business based solely on their sales of firearms and ammunition.

- Covered entities, which are companies processing transactions for merchants, are also restricted from assigning any distinguishing code to firearms retailers.

Enforcement Mechanism

The enforcement of these regulations falls under the jurisdiction of the Attorney General. Key points include:

- The Attorney General must establish a complaint process for firearms retailers and individuals who believe their rights have been violated under this bill.

- Upon receiving complaints, the Attorney General is required to investigate them.

- If a violation is confirmed, a written notice must be sent to the offending payment card network or covered entity, demanding remediation within 30 days.

- If no action is taken, the Attorney General has the authority to take legal action in federal court to stop the violation.

- Notably, individuals cannot bring private lawsuits related to violations under this act.

Preemption of State and Local Laws

The bill preempts any state or local laws that regulate merchant category codes for firearms retailers, meaning that once this bill becomes law, states cannot create their own rules regarding how firearms retailers are classified.

Annual Reporting

The Attorney General is required to report to Congress each year. The report will include:

- The number of investigations conducted under this section.

- A summary of these cases and their outcomes.

- Data and analysis related to the effectiveness of this law.

Definitions of Key Terms

The bill outlines specific definitions for terms used, including:

- Ammunition: Defined as per existing U.S. law.

- Covered entity: An entity involved in processing transactions for merchants.

- Firearm: Defined according to federal law.

- Firearms retailer: A business that sells or trades firearms or ammunition.

- Merchant category code: A code used to categorize merchants based on the type of business.

- Payment card network: An entity that facilitates credit and debit card transactions.

Relevant Companies

- V (Visa Inc.) - As a major payment card network, Visa would be directly impacted by the prohibition on classifying firearms retailers separately from other types of retailers.

- MQ (Mastercard Incorporated) - Similar to Visa, Mastercard would also need to comply with the regulations regarding merchant category codes for firearms retailers.

- DFS (Discover Financial Services) - Discover, as another payment card network, would be affected by the requirements regarding the classification of firearms retailers.

This is an AI-generated summary of the bill text. There may be mistakes.

