We have received text from S. 2638: Energy Efficiency for Affordable Housing Act. This bill was received on 2025-07-31, and currently has 3 cosponsors.

Here is a short summary of the bill:

This bill, titled the Energy Efficiency for Affordable Housing Act , proposes amendments to the Internal Revenue Code of 1986 focused on enhancing energy performance in affordable housing. Here are the main points of the bill:

Increased Tax Credits

The bill seeks to increase the low-income housing credit for rehabilitation expenses for buildings that meet enhanced energy performance standards. Specifically:

- The rehabilitation expenditures for existing buildings achieving enhanced energy performance will be increased to 130% of the current allowable expenses.

- If modifications to a building are expected to reduce its energy usage by at least 50% compared to previous levels, those modifications may qualify under this enhanced credit.

Criteria for Enhanced Energy Performance

To qualify for the increased credits, a building must meet one of the following conditions:

- It meets the minimum requirements of an advanced building construction standard as determined by the Secretary of Energy.

- The owner submits a qualified retrofit plan, which must be certified by a licensed professional and show expected energy savings.

Special Considerations for High-Cost Areas

For buildings located in high-cost areas that also achieve enhanced energy performance, the bill provides an even larger increase in applicable rehabilitation expenditures, raising them to 160% of current allowances.

Effective Date

The amendments proposed in this bill would apply to buildings for which housing credit amounts are allocated after December 31, 2025. Additional provisions apply to projects financed by specific bond obligations that commence after the same date.

Summary of Benefits

The intent of the bill is to encourage energy-efficient renovations in affordable housing, potentially leading to reduced energy consumption and costs, thus supporting sustainable living practices while addressing housing affordability issues.

Relevant Companies

- GE - General Electric might benefit from an increase in demand for energy-efficient technologies used in building renovations.

- <a href="https://www.quiverquant.com/stock/ROL/>ROL

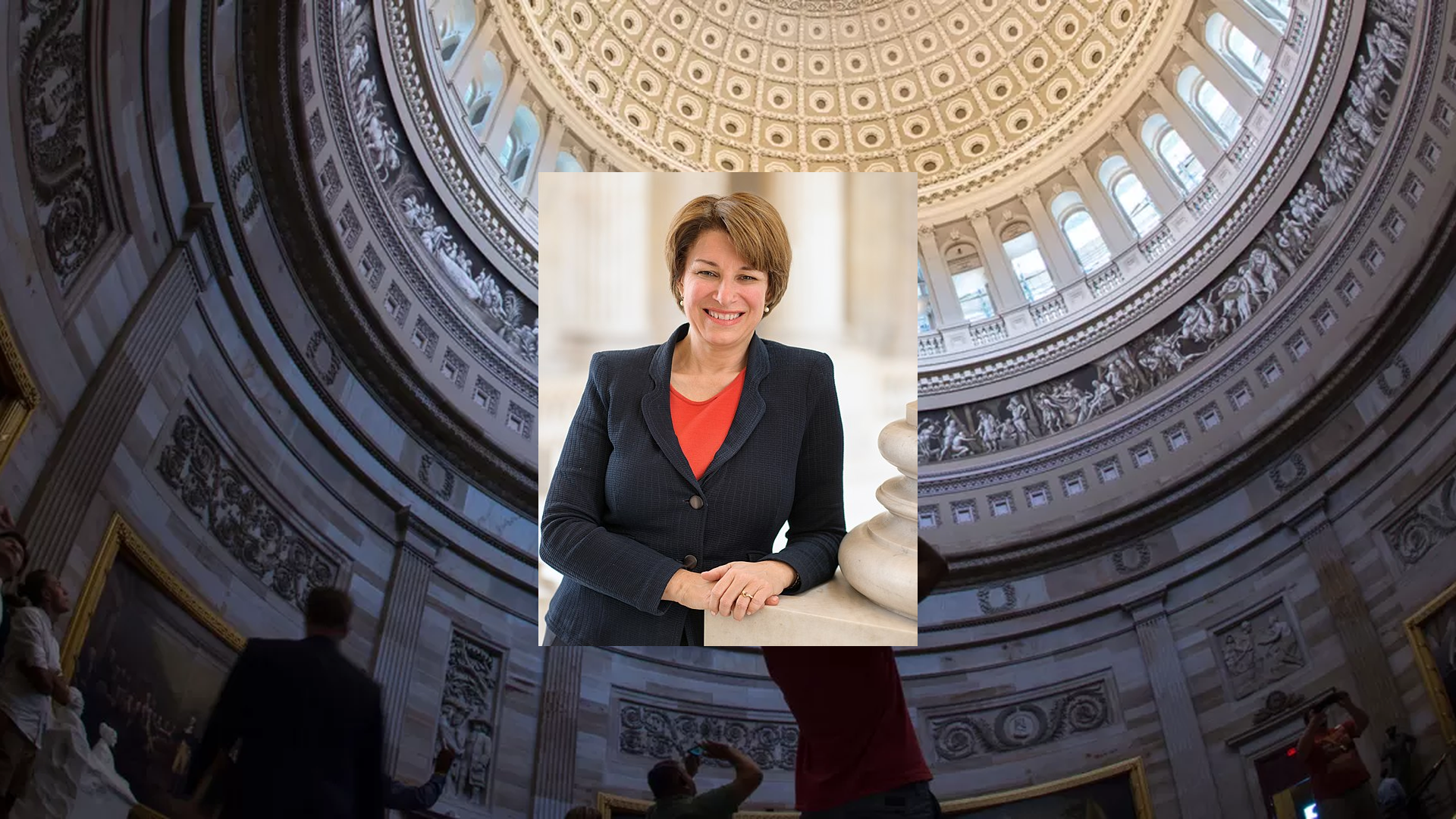

Senator Amy Klobuchar Bill Proposals

Here are some bills which have recently been proposed by Senator Amy Klobuchar:

- S.2665: A bill to amend the Federal Food, Drug, and Cosmetic Act to provide for notification by manufacturers of critical drugs of increased demand, and for other purposes.

- S.2662: A bill to amend the Small Business Investment Act of 1958 to improve the loan guaranty program, enhance the ability of small manufacturers to access affordable capital, and for other purposes.

- S.2639: Military Spouse Entrepreneurship Act of 2025

- S.2638: Energy Efficiency for Affordable Housing Act

- S.2576: Election Mail Act

- S.2467: Agricultural Biorefinery Innovation and Opportunity Act of 2025

You can track bills proposed by Senator Amy Klobuchar on Quiver Quantitative's politician page for Klobuchar.

Senator Amy Klobuchar Net Worth

Quiver Quantitative estimates that Senator Amy Klobuchar is worth $2.1M, as of August 12th, 2025. This is the 223rd highest net worth in Congress, per our live estimates.

Klobuchar has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track Senator Amy Klobuchar's net worth on Quiver Quantitative's politician page for Klobuchar.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.