Clene Inc. announces financial results and updates on CNM-Au8 programs, planning FDA submissions and biomarker analyses for ALS and MS.

Quiver AI Summary

Clene Inc. announced updates on its CNM-Au8 programs, focusing on treatments for amyotrophic lateral sclerosis (ALS) and multiple sclerosis (MS), during its second quarter financial results presentation. Following positive feedback from the FDA on its statistical analysis plan, Clene plans to analyze neurofilament light data from its NIH-sponsored Early Access Protocol in early Q4 2025. A second Type C meeting with the FDA is set for Q3 2025 to discuss the survival benefits of CNM-Au8 in ALS, with a New Drug Application expected by the end of 2025 for potential accelerated approval. For MS, an end-of-Phase 2 meeting is also planned in the third quarter to review results from the Phase 2 VISIONARY-MS trial. As of June 30, 2025, Clene reported cash reserves of $7.3 million, supplemented by recent fundraising efforts, providing a runway into Q1 2026. Despite a net loss of $7.4 million for the quarter, Clene remains committed to advancing its neurodegenerative disease therapies.

Potential Positives

- Clene plans to analyze neurofilament light data from its NIH-sponsored Early Access Protocol, with results expected early in Q4 2025, which could provide important biomarkers for ALS treatment.

- A second Type C meeting with the FDA is scheduled to review CNM-Au8's survival benefit in ALS, indicating ongoing engagement with regulatory authorities.

- Clene expects to submit a New Drug Application by the end of 2025 for accelerated approval of CNM-Au8 for ALS, potentially leading to market entry for a new treatment option.

- The company reported a cash runway into the first quarter of 2026, which supports continued operations and clinical development activities.

Potential Negatives

- Clene's cash and cash equivalents decreased significantly from $12.2 million at the end of 2024 to $7.3 million by June 30, 2025, raising concerns about the company's financial stability and ability to sustain operations beyond early 2026 without additional funding.

- The company reported a net loss of $7.4 million for the quarter ending June 30, 2025, which is an increase compared to a net loss of $6.8 million for the same quarter in 2024, indicating worsening financial performance.

- The total other expense for the quarter ended June 30, 2025, was $1.6 million, a flip from total other income of $0.6 million in 2024, highlighting significant financial challenges and potential liquidity issues.

FAQ

When will Clene analyze the neurofilament light data?

Clene plans to analyze the NfL data in early Q4 2025.

What is the purpose of the Type C meeting with the FDA?

The meeting will review the survival benefit associated with CNM-Au8 dosing.

When does Clene plan to submit its New Drug Application?

Clene expects to submit its NDA for CNM-Au8 in Q4 2025.

How much cash does Clene have for operations?

As of June 30, 2025, Clene has $7.3 million in cash for operations.

What neurodegenerative diseases does Clene focus on?

Clene focuses on treatments for ALS, MS, and other neurodegenerative diseases.

Disclaimer: This is an AI-generated summary of a press release distributed by GlobeNewswire. The model used to summarize this release may make mistakes. See the full release here.

$CLNN Insider Trading Activity

$CLNN insiders have traded $CLNN stock on the open market 8 times in the past 6 months. Of those trades, 0 have been purchases and 8 have been sales.

Here’s a breakdown of recent trading of $CLNN stock by insiders over the last 6 months:

- RESONANCE LLC GENERAL has made 0 purchases and 8 sales selling 5,593 shares for an estimated $21,374.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$CLNN Analyst Ratings

Wall Street analysts have issued reports on $CLNN in the last several months. We have seen 4 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- D. Boral Capital issued a "Buy" rating on 07/18/2025

- Benchmark issued a "Buy" rating on 05/08/2025

- Jones Trading issued a "Buy" rating on 04/23/2025

- HC Wainwright & Co. issued a "Buy" rating on 04/08/2025

To track analyst ratings and price targets for $CLNN, check out Quiver Quantitative's $CLNN forecast page.

$CLNN Price Targets

Multiple analysts have issued price targets for $CLNN recently. We have seen 4 analysts offer price targets for $CLNN in the last 6 months, with a median target of $30.5.

