We have received text from S. 3027: Interstate Commerce Simplification Act of 2025. This bill was received on None, and currently has no cosponsors.

Here is a short summary of the bill:

This bill, known as the Interstate Commerce Simplification Act of 2025, seeks to amend existing legislation regarding state taxation related to business activities that involve soliciting orders across state lines. The primary aim is to adjust the interpretation of what counts as "solicitation of orders" under Public Law 86-272.

Key Provisions

- The bill proposes changes to Section 101(d) of Public Law 86-272 by redefining the term "solicitation of orders." Under the amended definition, this term will include any business activity that aids in the solicitation of orders, even if the activity also has other valuable business functions.

- This change is intended to expand the types of business activities that fall under this definition, potentially affecting how interstate commerce operates and how states can levy taxes on these activities.

Impact on State Taxation

By expanding the definition of solicitation of orders, the bill aims to clarify the limitations on states’ abilities to impose taxes on out-of-state businesses. This could lead to a greater number of businesses being exempt from state taxes when they perform certain activities that solicit orders, further impacting state revenue collection.

Overall Objective

The ultimate goal of the legislation is to simplify the regulatory framework governing interstate commerce and taxation, potentially making it easier for businesses to operate across state lines without facing complex tax implications.

Implementation

If enacted, the bill would lead to revisions in how businesses assess their tax obligations when engaging in soliciting orders across different states and may affect the competitiveness of businesses depending on the specifics of their operations.

Relevant Companies

- AMZN (Amazon.com, Inc.): This company frequently engages in interstate commerce and could be impacted by changes to tax obligations related to order solicitation.

- UPS (United Parcel Service, Inc.): As a major logistics and transportation company, UPS might see changes in how it operates regarding interstate business and tax regulations.

- FLWS (1-800-Flowers.com, Inc.): This retailer operates nationally and could be significantly impacted by the way solicitation and tax laws change under the bill.

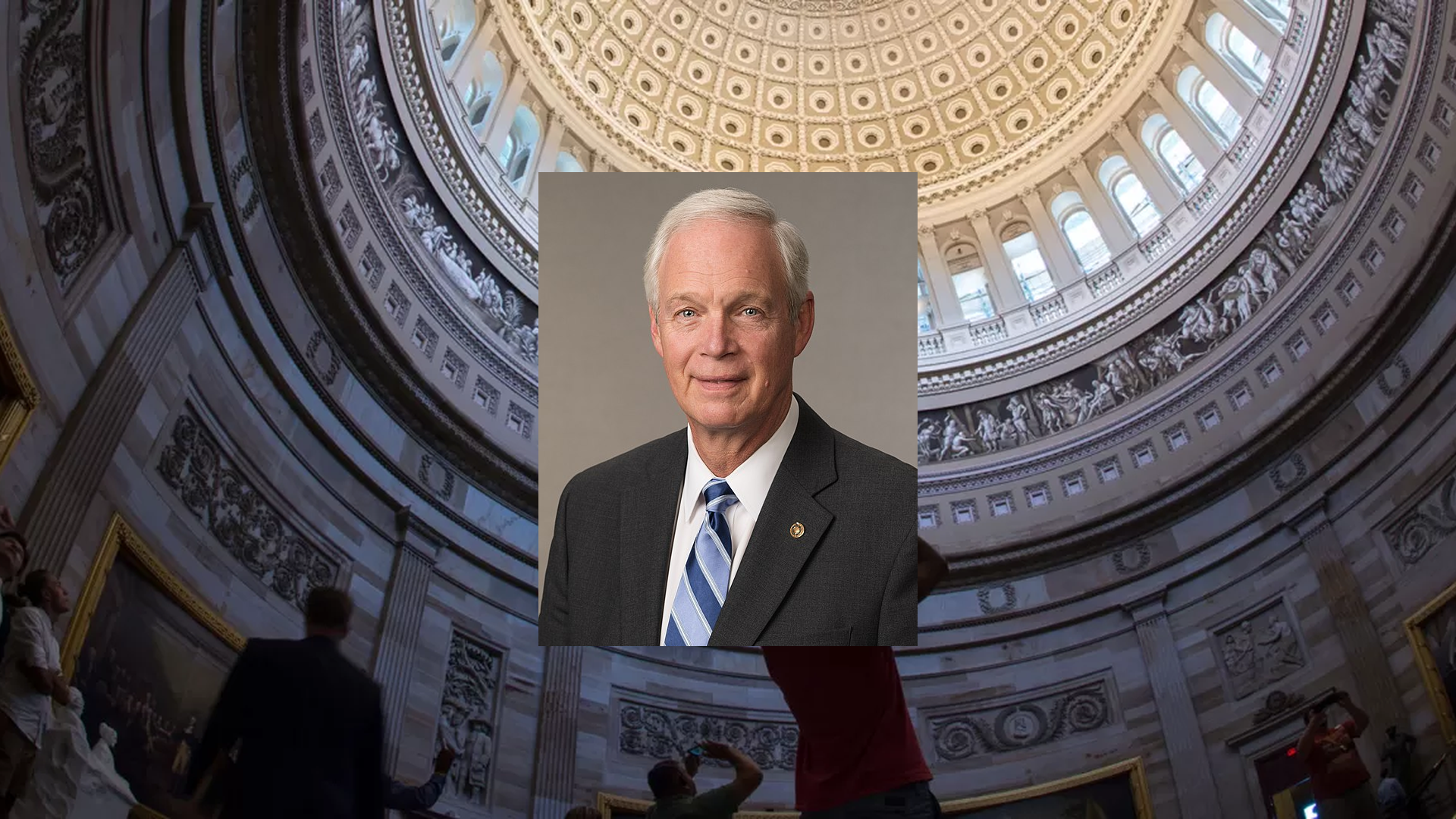

Senator Ron Johnson Bill Proposals

Here are some bills which have recently been proposed by Senator Ron Johnson:

- S.3027: Interstate Commerce Simplification Act of 2025

- S.3012: Shutdown Fairness Act

- S.3001: Shutdown Fairness Act

- S.2806: Eliminate Shutdowns Act

- S.2641: Health Care Freedom and Choice Act

- S.1983: No WHO Pandemic Preparedness Treaty Without Senate Approval Act

You can track bills proposed by Senator Ron Johnson on Quiver Quantitative's politician page for Johnson.

Senator Ron Johnson Net Worth

Quiver Quantitative estimates that Senator Ron Johnson is worth $67.8M, as of October 24th, 2025. This is the 22nd highest net worth in Congress, per our live estimates.

Johnson has approximately $20.8M invested in publicly traded assets which Quiver is able to track live.

You can track Senator Ron Johnson's net worth on Quiver Quantitative's politician page for Johnson.

Senator Ron Johnson Stock Trading

We have data on up to $25.2M of trades from Senator Ron Johnson, which we parsed from STOCK Act filings.

You can track Senator Ron Johnson's stock trading on Quiver Quantitative's politician page for Johnson.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.