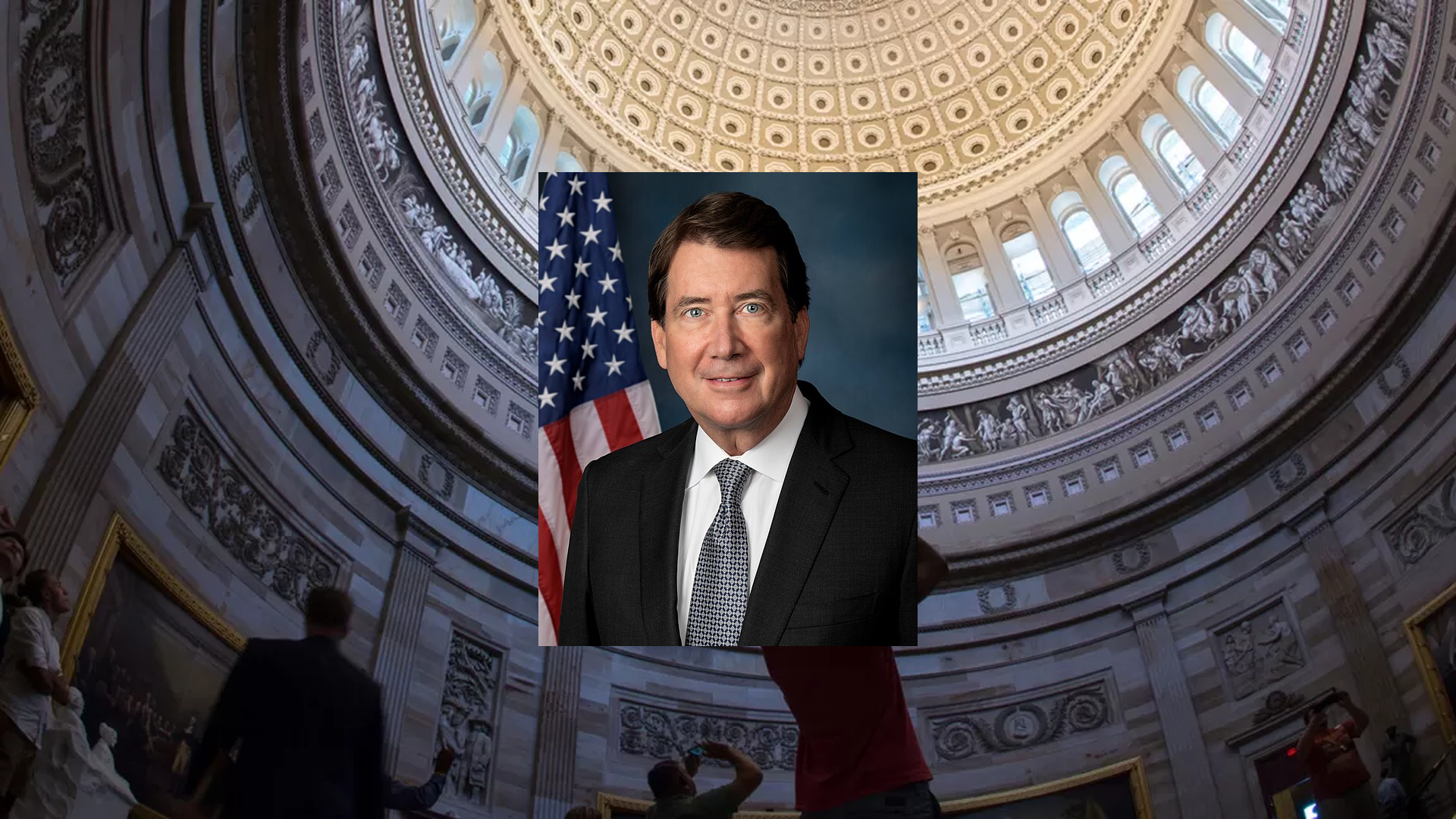

The Senate has passed S. 1582 - Guiding and Establishing National Innovation for U.S. Stablecoins Act. This bill was introduced by Senator Bill Hagerty.

The vote was 68-30.

You can track corporate lobbying on this bill and relevant congressional stock trades on Quiver Quantitative's S. 1582 bill page.

Here is a short summary of a May 5, 2025 version of the bill.

