Representative Derek Tran introduces legislation aiming to reduce costs for working parents, focusing on healthcare and baby products.

Quiver AI Summary

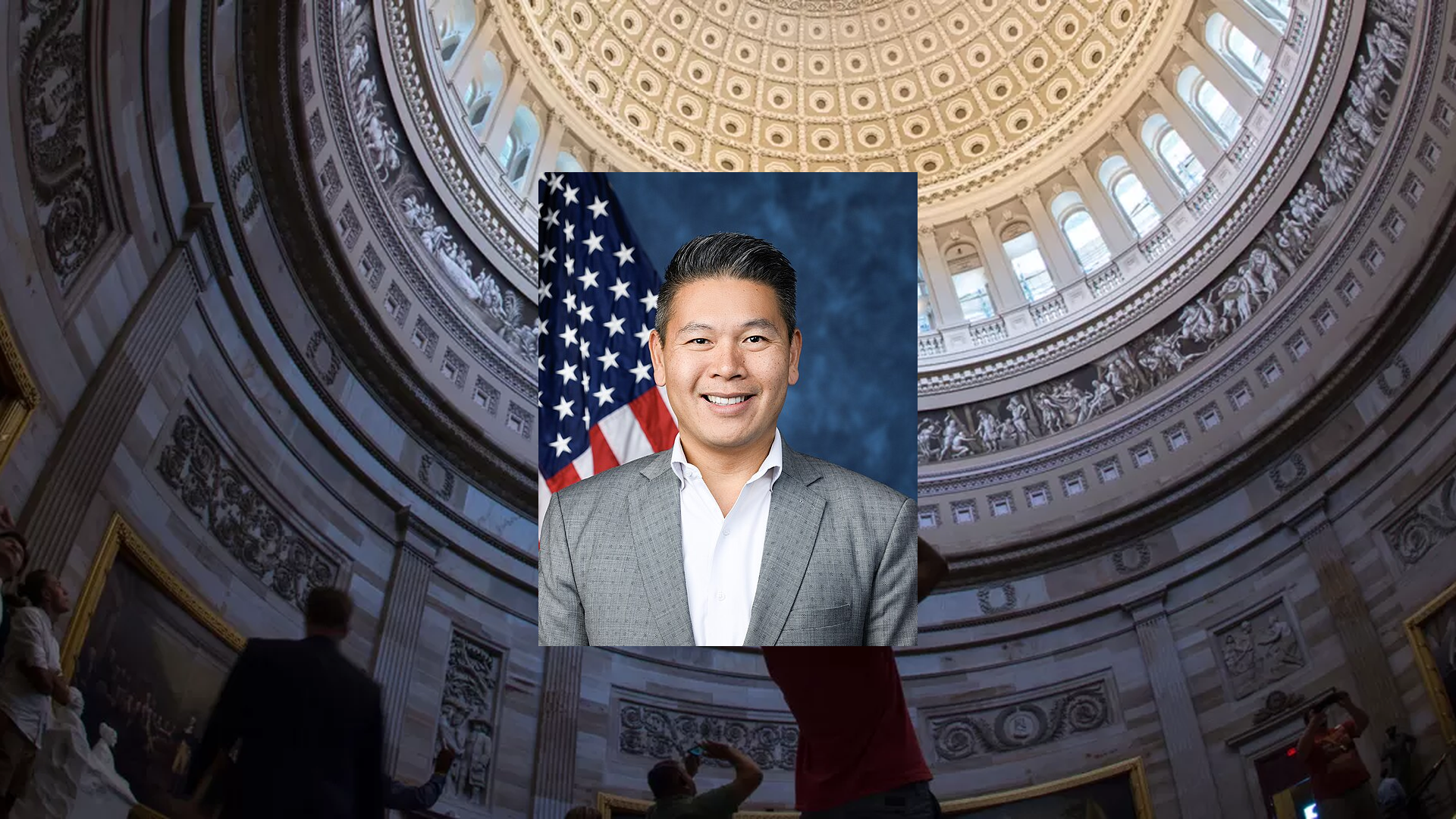

U.S. Representative Derek Tran (CA-45) has introduced two new legislative proposals aimed at reducing costs for working parents. The Keep Kids Covered Act, co-sponsored by Representative Kathy Castor (FL-14), and the Baby Food Tax Relief Act are designed to lower essential healthcare and food expenses for children.

Tran emphasized the importance of these measures, stating, “No parent should have to wonder where their child’s next meal is coming from.” The Keep Kids Covered Act aims to ensure continual access to affordable healthcare for children and mitigate their emergency medical treatment needs. The Baby Food Tax Relief Act seeks to exempt crucial baby feeding products from tariffs imposed under prior administrations.

As part of the Congressional Dads Caucus, Tran is also backing several related initiatives to alleviate the financial burdens on families, including tax relief for baby clothing and other child-related expenses. Tran has consistently pushed for legislative solutions to the cost-of-living crisis affecting families.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Derek Tran Fundraising

Derek Tran recently disclosed $780.9K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 67th most from all Q2 reports we have seen this year. 70.8% came from individual donors.

Tran disclosed $219.1K of spending. This was the 241st most from all Q2 reports we have seen from politicians so far this year.

Tran disclosed $1.2M of cash on hand at the end of the filing period. This was the 262nd most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Derek Tran's fundraising on Quiver Quantitative.