S. 445: Carried Interest Fairness Act of 2025

The Carried Interest Fairness Act of 2025 primarily aims to amend the Internal Revenue Code regarding the taxation of income generated from investment management services. This legislation specifically targets personal service income derived from pass-through entities, such as partnerships, that are involved in investment management. Key components of the bill include:

Tax Classification Changes

It modifies how specific income types are classified and treated for tax purposes. The goal is to ensure that income from investment management services is taxed at regular income tax rates rather than at the lower capital gains rates, which typically apply to investment profits. This means that individuals profiting from their partnership interests in management services will face higher tax liabilities compared to previous classifications.

Partnerships and Real Estate Investment Trusts (REITs)

The bill outlines the conditions under which certain partnerships can qualify for tax treatments relevant to REITs. This includes establishing what constitutes acceptable partnership activities to qualify for these tax advantages while also detailing penalties for any underpayments that may arise from inaccurate reporting of income. Moreover, there are specific accounting rules provided for partners who offer investment management services, setting more stringent documentation and reporting requirements.

Effective Date

The changes proposed in the Carried Interest Fairness Act of 2025 are set to take effect for taxable years ending after the enactment of the bill. This means any income earned after this point will be subject to the new classifications and tax structures outlined in the legislation.

Overall Impact

By adjusting how investment management income is taxed and redefining qualifications for tax treatments associated with partnerships and REITs, the bill seeks to increase tax fairness and ensure that those in investment management positions are paying taxes that more accurately reflect their income level.

Relevant Companies

- BLK (BlackRock, Inc.) - As one of the largest asset management firms, changes in taxation on investment management income could significantly impact their profitability and operational strategies.

- AXP (American Express Company) - With a focus on financial services and investment management, alterations in tax liabilities could affect their investment services revenue streams.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

15 bill sponsors

-

TrackTammy Baldwin

Sponsor

-

TrackCory A. Booker

Co-Sponsor

-

TrackMazie K. Hirono

Co-Sponsor

-

TrackTim Kaine

Co-Sponsor

-

TrackAmy Klobuchar

Co-Sponsor

-

TrackBen Ray Lujan

Co-Sponsor

-

TrackEdward J. Markey

Co-Sponsor

-

TrackJeff Merkley

Co-Sponsor

-

TrackPatty Murray

Co-Sponsor

-

TrackJack Reed

Co-Sponsor

-

TrackBernard Sanders

Co-Sponsor

-

TrackBrian Schatz

Co-Sponsor

-

TrackChris Van Hollen

Co-Sponsor

-

TrackElizabeth Warren

Co-Sponsor

-

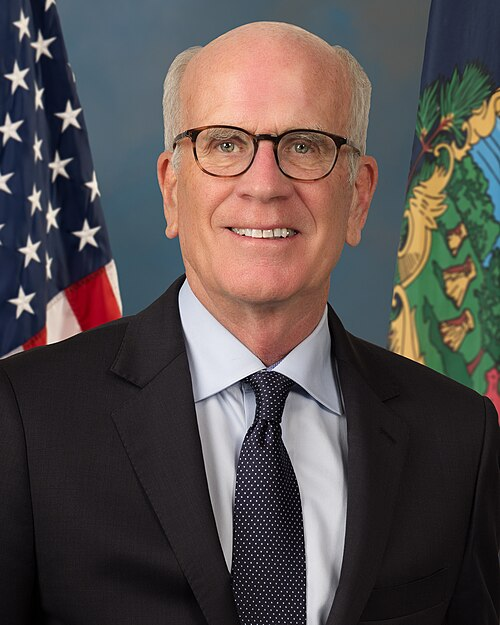

TrackPeter Welch

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Feb. 06, 2025 | Introduced in Senate |

| Feb. 06, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.