S. 394: Guiding and Establishing National Innovation for U.S. Stablecoins of 2025

The bill titled "Guiding and Establishing National Innovation for U.S. Stablecoins of 2025" aims to regulate the use and operation of payment stablecoins in the United States. It specifies that only authorized or permitted issuers are allowed to operate payment stablecoins, ensuring a controlled environment for their use.

Key Regulatory Framework

The legislation establishes a clear set of standards that regulated issuers must adhere to, covering several important areas:

- Reserves: Issuers must maintain sufficient reserves to back the stablecoins they issue.

- Disclosure: There are requirements for transparency in how issuers operate and manage the stablecoins.

- Compliance: Issuers are expected to comply with various regulations established by both federal and state authorities.

Regulatory Authority

The bill delineates the roles and responsibilities of federal and state regulators, ensuring that there is a structured oversight mechanism for payment stablecoin issuers. This includes:

- Enforcement Powers: Regulators are granted specific enforcement powers, especially in urgent situations to protect market integrity and customer interests.

- Customer Protection: The bill places an emphasis on safeguarding consumer interests, ensuring that issuers follow customer protection requirements.

- Insolvency Proceedings: It outlines how claims will be prioritized during the insolvency of a stablecoin issuer, providing clarity in case of financial distress.

- State-Qualified Issuers: Some state laws will not apply to issuers that qualify under this new regulatory framework, offering them certain advantages.

Overall Objectives

The primary objectives of this legislation are to enhance the safety and reliability of payment stablecoins, encourage public confidence in their use, and establish a unified regulatory approach across different jurisdictions in the U.S. This aims to foster innovation in the sector while ensuring consumer protection and market stability.

Relevant Companies

- COIN (Coinbase): As a major player in the cryptocurrency exchange space, Coinbase may be directly affected by the regulatory environment that this bill establishes, particularly concerning the stablecoin offerings on its platform.

- BLK (BlackRock): With BlackRock's interests in blockchain and cryptocurrency investments, the company's strategies might be influenced by the regulatory standards set forth in this legislation regarding stablecoin issuers.

This is an AI-generated summary of the bill text. There may be mistakes.

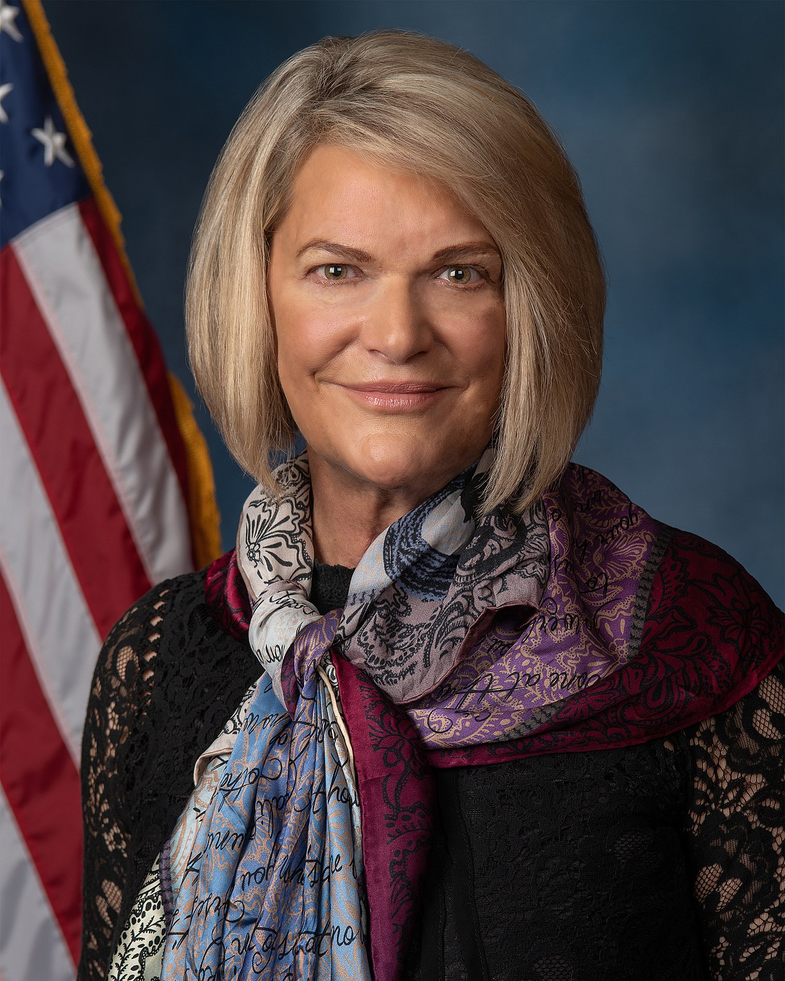

Sponsors

5 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Feb. 04, 2025 | Introduced in Senate |

| Feb. 04, 2025 | Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.