Here are some recent targets:

- Jason Kolbert from D. Boral Capital set a target price of $23.0 on 07/18/2025

- Bruce Jackson from Benchmark set a target price of $33.0 on 05/08/2025

- Justin Walsh from Jones Trading set a target price of $30.0 on 04/23/2025

- Joseph Pantginis from HC Wainwright & Co. set a target price of $31.0 on 04/08/2025

Full Release

- Following constructive FDA feedback on its proposed statistical analysis plan, Clene plans to analyze the neurofilament light data from its large NIH-sponsored Early Access Protocol early in the fourth quarter of 2025

- A second Type C meeting has been scheduled with the FDA in the third quarter of 2025 to review the survival benefit associated with CNM-Au8 dosing

- The Company expects to submit a New Drug Application in the fourth quarter of 2025 for potential accelerated approval of CNM-Au8 ® in ALS

- A Type B end-of-Phase 2 FDA meeting has been scheduled in the third quarter of 2025 to discuss the MS clinical development program

-

Cash and cash equivalents of $7.3 million as of June 30, 2025, together with $1.9 million raised in equity and a $1.5 million increase in its convertible debt facility subsequent to June 30, 2025, provides cash runway into the first quarter of 2026

SALT LAKE CITY, Aug. 14, 2025 (GLOBE NEWSWIRE) -- Clene Inc. (Nasdaq: CLNN) (along with its subsidiaries, “Clene”) and its wholly owned subsidiary Clene Nanomedicine Inc., a late clinical-stage biopharmaceutical company focused on revolutionizing the treatment of neurodegenerative diseases, including amyotrophic lateral sclerosis (ALS) and multiple sclerosis (MS), today announced its second quarter 2025 financial results, provided recent updates on its CNM-Au8 programs and announced sufficient cash runway into the first quarter of 2026.

“We look forward to engaging with the FDA in our upcoming meeting this quarter focused on the extensive survival data that CNM-Au8 has generated in ALS patients. We are also advancing activities necessary to analyze our NIH-sponsored EAP neurofilament light biomarker data, with results expected in the fourth quarter,” said Rob Etherington, President and CEO of Clene. “These meetings and biomarker analyses represent the final steps to our potential submission of an NDA under the accelerated approval pathway for ALS by the end of 2025. Our commitment to the ALS community remains unwavering as we endeavor to develop an impactful therapeutic agent for this devastating disease,” he concluded.

Second Quarter 2025 and Recent Operating Highlights

CNM-Au8 for the treatment of ALS

Clene held a productive Type C meeting with the U.S. Food and Drug Administration (FDA) to discuss its proposed statistical analysis methodology for assessing neurofilament light (NfL) biomarker changes from ALS patients enrolled in its National Institute of Health (NIH)-sponsored expanded access program (EAP). NfL change will be analyzed following 9 months of treatment (primary NfL analysis) and after 6 months of treatment (supportive NfL analysis). These analyses are intended to provide supportive data of the NfL change previously demonstrated in the HEALEY ALS Platform Trial double-blind period following 6 months of treatment with CNM-Au8. Clene expects to conduct the analysis of this NfL biomarker data early in the fourth quarter of 2025.

A second Type C meeting with the FDA to review the long-term survival benefit from CNM-Au8 30 mg treatment compared to concurrently randomized controls from another HEALEY ALS Platform Trial regimen, in addition to other survival data, is planned in the third quarter of 2025. This additional analysis is expected to provide further support of the new drug application (NDA) submission under the accelerated approval pathway, planned to be submitted by the end of 2025.

CNM-Au8 for the treatment of MS

In April, Clene presented new evidence of remyelination and neuronal repair with CNM-Au8 treatment at the American Academy of Neurology (AAN) Late-Breaking Science Session at the AAN 2025 Annual Meeting. The presentation, titled “Physiologic and Anatomical Evidence of Neuronal Repair and Remyelination from the Long-Term Open-Label Extension of the Phase 2 VISIONARY-MS Trial,” highlighted significant and clinically meaningful improvements in cognition and visual function, supported by corresponding objective biomarkers, including advanced MRI Diffusion Tensor Imaging (DTI) and multi-focal Visual Evoked Potential (mf-VEP) assessments which confirmed anatomical and physiological improvements, indicating remyelination and neuronal repair in the brains of MS patients treated with CNM-Au8 during the long-term extension of VISIONARY-MS.

