We have received text from H.R. 4181: Wildfire Infrastructure and Landowner Tax Relief Act of 2025. This bill was received on 2025-06-26, and currently has 7 cosponsors.

Here is a short summary of the bill:

This bill, titled the

Wildfire Infrastructure and Landowner Tax Relief Act of 2025

, aims to amend the Internal Revenue Code to provide incentive measures for wildfire prevention. It introduces various tax benefits for individuals and entities engaging in activities related to reducing hazardous fuels and improving real property to facilitate wildfire prevention efforts.

Key Provisions

Exclusion of Income Related to Hazardous Fuel Reduction Activities

The bill states that if a taxpayer receives grants or awards for conducting hazardous fuel reduction activities or improvements on their property, that income will not be included when calculating gross income for tax purposes. This means:

- Taxpayers can receive financial assistance without it impacting their taxable income.

-

Hazardous fuel reduction activities include installations for controlling fire behavior (like

fuel breaks

andfirebreaks

) and the reduction of hazardous vegetation through various methods such as prescribed burns or mechanical treatments.

Tax Deductions for Hazardous Fuel Reduction Activities

The bill allows taxpayers to deduct amounts they spend on qualified hazardous fuel reduction activities in their taxable income. The criteria for such deductions include:

- The activity must meet the definition of hazardous fuel reduction as outlined in the bill.

- The activity must be certified by a fire management agency as beneficial for reducing hazardous fuels or aiding in firefighting efforts.

It also includes provisions to ensure that no taxpayer can receive both an exclusion of income and a deduction for the same expense, preventing what is referred to as a

double benefit

.

Definitions

Several terms are clearly defined in the bill to clarify what constitutes hazardous fuel reduction activities and improvements. Key definitions include:

-

Hazardous fuel reduction activity

– Activities aimed at wildfire prevention through various methods. -

Hazardous fuel reduction improvement

– Modifications to real property that support firefighting, such as installing necessary equipment or facilitating access for firefighters. -

Hazardous fuel

– Vegetative materials that can easily catch fire, including trees, grasses, shrubs, and dead vegetation.

Effective Dates

All amendments introduced by this bill will apply to income received and expenditures made after the date of enactment of the Act.

Relevant Companies

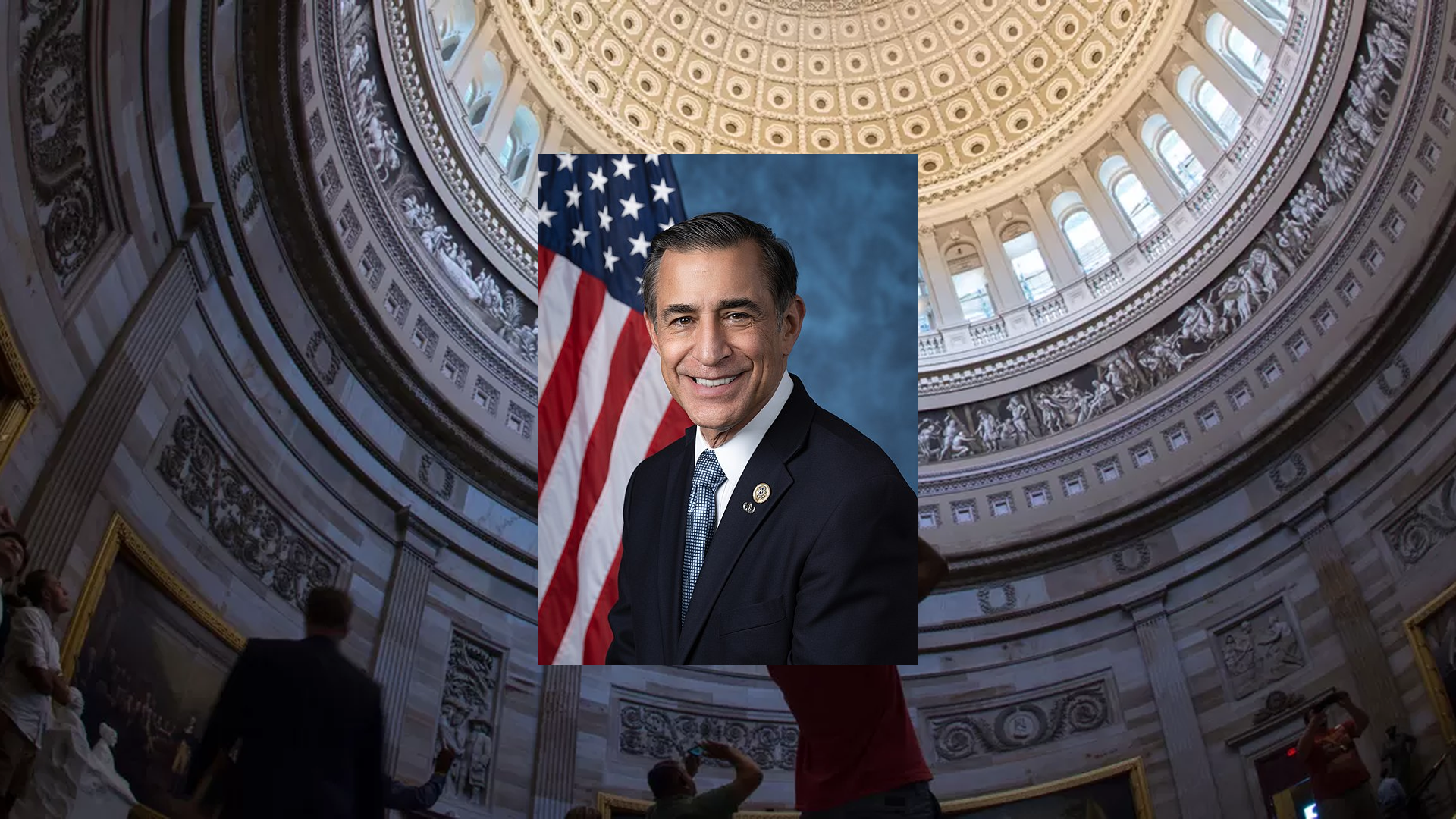

None found.Representative Darrell Issa Bill Proposals

Here are some bills which have recently been proposed by Representative Darrell Issa:

- H.R.4283: To designate the facility of the United States Postal Service located at 1157 West Mission Avenue in Escondido, California, as the "Captain E. Royce Williams Post Office Building".

- H.R.4181: To amend the Internal Revenue Code of 1986 to provide incentives for wildfire prevention.

- H.R.4072: Pro Codes Act

- H.R.4009: Pro Codes Act

- H.R.3914: Valor Has No Expiration Act

- H.R.3770: FIREARM Act

You can track bills proposed by Representative Darrell Issa on Quiver Quantitative's politician page for Issa.

Representative Darrell Issa Net Worth

Quiver Quantitative estimates that Representative Darrell Issa is worth $234.7M, as of July 15th, 2025. This is the 6th highest net worth in Congress, per our live estimates.

Issa has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track Representative Darrell Issa's net worth on Quiver Quantitative's politician page for Issa.

Representative Darrell Issa Stock Trading

We have data on up to $405.0M of trades from Representative Darrell Issa, which we parsed from STOCK Act filings.

You can track Representative Darrell Issa's stock trading on Quiver Quantitative's politician page for Issa.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.