S. 969: Stop Predatory Investing Act

The Stop Predatory Investing Act is a proposed law that aims to change how certain taxpayers can deduct expenses related to owning rental properties. Here’s a breakdown of its main components:

1. Interest Deduction Changes

The bill disallows taxpayers classified as "disqualified single family property owners" from deducting any interest payments on loans related to residential rental properties they own. A disqualified single family property owner is defined as anyone who owns 50 or more single-family residential rental properties. This rule will not apply to interest deducted in the year the property is sold under specific conditions, such as selling the property to an individual for their primary residence or to a qualified nonprofit that focuses on affordable housing.

2. Definitions of Key Terms

- Disqualified Single Family Property Owner: Any taxpayer owning 50 or more single-family residential rental properties.

- Single Family Residential Rental Property: A residential rental property housing four or fewer dwelling units.

3. Depreciation Deduction Changes

Similar to the interest deductions, the bill also prohibits disqualified single family property owners from deducting depreciation on their rental properties. The same exceptions apply in cases where the property is sold.

4. Exceptions and Qualifications

Some exceptions allow for short-term deductions or sales involving individuals for their primary residences and qualified nonprofit organizations focused on affordable housing. The legislation also includes specific definitions for types of nonprofit organizations that qualify for these exceptions.

5. Implementation and Regulations

The Secretary of the Treasury will be tasked with creating regulations to enforce these new deductions and ensure compliance, including measures to prevent any attempts to bypass the intent of the new law.

6. Effective Dates

The changes specified by the act would go into effect for taxable years starting after the bill becomes law.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