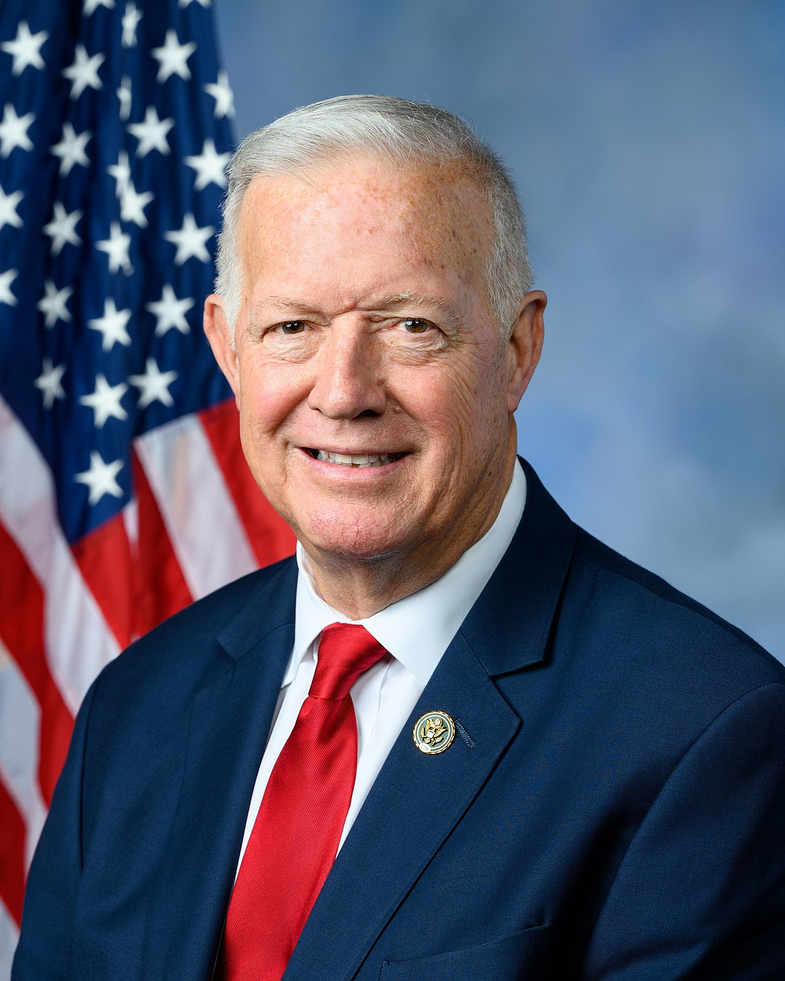

Sponsors

125 bill sponsors

-

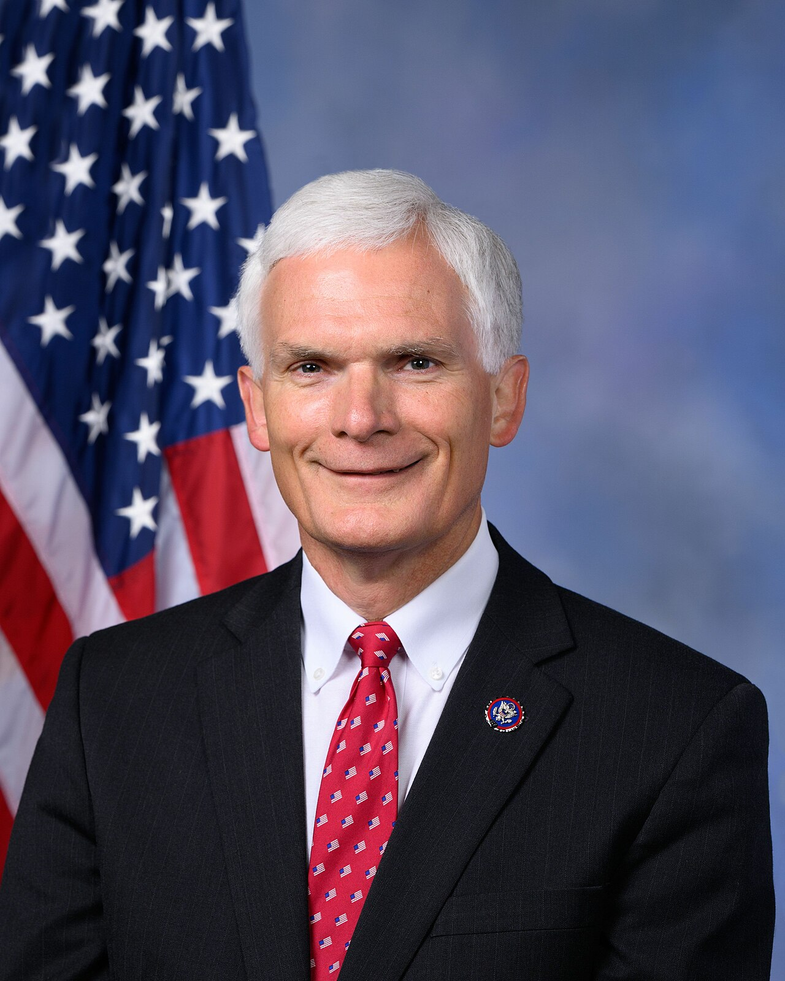

TrackRiley Moore

Sponsor

-

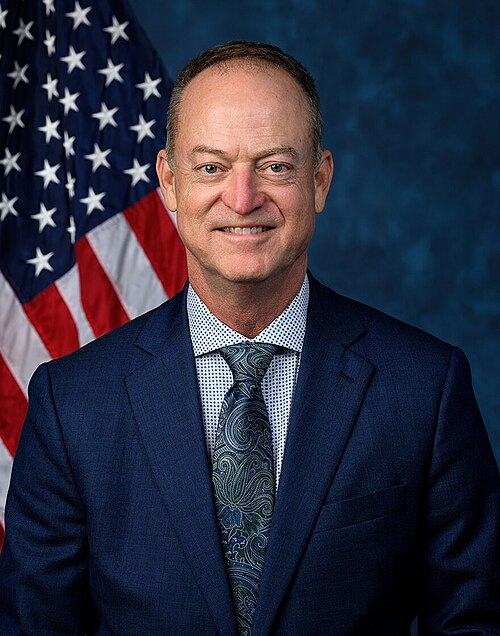

TrackRobert B. Aderholt

Co-Sponsor

-

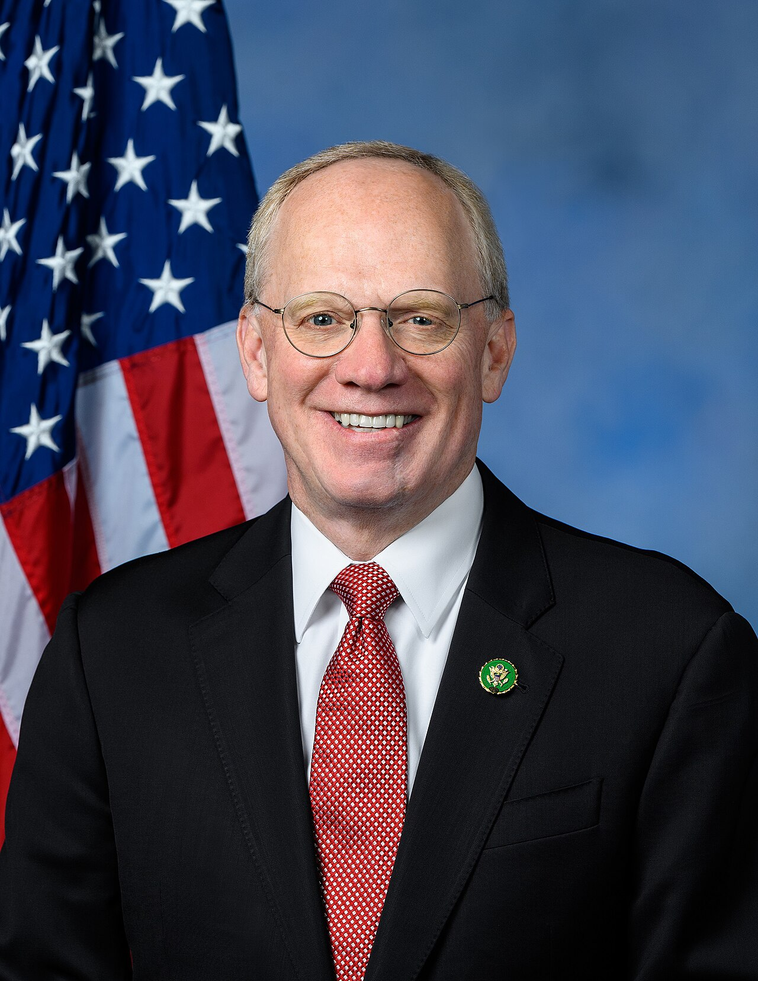

TrackMark E. Amodei

Co-Sponsor

-

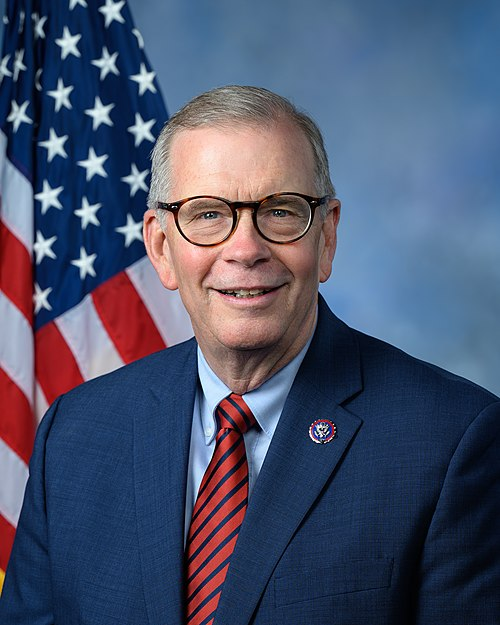

TrackJodey C. Arrington

Co-Sponsor

-

TrackBrian Babin

Co-Sponsor

-

TrackDon Bacon

Co-Sponsor

-

TrackAndy Barr

Co-Sponsor

-

TrackMichael Baumgartner

Co-Sponsor

-

TrackAaron Bean

Co-Sponsor

-

TrackNicholas Begich

Co-Sponsor

-

TrackJack Bergman

Co-Sponsor

-

TrackAndy Biggs

Co-Sponsor

-

TrackSheri Biggs

Co-Sponsor

-

TrackGus M. Bilirakis

Co-Sponsor

-

TrackLauren Boebert

Co-Sponsor

-

TrackMike Bost

Co-Sponsor

-

TrackEarl L. "Buddy" Carter

Co-Sponsor

-

TrackBen Cline

Co-Sponsor

-

TrackMichael Cloud

Co-Sponsor

-

TrackAndrew S. Clyde

Co-Sponsor

-

TrackMike Collins

Co-Sponsor

-

TrackJames Comer

Co-Sponsor

-

TrackDan Crenshaw

Co-Sponsor

-

TrackMonica De La Cruz

Co-Sponsor

-

TrackScott DesJarlais

Co-Sponsor

-

TrackTroy Downing

Co-Sponsor

-

TrackChuck Edwards

Co-Sponsor

-

TrackJake Ellzey

Co-Sponsor

-

TrackRon Estes

Co-Sponsor

-

TrackGabe Evans

Co-Sponsor

-

TrackMike Ezell

Co-Sponsor

-

TrackPat Fallon

Co-Sponsor

-

TrackJulie Fedorchak

Co-Sponsor

-

TrackRandy Feenstra

Co-Sponsor

-

TrackBrad Finstad

Co-Sponsor

-

TrackScott Fitzgerald

Co-Sponsor

-

TrackCharles J. "Chuck" Fleischmann

Co-Sponsor

-

TrackScott Franklin

Co-Sponsor

-

TrackRussell Fry

