S. 976: Insurance Fraud Accountability Act

The Insurance Fraud Accountability Act aims to amend the Patient Protection and Affordable Care Act (ACA) to reduce fraudulent enrollments in qualified health plans. Here’s a summary of its key provisions:

Penalties for Agents and Brokers

- The bill introduces new civil and criminal penalties for agents and brokers who fail to provide correct information when enrolling individuals in health plans.

- Agents and brokers can face fines ranging from $10,000 to $50,000 for each instance of providing incorrect information due to negligence.

- If an agent or broker knowingly provides false or fraudulent information, they could face fines of up to $200,000 for each individual affected.

- There are also provisions for imprisonment of up to 10 years for willful violations of these rules.

Consumer Protections

- The bill mandates the creation of a verification process to ensure that new enrollments and changes in coverage provided by agents or brokers are accurate and authorized by the individual enrolling.

- Agents and brokers will be required to provide documentation proving they have the individual's consent for enrollment changes.

- Commission payments to brokers will be held until any inconsistencies in the enrollment data are resolved.

- Individuals must receive timely notifications of any changes to their enrollment status or coverage.

Audits and Oversight

- The bill requires the Secretary of Health and Human Services to oversee compliance by implementing periodic audits of agents and brokers based on various factors, including consumer complaints and suspicious enrollment patterns.

- Any findings from these audits will be shared with states and could lead to further investigations into fraudulent activities.

Regulation of Marketing Organizations

- The bill extends regulatory authority over field marketing organizations and third-party marketing organizations, ensuring they adhere to certain standards when participating in the enrollment process.

- Criteria will be established for agents and brokers, requiring them to act in the best interests of their clients and comply with designated marketing practices.

Transparency Initiatives

- The Secretary is tasked with developing a process to keep a list of suspended and terminated agents and brokers accessible to qualified health plans and exchanges, promoting transparency and accountability in the healthcare enrollment process.

Implementation Timeline

- Many provisions of the bill, particularly those related to the verification process and regulatory oversight, are to be implemented by January 1, 2029, giving time for the necessary systems to be put in place.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

11 bill sponsors

-

TrackRon Wyden

Sponsor

-

TrackRichard Blumenthal

Co-Sponsor

-

TrackTammy Duckworth

Co-Sponsor

-

TrackMazie K. Hirono

Co-Sponsor

-

TrackAmy Klobuchar

Co-Sponsor

-

TrackPatty Murray

Co-Sponsor

-

TrackBrian Schatz

Co-Sponsor

-

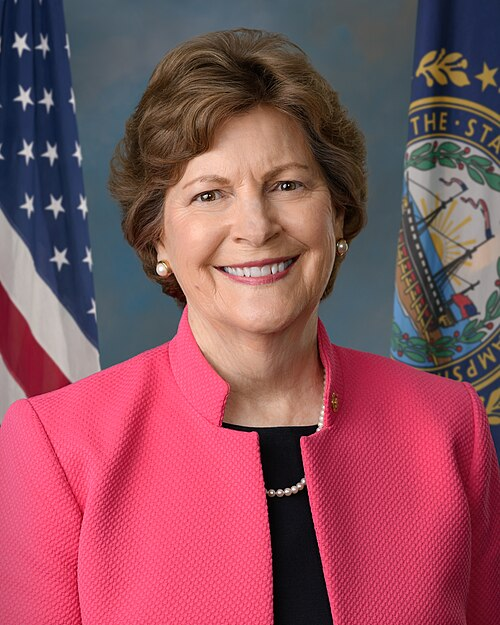

TrackJeanne Shaheen

Co-Sponsor

-

TrackTina Smith

Co-Sponsor

-

TrackChris Van Hollen

Co-Sponsor

-

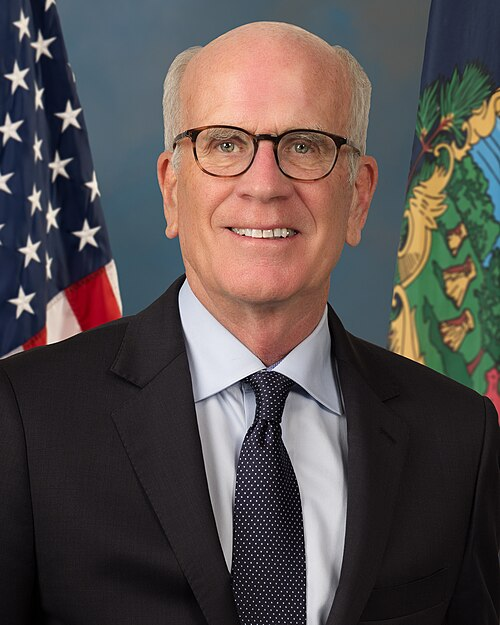

TrackPeter Welch

Co-Sponsor

Actions

3 actions

| Date | Action |

|---|---|

| Nov. 06, 2025 | Committee on Homeland Security and Governmental Affairs Senate Permanent Subcommittee on Investigations. Hearings held. |

| Mar. 12, 2025 | Introduced in Senate |

| Mar. 12, 2025 | Read twice and referred to the Committee on Health, Education, Labor, and Pensions. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.