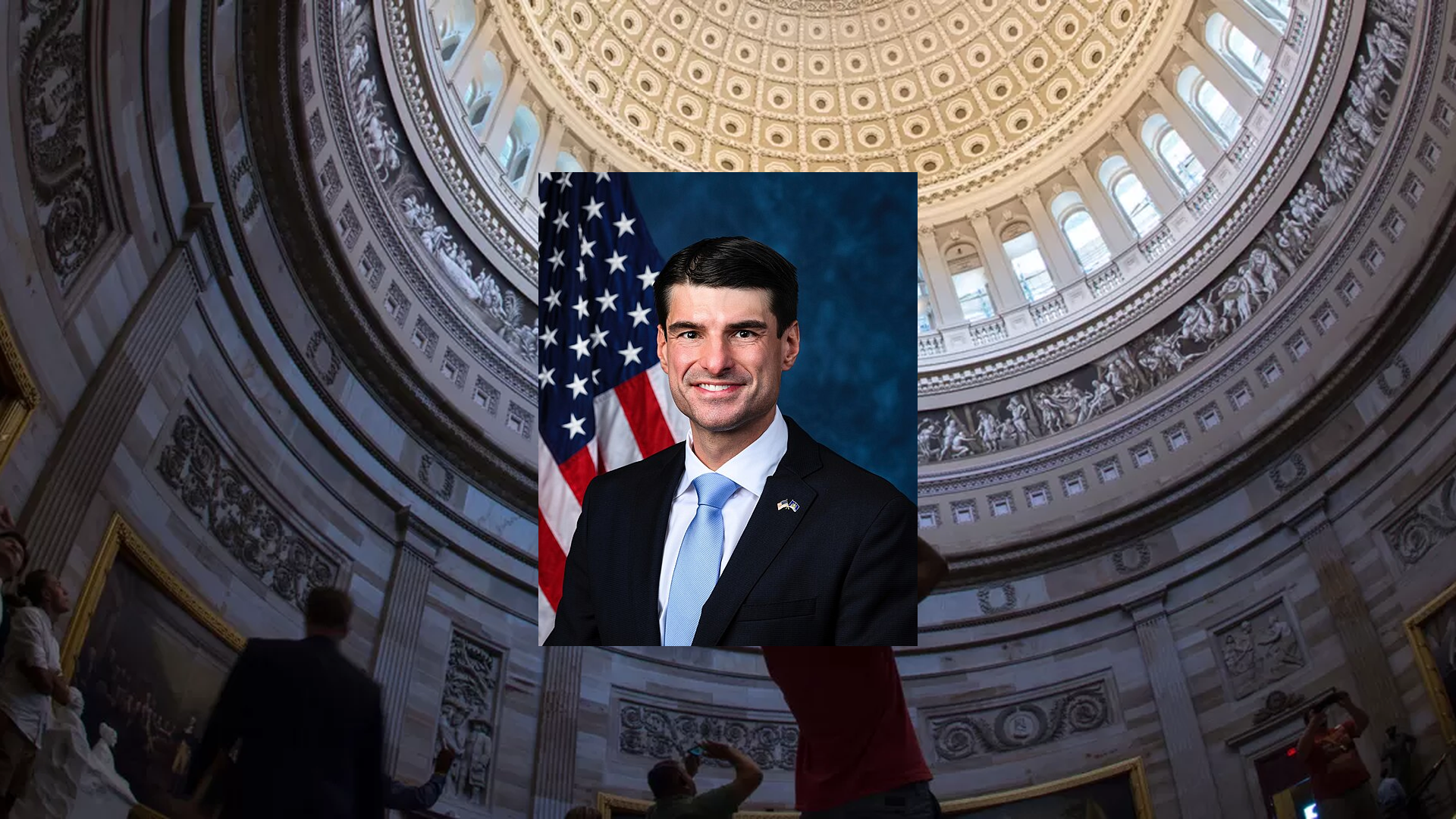

Representative Rob Bresnahan introduced H.R. 5695, preventing IRS tax collection during government shutdowns, ensuring taxpayer fairness.

Quiver AI Summary

On October 8, 2025, U.S. Representative Rob Bresnahan, Jr. introduced H.R. 5695, known as the No Taxation Without Operation Act, amidst the ongoing government shutdown. This proposed legislation aims to bar the IRS from collecting federal taxes when the government is unable to provide essential services, addressing what Bresnahan describes as a "ridiculous double standard."

Under this act, tax collections would halt during government shutdowns, and penalties for nonpayment would freeze. It also seeks to exempt backpay for furloughed federal workers from income tax once the government reopens. Bresnahan, expressing commitment to taxpayer fairness, has taken steps to withhold his own salary during the shutdown.

The bill aligns with Bresnahan's efforts to promote government accountability, following his support for extending government funding through various legislative measures. He criticized Senate Democrats for their role in the shutdown, vowing to advocate for the needs of his constituents in Northeastern Pennsylvania.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Robert Bresnahan Net Worth

Quiver Quantitative estimates that Robert Bresnahan is worth $36.8M, as of October 8th, 2025. This is the 39th highest net worth in Congress, per our live estimates.

Bresnahan has approximately $12.5M invested in publicly traded assets which Quiver is able to track live.

You can track Robert Bresnahan's net worth on Quiver Quantitative's politician page for Bresnahan.

Robert Bresnahan Bill Proposals

Here are some bills which have recently been proposed by Robert Bresnahan:

- H.R.5695: To suspend Federal individual income taxes during a lapse in appropriations, and for other purposes.

- H.R.5293: To authorize the President to award the Medal of Honor to Ret. Col. Robert J. Graham for acts of valor while as a member of the Air Force during the Vietnam War.

- H.R.4782: Local Farmers Feeding our Communities Act

- H.R.4426: SMART Act

- H.R.3428: Mid-Atlantic River Basin Commissions Review Act

- H.R.3182: To amend title 5, United States Code, to prohibit Members of Congress and their spouses from trading stock, and for other purposes.

You can track bills proposed by Robert Bresnahan on Quiver Quantitative's politician page for Bresnahan.

Robert Bresnahan Fundraising

Robert Bresnahan recently disclosed $558.8K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 131st most from all Q2 reports we have seen this year. 60.9% came from individual donors.

Bresnahan disclosed $744.8K of spending. This was the 46th most from all Q2 reports we have seen from politicians so far this year.

Bresnahan disclosed $861.9K of cash on hand at the end of the filing period. This was the 333rd most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Robert Bresnahan's fundraising on Quiver Quantitative.