12 bill sponsors

-

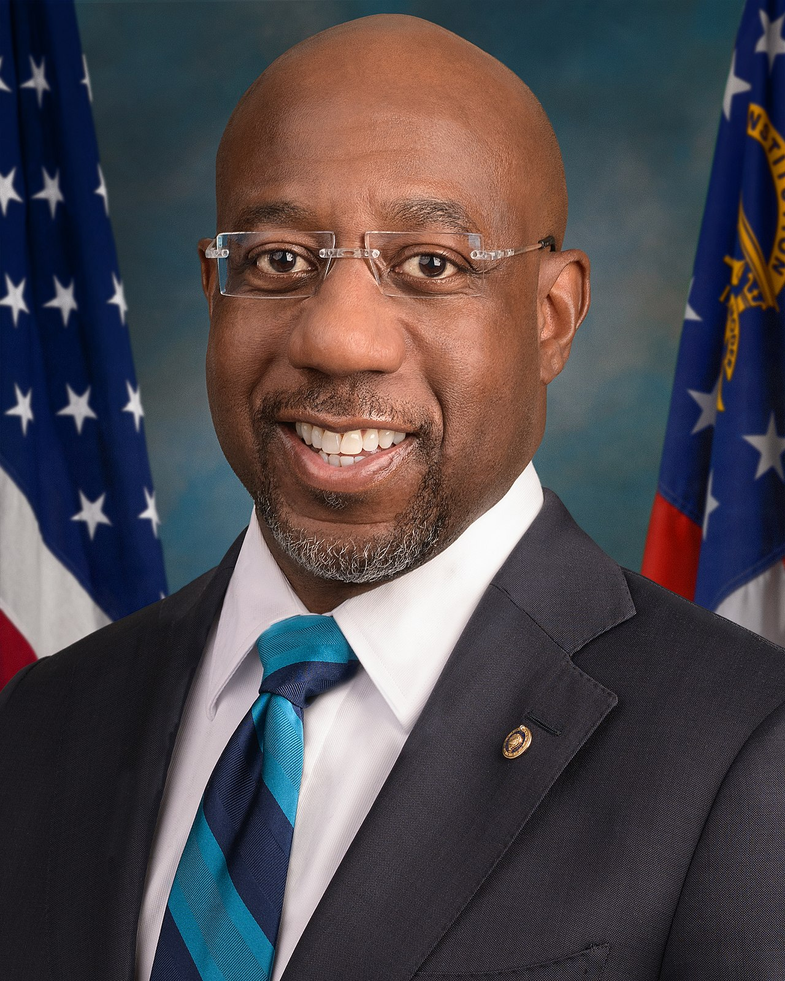

TrackRaphael G. Warnock

Sponsor

-

TrackTammy Baldwin

Co-Sponsor

-

TrackRichard Blumenthal

Co-Sponsor

-

TrackCory A. Booker

Co-Sponsor

-

TrackRuben Gallego

Co-Sponsor

-

TrackAmy Klobuchar

Co-Sponsor

-

TrackJack Reed

Co-Sponsor

-

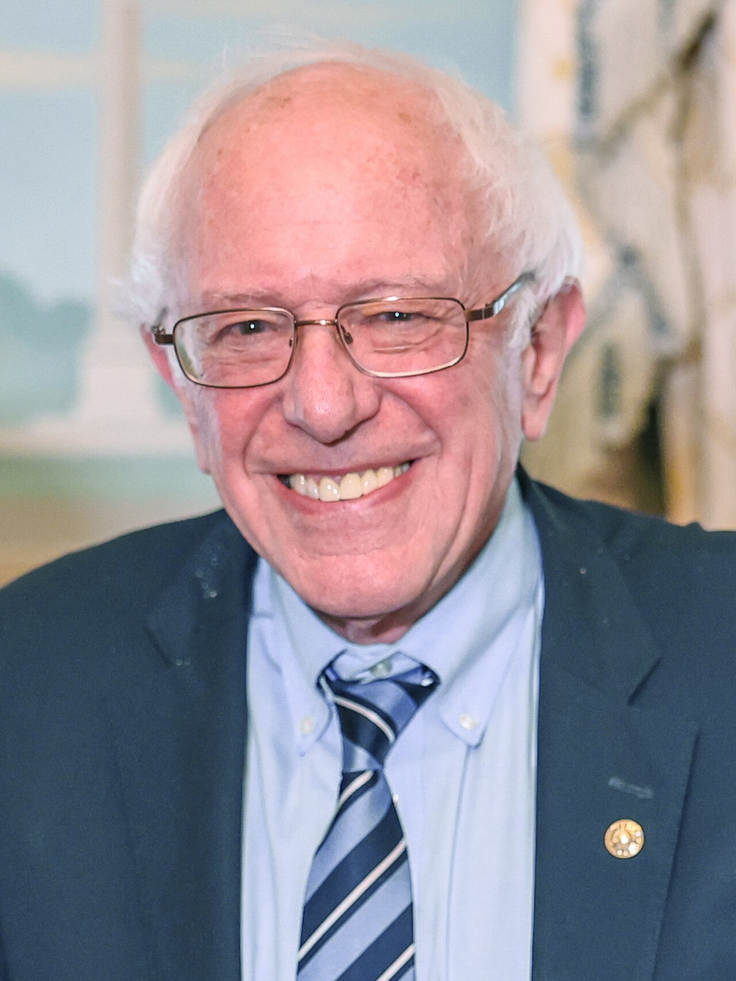

TrackBernard Sanders

Co-Sponsor

-

TrackTina Smith

Co-Sponsor

-

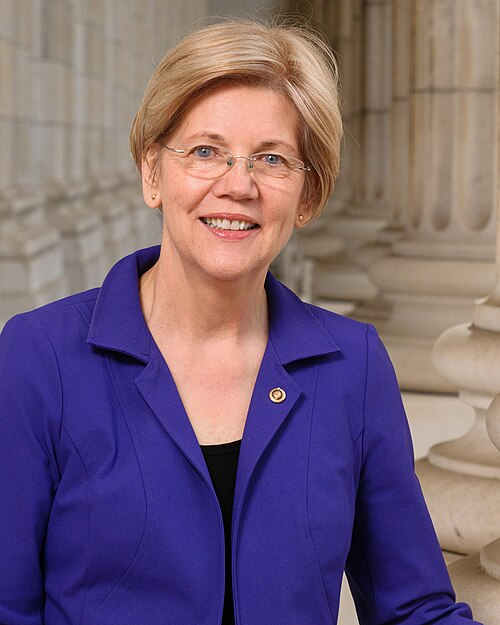

TrackElizabeth Warren

Co-Sponsor

-

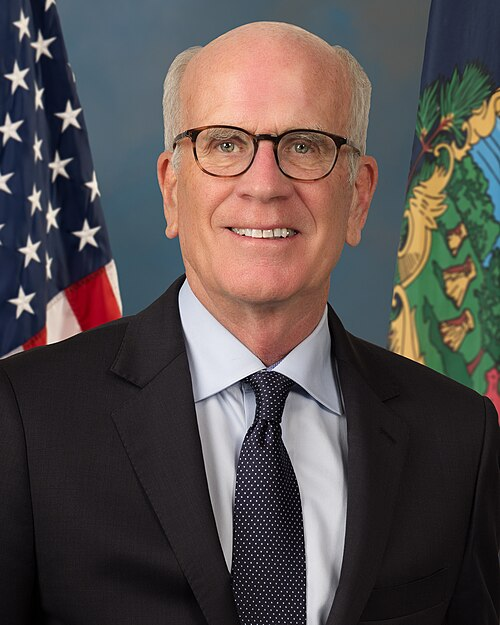

TrackPeter Welch

Co-Sponsor

-

TrackRon Wyden

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Mar. 11, 2025 | Introduced in Senate |

| Mar. 11, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.