Co-Sponsor

-

TrackBrandon Gill

Co-Sponsor

-

TrackCraig Goldman

Co-Sponsor

-

TrackTony Gonzales

Co-Sponsor

-

TrackLance Gooden

Co-Sponsor

-

TrackPaul A. Gosar

Co-Sponsor

-

TrackSam Graves

Co-Sponsor

-

TrackMark E. Green

Co-Sponsor

-

TrackGlenn Grothman

Co-Sponsor

-

TrackMichael Guest

Co-Sponsor

-

TrackBrett Guthrie

Co-Sponsor

-

TrackAbraham Hamadeh

Co-Sponsor

-

TrackMike Haridopolos

Co-Sponsor

-

TrackPat Harrigan

Co-Sponsor

-

TrackMark Harris

Co-Sponsor

-

TrackAndy Harris

Co-Sponsor

-

TrackDiana Harshbarger

Co-Sponsor

-

TrackKevin Hern

Co-Sponsor

-

TrackClay Higgins

Co-Sponsor

-

TrackAshley Hinson

Co-Sponsor

-

TrackRichard Hudson

Co-Sponsor

-

TrackBill Huizenga

Co-Sponsor

-

TrackWesley Hunt

Co-Sponsor

-

TrackJeff Hurd

Co-Sponsor

-

TrackDarrell Issa

Co-Sponsor

-

TrackBrian Jack

Co-Sponsor

-

TrackRonny Jackson

Co-Sponsor

-

TrackTrent Kelly

Co-Sponsor

-

TrackMike Kennedy

Co-Sponsor

-

TrackDavid Kustoff

Co-Sponsor

-

TrackNick LaLota

Co-Sponsor

-

TrackDoug LaMalfa

Co-Sponsor

-

TrackNicholas A. Langworthy

Co-Sponsor

-

TrackRobert E. Latta

Co-Sponsor

-

TrackLaurel M. Lee

Co-Sponsor

-

TrackJulia Letlow

Co-Sponsor

-

TrackBarry Loudermilk

Co-Sponsor

-

TrackTracey Mann

Co-Sponsor

-

TrackLisa C. McClain

Co-Sponsor

-

TrackAddison McDowell

Co-Sponsor

-

TrackJohn McGuire

Co-Sponsor

-

TrackMark Messmer

Co-Sponsor

-

TrackDaniel Meuser

Co-Sponsor

-

TrackMax L. Miller

Co-Sponsor

-

TrackMary E. Miller

Co-Sponsor

-

TrackJohn R. Moolenaar

Co-Sponsor

-

TrackBlake D. Moore