The Company plans to hold an end-of-Phase 2 Type B meeting with the FDA in the third quarter of 2025. This meeting will review results from the Phase 2 VISIONARY-MS trial and discuss the planned Phase 3 study focusing on cognition improvement as an adjunct to standard-of-care MS therapies.

Second Quarter 2025 Financial Results

Clene’s cash and cash equivalents totaled $7.3 million as of June 30, 2025, compared to $12.2 million as of December 31, 2024. Clene expects that its resources as of June 30, 2025, together with $1.9 million raised in equity and a $1.5 million increase in its convertible debt facility subsequent to June 30, 2025, will be sufficient to fund its operations into the first quarter of 2026.

Research and development expenses were $3.5 million for the quarter ended June 30, 2025, compared to $4.2 million for the same period in 2024. The year-over-year decrease was primarily related to a decrease in personnel expenses due to cost saving initiatives and a decrease in manufacturing personnel due to the conclusion of various clinical programs, a decrease in stock-based compensation expense due to the timing of awards, as well as an increase in grant revenue, recorded as a reduction to research and development expense, due to an increase in enrollment and study operations in our NIH-sponsored EAP; partially offset by an increase in expenses related to our lead drug candidate, CNM-Au8, due to an increase in expenses related to our ALS clinical programs, including our NIH-sponsored EAP, and increased planning activities for the RESTORE-ALS Phase 3 clinical trial.

General and administrative expenses were $2.4 million for the quarter ended June 30, 2025, compared to $3.3 million for the same period in 2024. The year-over-year decrease was primarily related to a decrease in personnel expenses due to cost saving initiatives, a decrease in stock-based compensation expense due to the timing of awards, a decrease in legal fees primarily related to intellectual property and regulatory activities, and decreases in other expenses related to lobbying activities, travel, meals, office and other miscellaneous expenses; partially offset by an increase in finance and accounting fees, primarily due to an increase in audit and tax fees and fees from consultants, advisors, and other financial vendors.

Total other expense was $1.6 million for the quarter ended June 30, 2025, compared to total other income of $0.6 million for the same period in 2024. The year-over-year change was primarily related to non-cash losses recognized on the change in fair values of derivative liabilities separated from our senior secured convertible promissory notes, non-cash losses recognized on the change in fair values of common stock warrant liabilities, and a decrease in interest income primarily due to lower average balances of cash and cash equivalents and lower interest rates; partially offset by a decrease in interest expense primarily due to declining balances of notes payable following principal repayments.

Clene reported a net loss of $7.4 million, or $0.78 per share, for the quarter ended June 30, 2025, compared to a net loss of $6.8 million, or $1.06 per share, for the same period in 2024.

About Clene

Clene Inc., (Nasdaq: CLNN) along with its subsidiaries, “Clene” and its wholly owned subsidiary Clene Nanomedicine, Inc., is a late clinical-stage biopharmaceutical company focused on improving mitochondrial health and protecting neuronal function to treat neurodegenerative diseases, including amyotrophic lateral sclerosis, Parkinson’s disease, and multiple sclerosis. CNM-Au8

®

is an investigational first-in-class therapy that improves central nervous system cells’ survival and function via a mechanism that targets mitochondrial function and the NAD pathway while reducing oxidative stress. CNM-Au8

®

is a federally registered trademark of Clene Nanomedicine, Inc. The company is based in Salt Lake City, Utah, with R&D and manufacturing operations in Maryland. For more information, please visit www.clene.com or follow us on

X

(formerly

Twitter

) and

LinkedIn

.

