S. 967: Downpayment Toward Equity Act of 2025

This bill, known as the Downpayment Toward Equity Act of 2025, aims to provide assistance to first-generation homebuyers to help them acquire homes, thereby addressing historical inequities in homeownership and narrowing the racial homeownership gap in the United States. Here’s a breakdown of its key components:

Objectives

The primary goals of the bill are to:

- Offer financial assistance to first-generation homebuyers for down payments and related costs.

- Support efforts to promote equity in homeownership among historically marginalized groups.

Definitions

Key definitions outlined in the bill include:

- First-generation homebuyer: A buyer whose parents or guardians did not own a home, or individuals who have been in foster care or institutional care.

- Eligible home: Residential properties including single-family homes, condominiums, and manufactured housing that meet specific criteria.

- Eligible mortgage loan: Residential loans that comply with certain standards set forth by federal agencies or programs.

Downpayment Assistance Program

The bill establishes a program where:

- The Secretary of Housing and Urban Development will administer grants to states and eligible entities for providing financial assistance.

- 75% of funds will be allocated to states based on the number of potential qualified homebuyers, while 25% will be awarded to other eligible entities on a competitive basis.

Eligible Uses of Assistance

Funds from the grants may be used for:

- Down payment and closing costs.

- Subsidizing shared equity homes to make them more affordable.

- Home modifications for individuals with disabilities prior to occupancy.

Grant Limitations

Key limitations on the financial assistance include:

- Assistance may not exceed $20,000 or 10% of the purchase price for a home, with provisions for higher amounts in certain cases.

- Assistance will be available only once per qualified homebuyer.

Eligibility Criteria

To qualify for assistance, homebuyers must meet the following:

- Income limits, not exceeding 120% of the area median income, or 140% in high-cost areas.

- Self-attest that they are first-time buyers and fall within the definition of first-generation homebuyers.

Counseling Requirements

Homebuyers will be required to complete a counseling program regarding the responsibilities of homeownership before receiving assistance. Alternatives will be allowed if capacity issues arise in approved counseling agencies.

Reporting and Accountability

The Secretary will produce annual reports that detail:

- Demographics of applicants and recipients to monitor equitable outcomes.

- Types and amounts of assistance provided.

- Details on properties acquired through the assistance.

Funding Authorization

The bill authorizes $100 billion for the grant programs, ensuring that these funds are available until fully expended.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

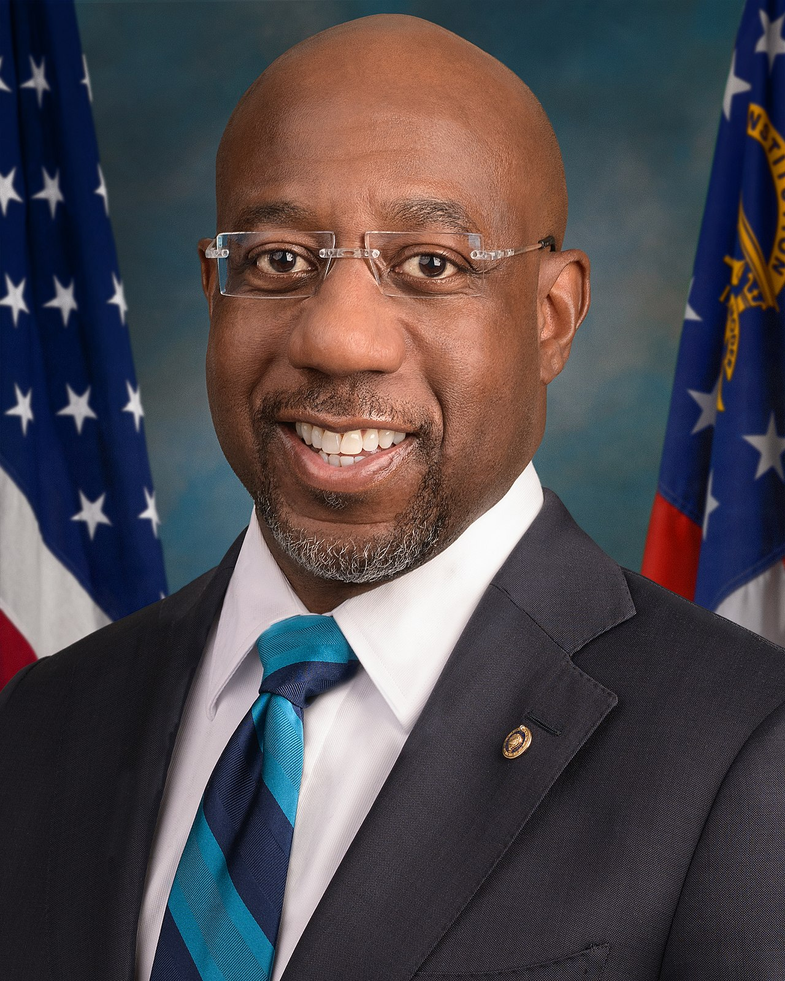

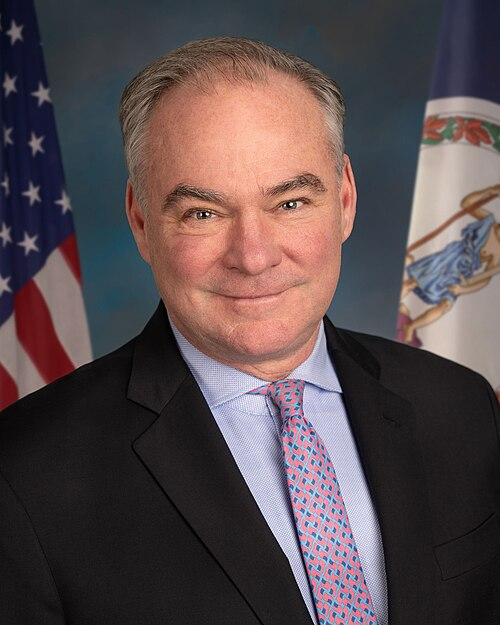

Sponsors

7 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Mar. 11, 2025 | Introduced in Senate |

| Mar. 11, 2025 | Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.