The CEO Who Won't Stop Buying

Posted: 2 hours ago / Feb. 16, 2026 2:01 a.m. UTC

I'm thrilled to announce the launch of the Editorial Quant newsletter - where data meets dollars and cents.

Have questions? Spotted an interesting data trend? Just want to chat about what we're building? → Drop me a line at

If you find value in what we're doing, please

(yes, even your mom who keeps asking what stocks to buy).

There's a concept in securities law called "

." It sounds nefarious but it's actually the opposite: the SEC requires corporate insiders—executives, directors, anyone owning more than 10% of a company—to publicly report every time they buy or sell their own company's stock. They file a Form 4 within two business days of each transaction. The filings go straight into EDGAR, the SEC's public database, and anyone can read them.

The logic is elegant. If the people who know a company best are buying shares with their own money, that tells you something. Not everything CEOs buy stock for all sorts of reasons, but when a CEO walks into the open market every single week for ten consecutive months and purchases shares at whatever price the market gives him, "diversifying his personal portfolio" is probably not the explanation.

Bill O'Dowd, the CEO of Dolphin Entertainment

, has purchased stock 67 times since late 2021:

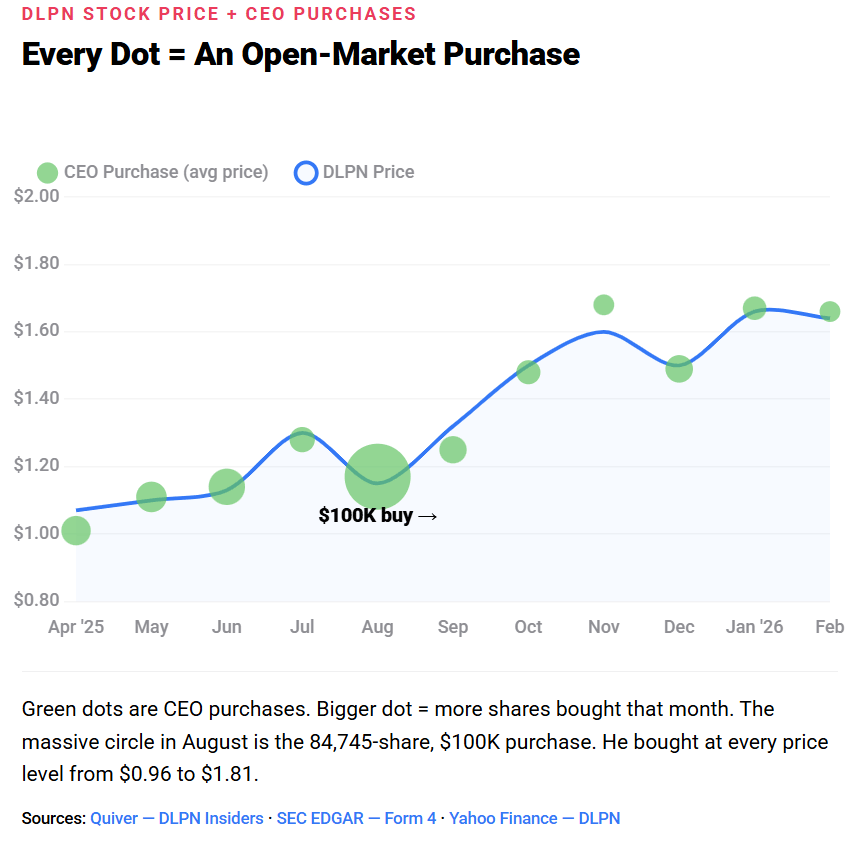

The interesting part isn't the count—it's the pattern. Starting in April 2025, he switched from occasional block purchases to a weekly buying program that has not stopped. Fifty-two purchases in 46 weeks, at prices ranging from $0.96 to $1.81, totaling 284,447 shares for $352,651 of his personal money.

The thing about weekly open-market purchases is that they can't be faked. This isn't an options exercise, it isn't a grant vesting on a schedule, it isn't a board-approved buyback.

is logging into his brokerage account, typing in the ticker, and clicking "buy" every Monday morning. He started at $0.96 in April and kept buying through $1.81 in January. The stock goes up, he buys. The stock goes down, he buys more.

In a micro-cap like

with a $19.5 million market cap, and about 12 million shares outstanding a CEO accumulating 434,690 shares is becoming a meaningful percentage of the float. At some point, the repeated insider buys blur into a kind of informal self-tender offer: the CEO is effectively saying "if you won't re-rate the stock, I will."

It's a governance Rorschach test. Either it's incredible alignment (this man has more skin in the game than most of his shareholders) or it's a sign there aren't many better capital-allocation ideas than buying the stock every week. Both could be true.

There's a concept in corporate governance called "blackout periods." During the weeks before a company reports earnings, insiders are prohibited from trading their company's stock. The logic is straightforward: if you know the quarter was bad, you shouldn't be allowed to sell before everyone else finds out.