Co-Sponsor

-

TrackTim Moore

Co-Sponsor

-

TrackBarry Moore

Co-Sponsor

-

TrackGregory F. Murphy

Co-Sponsor

-

TrackTroy E. Nehls

Co-Sponsor

-

TrackDan Newhouse

Co-Sponsor

-

TrackScott Perry

Co-Sponsor

-

TrackAugust Pfluger

Co-Sponsor

-

TrackGuy Reschenthaler

Co-Sponsor

-

TrackMike Rogers

Co-Sponsor

-

TrackJohn W. Rose

Co-Sponsor

-

TrackDavid Rouzer

Co-Sponsor

-

TrackMichael A. Rulli

Co-Sponsor

-

TrackJohn H. Rutherford

Co-Sponsor

-

TrackDerek Schmidt

Co-Sponsor

-

TrackAustin Scott

Co-Sponsor

-

TrackPete Sessions

Co-Sponsor

-

TrackJefferson Shreve

Co-Sponsor

-

TrackAdrian Smith

Co-Sponsor

-

TrackPete Stauber

Co-Sponsor

-

TrackElise M. Stefanik

Co-Sponsor

-

TrackW. Gregory Steube

Co-Sponsor

-

TrackDale W. Strong

Co-Sponsor

-

TrackMarlin A. Stutzman

Co-Sponsor

-

TrackClaudia Tenney

Co-Sponsor

-

TrackThomas P. Tiffany

Co-Sponsor

-

TrackWilliam R. Timmons IV

Co-Sponsor

-

TrackDavid G. Valadao

Co-Sponsor

-

TrackJefferson Van Drew

Co-Sponsor

-

TrackBeth Van Duyne

Co-Sponsor

-

TrackDerrick Van Orden

Co-Sponsor

-

TrackAnn Wagner

Co-Sponsor

-

TrackTim Walberg

Co-Sponsor

-

TrackRandy K. Weber, Sr.

Co-Sponsor

-

TrackDaniel Webster

Co-Sponsor

-

TrackTony Wied

Co-Sponsor

-

TrackRoger Williams

Co-Sponsor

-

TrackJoe Wilson

Co-Sponsor

-

TrackSteve Womack

Co-Sponsor

-

TrackRudy Yakym III

Co-Sponsor

-

TrackRyan K. Zinke

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Feb. 11, 2025 | Introduced in House |

| Feb. 11, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.