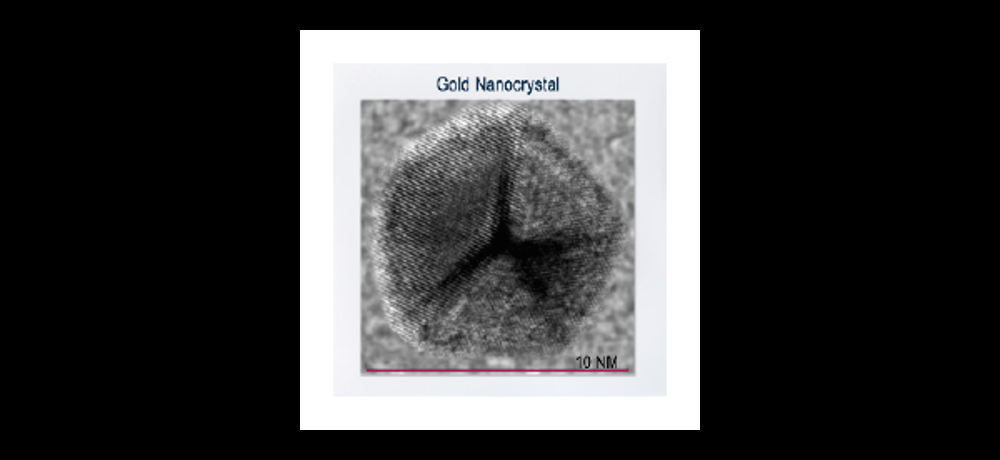

About CNM-Au8

®

CNM-Au8 is an oral suspension of gold nanocrystals developed to restore neuronal health and function by increasing energy production and utilization. The catalytically active nanocrystals of CNM-Au8 drive critical cellular energy producing reactions that enable neuroprotection and remyelination by increasing neuronal and glial resilience to disease-relevant stressors. CNM-Au8

®

is a federally registered trademark of Clene Nanomedicine, Inc.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, which are intended to be covered by the “safe harbor” provisions created by those laws. Clene’s forward-looking statements include, but are not limited to, statements regarding the Company’s expectations regarding the timing and outcome of its meetings with the FDA, the timing of its Phase 3 RESTORE-ALS study, the submission of its NDA, its meeting with the FDA and resulting statistical analyses, and the actual NfL biomarker collection and analyses and the timing thereof; that it will be able to determine concordance of the NIH-sponsored EAP NfL data with NfL data from the HEALEY ALS Platform Trial; and that its resources will be sufficient to fund its operations into the fourth quarter of 2025. In addition, any statements that refer to characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “contemplate,” “continue,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would,” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements represent our views as of the date of this press release and involve a number of judgments, risks and uncertainties. We anticipate that subsequent events and developments will cause our views to change. We undertake no obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date. Some factors that could cause actual results to differ include the Company's ability to demonstrate the efficacy and safety of its drug candidates; the clinical results for its drug candidates, which may not support further development or marketing approval; actions of regulatory agencies; the Company’s limited operating history and its ability to obtain additional funding for operations and to complete the development and commercialization of its drug candidates, and other risks and uncertainties set forth in “Risk Factors” in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this press release, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and you are cautioned not to rely unduly upon these statements. All information in this press release is as of the date of this press release. The information contained in any website referenced herein is not, and shall not be deemed to be, part of or incorporated into this press release.

|

Investor Contact

Kevin Gardner LifeSci Advisors [email protected] (617) 283-2856 |

CLENE INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(In thousands, except share and per share amounts)

(Unaudited)

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Revenue: | ||||||||||||||||

| Product revenue | $ | 1 | $ | 64 | $ | 65 | $ | 108 | ||||||||

| Royalty revenue | 26 | 27 | 43 | 56 | ||||||||||||

| Total revenue | 27 | 91 | 108 | 164 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Cost of revenue | — | 18 | 20 | 34 | ||||||||||||

| Research and development | 3,514 | 4,150 | 4,995 | 10,019 | ||||||||||||

| General and administrative | 2,377 | 3,314 | 5,033 | 6,734 | ||||||||||||

| Total operating expenses | 5,891 | 7,482 | 10,048 | 16,787 | ||||||||||||

| Loss from operations | (5,864 | ) | (7,391 | ) | (9,940 | ) | (16,623 | ) | ||||||||

| Other income (expense), net: | ||||||||||||||||

| Interest income | 62 | 269 | 143 | 628 | ||||||||||||

| Interest expense | (679 | ) | (1,282 | ) | (1,287 | ) | (2,526 | ) | ||||||||

| Change in fair value of common stock warrant liabilities | (515 | ) | 1,568 | 1,995 | 259 | |||||||||||

