S. 930: To amend the Internal Revenue Code of 1986 to exclude from gross income capital gains from the sale of certain farmland property which are reinvested in individual retirement plans.

This bill proposes changes to the Internal Revenue Code to provide tax benefits for individuals selling certain farmland. Here’s a summary of its key provisions:

Exclusion of Capital Gains

The bill allows taxpayers to exclude from their gross income any capital gains from the sale of qualified farmland property to qualified farmers, provided that the profits are reinvested into an individual retirement plan (IRA) within 60 days of the sale.

Definitions

- Qualified Farmland Property: This refers to real estate in the United States used for farming or leased to a farmer for farming purposes for most of the ten years before the sale.

- Qualified Farmer: An individual who actively engages in farming and is designated in a signed agreement related to the farmland sale.

Tax Treatment for Further Dispositions

If, within ten years after the sale, the qualified farmer disposes of the farmland or stops using it for farming, an additional tax will apply. This tax will equal a percentage of the previously excluded gain from the sale, plus interest on that amount from the time of the sale.

Election and Agreements

To benefit from this exclusion, the taxpayer must make a formal election, which is irrevocable, and submit a written agreement that will specify details about the excluded amount.

Special Rules

- Statute of Limitations: The period for assessing any tax related to the disposition will be extended to three years from when the IRS is notified of the sale or change in use.

- No Double Benefit: Taxpayers cannot claim both this exclusion and a deduction for the same amounts contributed to retirement plans.

Limitations on Contributions

The bill amends existing limitations on contributions to individual retirement accounts, allowing for increased contributions based on the gains from the sale of qualified farmland property within a specified period around the sale.

Effective Date

The changes proposed in the bill will apply to sales or exchanges occurring in taxable years following the law's enactment.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

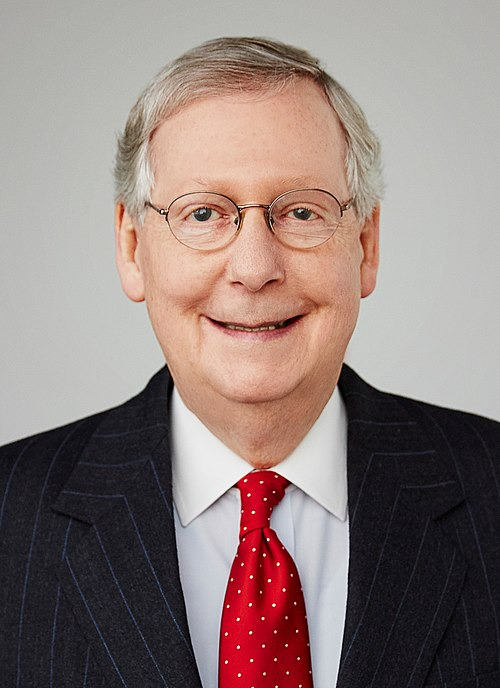

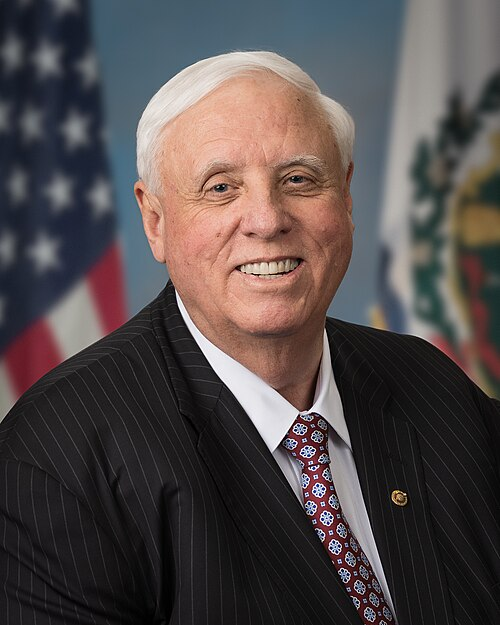

Sponsors

5 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Mar. 11, 2025 | Introduced in Senate |

| Mar. 11, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.