S. 588: Presidential Audit and Tax Transparency Act

The Presidential Audit and Tax Transparency Act proposes several amendments related to the examination and disclosure of income tax returns for U.S. Presidents and certain candidates for the presidency. Here are the key provisions of the bill:

1. Examination of Presidential Income Tax Returns

The bill mandates that the Secretary of the Treasury conduct audits of Presidential income tax returns shortly after they are filed. Specifically, the Secretary must:

- Start an examination as quickly as possible after the return is filed.

- Disclose an initial report about the examination within 90 days, which will include the taxpayer's name, the date the return was filed, and the date the examination commenced.

- Provide periodic reports every 180 days detailing the status of the examination until it is completed.

- Publish a final report within 90 days of completing the examination, including findings, adjustments proposed, and resolutions of disputes.

- Disclose information about any requests for extensions to file returns.

2. Public Availability of Audit Information

All reports and relevant audit materials must be made publicly available online. This includes:

- Disclosure of income tax returns for Presidents, their estates, and any entities they control.

- Disclosure of audit materials, which include any written communications about the examination and proposed adjustments.

However, sensitive personal information, such as social security numbers and addresses, will be omitted from public disclosures.

3. Disclosure Requirements for Presidential Candidates

The Act requires candidates nominated by major political parties to publicly disclose their tax returns. Specifically, they must:

- Include copies of their applicable income tax returns for the last three years when filing reports with the Federal Election Commission (FEC).

- Failing to disclose such returns will lead to action by the Director of the Office of Government Ethics or the FEC, who will request copies of the income tax returns from the Secretary of the Treasury.

- All disclosed returns must be made publicly available by either the Office of Government Ethics or the FEC, with necessary redactions.

4. Penalties for Non-compliance

The bill introduces penalties for individuals who knowingly fail to file or falsify any tax returns they are required to disclose under the new regulations.

5. Effective Date

The provisions of this Act will apply to new tax returns filed, amendments, or supplements after the bill is enacted.

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

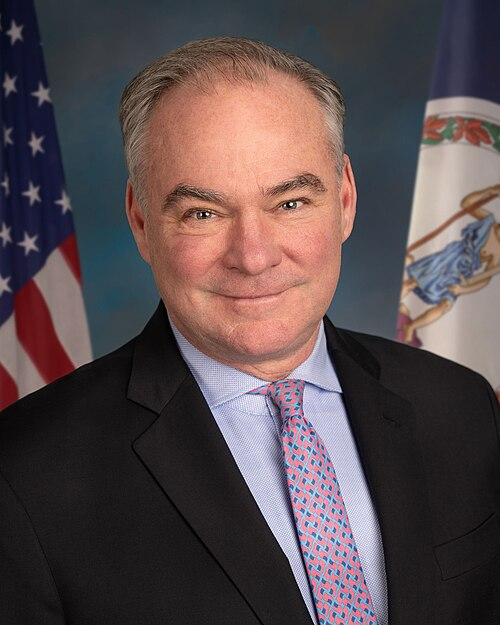

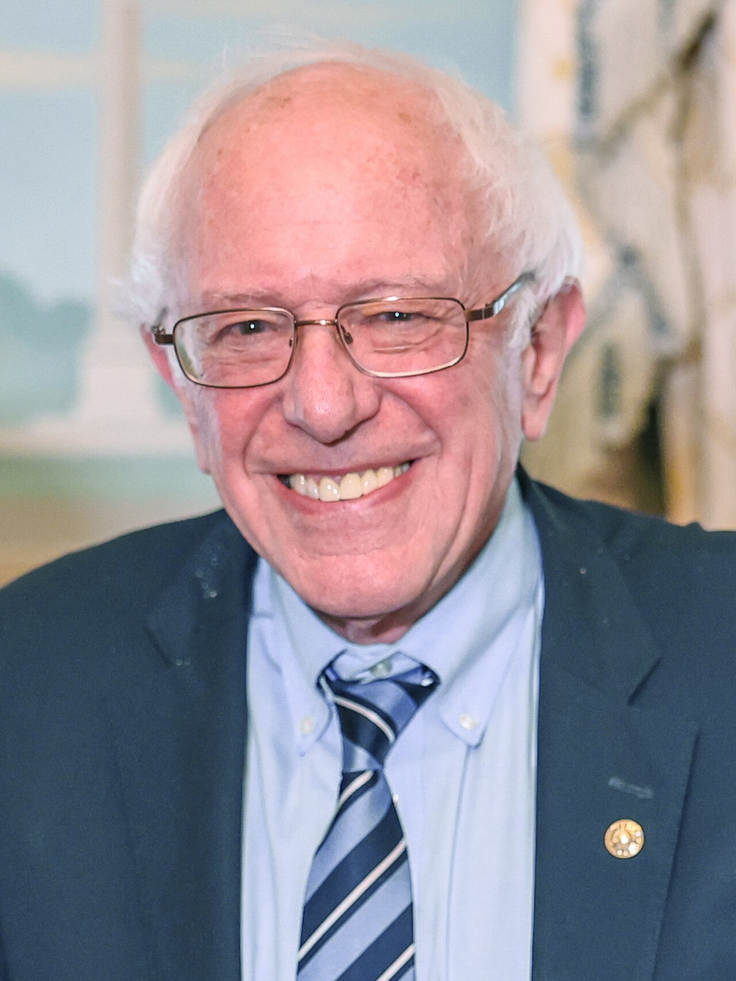

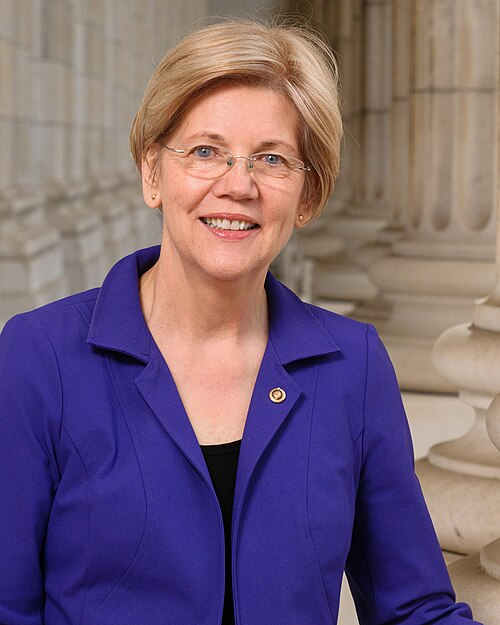

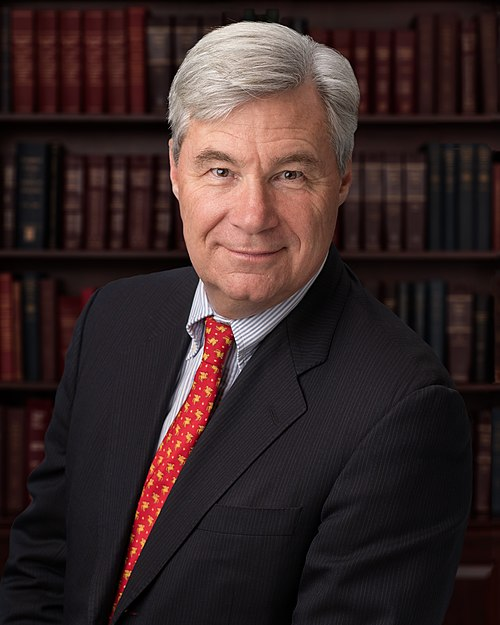

Sponsors

9 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Feb. 13, 2025 | Introduced in Senate |

| Feb. 13, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.