| Change in fair value of derivative liabilities | (439 | ) | — | 708 | — | |||||||||||

| Change in fair value of Clene Nanomedicine contingent earn-out liability | — | 22 | — | 75 | ||||||||||||

| Change in fair value of Initial Stockholders contingent earn-out liability | — | 3 | — | 10 | ||||||||||||

| Research and development tax credits and unrestricted grants | 16 | 26 | 211 | 312 | ||||||||||||

| Total other income (expense), net | (1,555 | ) | 606 | 1,770 | (1,242 | ) | ||||||||||

| Net loss before income taxes | (7,419 | ) | (6,785 | ) | (8,170 | ) | (17,865 | ) | ||||||||

| Income tax expense | — | — | — | — | ||||||||||||

| Net loss | $ | (7,419 | ) | $ | (6,785 | ) | $ | (8,170 | ) | $ | (17,865 | ) | ||||

| Other comprehensive income (loss): | ||||||||||||||||

| Unrealized loss on available-for-sale securities | $ | — | $ | 2 | $ | — | $ | (2 | ) | |||||||

| Foreign currency translation adjustments | 63 | 28 | 78 | (27 | ) | |||||||||||

| Total other comprehensive income (loss) | 63 | 30 | 78 | (29 | ) | |||||||||||

| Comprehensive loss | $ | (7,356 | ) | $ | (6,755 | ) | $ | (8,092 | ) | $ | (17,894 | ) | ||||

| Net loss per share – basic and diluted | $ | (0.78 | ) | $ | (1.06 | ) | $ | (0.89 | ) | $ | (2.78 | ) | ||||

| Weighted average common shares used to compute basic and diluted net loss per share | 9,523,592 | 6,423,182 | 9,176,063 | 6,422,242 | ||||||||||||

CLENE INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share amounts)

(Unaudited)

| June 30, |

December 31,

|

|||||||

| 2025 | 2024 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 7,285 | $ | 12,155 | ||||

| Accounts receivable | — | 64 | ||||||

| Inventory | 79 | 68 | ||||||

| Prepaid expenses and other current assets | 4,621 | 3,870 | ||||||

| Total current assets | 11,985 | 16,157 | ||||||

| Restricted cash | 58 | 58 | ||||||

| Operating lease right-of-use assets | 3,373 | 3,643 | ||||||

| Property and equipment, net | 6,709 | 7,479 | ||||||

| TOTAL ASSETS | $ | 22,125 | $ | 27,337 | ||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 828 | $ | 1,240 | ||||

| Accrued liabilities | 5,359 | 7,766 | ||||||

| Operating lease obligations, current portion | 1,013 | 926 | ||||||

| Notes payable, current portion | 374 | 359 | ||||||

| Convertible notes payable, current portion | — | — | ||||||

| Total current liabilities | 7,574 | 10,291 | ||||||

| Operating lease obligations, net of current portion | 3,706 | 4,132 | ||||||

| Notes payable, net of current portion | 4,619 | 4,610 | ||||||

| Convertible notes payable | 11,134 | 10,816 | ||||||

| Common stock warrant liabilities | 2,546 | 4,541 | ||||||

| Derivative liabilities | 1,096 | 1,804 | ||||||

| TOTAL LIABILITIES | 30,675 | 36,194 | ||||||

| Commitments and contingencies | ||||||||

| Stockholders’ deficit: | ||||||||

| Common stock, $0.0001 par value: 600,000,000 shares authorized; 9,462,071 and 8,089,565 shares issued and outstanding at June 30, 2025 and December 31, 2024, respectively | 1 | 1 | ||||||

| Additional paid-in capital | 281,593 | 273,194 | ||||||

| Accumulated deficit | (290,293 | ) | (282,123 | ) | ||||

| Accumulated other comprehensive income | 149 | 71 | ||||||

| TOTAL STOCKHOLDERS’ DEFICIT | (8,550 | ) | (8,857 | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT | $ | 22,125 | $ | 27,337 | ||||