S. 1582 - Guiding and Establishing National Innovation for U.S. Stablecoins Act Summary

The "Guiding and Establishing National Innovation for U.S. Stablecoins Act" is a piece of legislation designed to create a regulatory framework for payment stablecoins in the United States. Here are the key features of the bill:

Regulation of Payment Stablecoins

The bill mandates that issuers of payment stablecoins must:

- Maintain adequate reserves.

- Adhere to federal regulations.

- Not engage in unauthorized issuance or sales of stablecoins within the U.S.

By establishing these requirements, the legislation aims to ensure the safety and reliability of stablecoins in financial transactions.

Issuers' Obligations and Compliance

Payment stablecoin issuers are required to comply with specific regulations regarding:

- Custodial services for holding reserves.

- Management of reserves to ensure solvency.

- Sales practices that are not tied to misleading representations.

- Regular audits to confirm compliance and transparency.

Furthermore, the bill prohibits deceptive naming conventions that might imply government backing and establishes a clear framework for applications, supervision, and penalties to ensure compliance with financial regulations.

Enforcement Powers

The bill provides the primary Federal payment stablecoin regulator with the authority to:

- Issue cease-and-desist orders against violators.

- Impose civil penalties.

- Remove individuals associated with non-compliant issuers.

It also outlines procedures for enforcement actions and sets regulations that apply to state-issued payment stablecoins, including guidelines for anti-money laundering measures.

Bankruptcy, Regulatory Oversight, and Interoperability

The legislation addresses several important aspects of payment stablecoins, including:

- Priority in bankruptcy proceedings.

- Specific reserve requirements and regulatory oversight.

- Regulatory considerations for foreign-issued stablecoins.

- Legal definitions to clarify the status of stablecoins.

Moreover, it seeks to foster interoperability within the digital finance ecosystem, allowing for greater collaboration and integration of stablecoins within existing financial systems.

Relevant Companies

- COIN (Coinbase Global Inc.): As a major cryptocurrency exchange, Coinbase may be impacted by changes in regulatory compliance requirements for stablecoins, which could affect its trading operations and product offerings related to stablecoins.

- USDC (Circle Internet Financial): As a prominent issuer of the USD Coin (USDC), Circle is likely to be directly impacted by the bill's regulations concerning reserve management and compliance oversight.

- BNB (Binance Holdings Ltd.): Operations concerning Binance's stablecoin offerings may be affected by the regulatory framework established by this bill, particularly regarding reserve requirements and audit standards.

This article is not financial advice. Bill summaries may be unreliable. Consult Congress.gov for full bill text. See Quiver Quantitative's disclaimers for more information.

Senator Bill Hagerty Bill Proposals

Here are some bills which have recently been proposed by Senator Bill Hagerty:

- S.2060: A bill to prohibit sanctuary jurisdictions from receiving community development block grants.

- S.1715: Protecting Privacy in Purchases Act

- S.1582: GENIUS Act

- S.1522: District of Columbia Federal Immigration Compliance Act

- S.1375: SNOOP Act of 2025

- S.1283: Innovate to De-Escalate Modernization Act

You can track bills proposed by Senator Bill Hagerty on Quiver Quantitative's politician page for Hagerty.

Senator Bill Hagerty Net Worth

Quiver Quantitative estimates that Senator Bill Hagerty is worth $55.5M, as of June 17th, 2025. This is the 19th highest net worth in Congress, per our live estimates.

Hagerty has approximately $14.6M invested in publicly traded assets which Quiver is able to track live.

You can track Senator Bill Hagerty's net worth on Quiver Quantitative's politician page for Hagerty.

Senator Bill Hagerty Stock Trading

We have data on up to $53.8M of trades from Senator Bill Hagerty, which we parsed from STOCK Act filings. Some of the largest trades include:

- A November 8th, 2021 sale of up to $5M of $DDOG. The stock has fallen 34.76% since then.

- A December 28th, 2021 sale of up to $500K of $RNR. The stock has risen 42.34% since then.

- A December 23rd, 2021 sale of up to $250K of $RHP. The stock has risen 9.86% since then.

- A December 29th, 2021 sale of up to $250K of $PNFP. The stock has risen 7.45% since then.

- A December 29th, 2021 sale of up to $100K of $CCEP. The stock has risen 65.47% since then.

You can track Senator Bill Hagerty's stock trading on Quiver Quantitative's politician page for Hagerty.