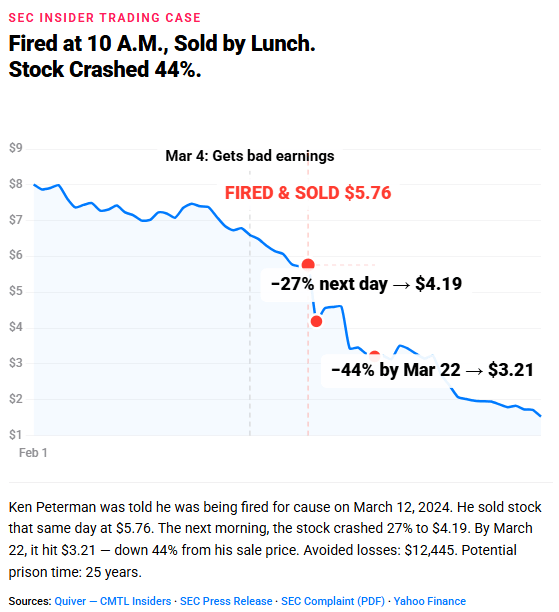

On March 4, 2024, Peterman received a confidential presentation showing that Comtech's quarterly results were going to be weak. On March 12, he was told he was being terminated for cause. That same day before the market had any idea, he sold 2,162 shares at $5.76 per share, pocketing $12,445.

Peterman also tried

, but the firm's blackout controls the automated systems that prevent insiders from trading during restricted windows caught the order and blocked it. If those controls hadn't worked, he would have avoided an additional $110,000 in losses. The system designed to protect executives from themselves actually worked. The executive just also tried to go around it.

This is the ultra-petty version of insider trading: not a grand, multi-year scheme just "I got fired, please sell my stock before everyone finds out why." The avoided loss number is comically small in the context of a CEO-level job, which perversely strengthens

: insider trading is about

behavior

, not dollar size.

The institutional picture tells its own story.

the quant fund that

added

25% to its DLPN position cut its CMTL stake by 54%, dumping 107,000 shares. When the algorithms say "sell" after your ex-CEO gets charged with fraud, the signal is unambiguous.

Congress? Zero trades in ComTech . Lobbying? $0 spend. This is a defense telecom company with no political footprint, which means the only story here is the one in the SEC complaint.

Comtech has since installed Kenneth Traub as Chairman and CEO. The stock has recovered from its $2 lows to about $5.87 a new management premium. But the Peterman saga remains a useful reminder that compliance systems exist for a reason, and that the most expensive trades are often the smallest ones.

When we first flagged this story, the headline was a $2.1 million sale on February 6.

Then we pulled the full insider data from Quiver:

CEO Matthew McRae hasn't made just one sale. He's made sixteen. Since March 2025, when his Rule 10b5-1 trading plan kicked in, McRae has sold roughly 3 million shares for total proceeds of approximately $44 million.

During that same period, he received over 1 million shares through Performance Stock Unit vestings. His current direct ownership sits at 1,011,288 shares, down from 2.49 million when the selling started.

And he's not alone. Every named insider at

(CFO Kurtis Binder, General Counsel Brian Busse) has been selling. Total insider liquidation across all officers: approximately $59 million. Insider purchases at market price: zero.

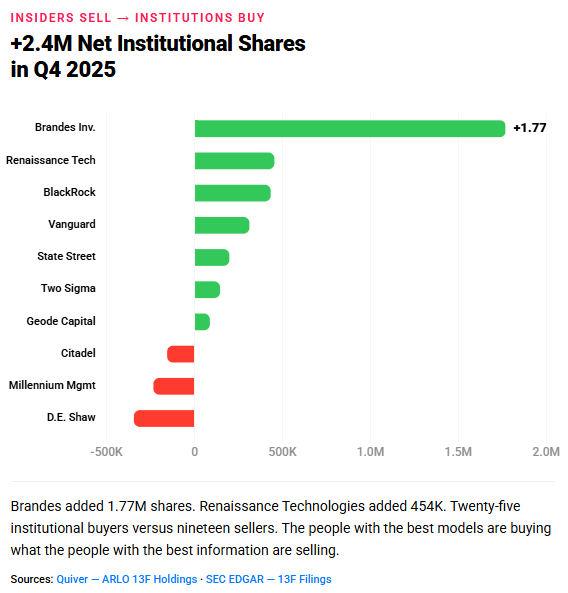

The institutional side is the mirror image. While insiders sold approximately $59 million, 25 institutional funds added a net 2.4 million shares in Q4 2025. Brandes Investment Partners opened a massive 1.77 million share position. Renaissance Technologies added 454,000 shares. BlackRock added 433,000. The people running quantitative models are buying what the people running the company are selling.

Congress? Zero trades in

. Lobbying? Arlo spends $60,000 per quarter on Science/Technology issues, a steady $240K annual budget. That's notable for a smart home camera company. There's no congressional trading angle here, but the lobbying spend suggests regulatory awareness that most retail investors miss.

In practice, "skin in the game" often means "stock compensation minus whatever I sold last quarter," and Arlo's filing history is that dynamic at scale. I'm not saying the CEO knows something. I'm just noting that the people who know the most about a company's future are the ones most actively diversifying away from it, while the stock sits 29% off its 52-week high.

Add Quiver Quantitative to your preferred sources on Google

Suggested Articles