S. 510: Financing Our Energy Future Act

This bill, titled the **Financing Our Energy Future Act**, proposes changes to the Internal Revenue Code to modify how certain energy-related projects can be structured for investment. The primary focus is to extend the publicly traded partnership (PTP) ownership structure to energy power generation projects and transportation fuels. Here’s a breakdown of what the bill entails:

Key Modifications to Tax Laws

The bill brings several revisions to the definitions and provisions currently existing under U.S. tax law, specifically targeting the definition of what income and gains can qualify for the publicly traded partnership structure.

- Expanded Eligibility: It broadens the scope of what constitutes qualifying income and gains. This includes income derived from:

- The generation of electric power or thermal energy using qualified energy resources.

- Operation of energy property.

- Storage and transportation of energy, including electric power, biomass, renewable fuels, and certain types of hydrogen.

- Production of fuels that focus on reducing greenhouse gas emissions.

- Generation of energy from advanced nuclear facilities.

- Production and transportation of renewable chemicals from biomass.

- Specific Definitions: The bill includes specific definitions of technologies and processes related to energy generation and storage, guiding investors on what qualifies under partnerships.

Focus on Green Energy

By extending the PTP framework to include green energy initiatives, the legislation is aimed at encouraging investment in various sustainable energy projects. The amendments suggest a particular interest in:

- Renewable sources such as solar, wind, and biomass.

- Energy storage solutions that can maintain the efficiency and supply of renewable energy.

- Technologies that help reduce overall greenhouse gas emissions.

Implementation Timeline

The changes outlined in this bill would take effect for taxable years beginning after December 31, 2025. Thus, companies and investors looking to benefit from these provisions would need to plan their strategies accordingly before this date.

Overall Intent

The general intent of this legislation is to foster a stronger investment environment for energy projects, particularly those that are environmentally sustainable. By allowing a broader range of income types to qualify for publicly traded partnerships, the bill seeks to mobilize more capital into the renewable energy sector.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

11 bill sponsors

-

TrackJerry Moran

Sponsor

-

TrackJohn Barrasso

Co-Sponsor

-

TrackSusan M. Collins

Co-Sponsor

-

TrackChristopher A. Coons

Co-Sponsor

-

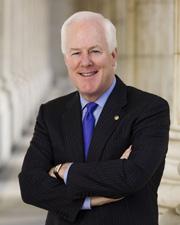

TrackJohn Cornyn

Co-Sponsor

-

TrackKevin Cramer

Co-Sponsor

-

TrackJohn R. Curtis

Co-Sponsor

-

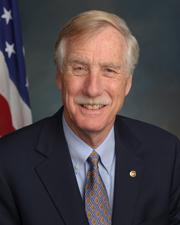

TrackAngus S. King Jr.

Co-Sponsor

-

TrackRoger Marshall

Co-Sponsor

-

TrackPete Ricketts

Co-Sponsor

-

TrackMark R. Warner

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Feb. 11, 2025 | Introduced in Senate |

| Feb. 11, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.