S. 3611: Blockchain Regulatory Certainty Act of 2026

The Blockchain Regulatory Certainty Act of 2026 aims to clarify the legal status of certain developers and providers of distributed ledger technologies, specifically focusing on those that do not control transactions involving digital assets. Here are the key points of the bill:

Definitions

The bill introduces several important definitions:

- Developer or Provider: Refers to any person or business that creates, publishes, or maintains software for distributed ledgers or associated services.

- Digital Asset: Any digital representation of value recorded on a distributed ledger secured by cryptography.

- Distributed Ledger: A technology that shares data across a network to create a public digital ledger of verified transactions using cryptographic methods.

- Distributed Ledger Service: Any service that enables access to a distributed ledger system, including functions for sending, receiving, or storing digital assets.

- Non-controlling Developer or Provider: A party that does not have unilateral control over initiating or executing transactions involving the digital assets of users without third-party approval.

Treatment Under Money Transmission Laws

The bill stipulates the following treatment for non-controlling developers or providers:

- They will not be classified as a money transmitting business under U.S. law, meaning they will not be subject to the associated regulatory requirements.

- These entities will not face requirements similar to those of money transmitters merely for creating or maintaining software for distributed ledgers or providing infrastructure for such services.

Registration Requirements

Post-enactment, non-controlling developers or providers will not be subject to any registration requirements that were applicable prior to the bill's enactment, under similar circumstances. This includes activities like:

- Creating or maintaining software for distributed ledgers.

- Providing hardware or software to help customers safeguard their digital assets.

- Providing infrastructure support for distributed ledger services.

Legal Clarifications

The bill clarifies that:

- It does not alter the classification of developers or providers as money transmitters based on activities outside the scope defined in the bill.

- Compliance with federal and state anti-money laundering and terrorism financing laws remains intact.

- It does not affect intellectual property laws or state laws that align with this legislation.

Impact on Digital Asset Regulation

The bill aims to provide legal safety for developers and providers of blockchain services, promoting innovation while delineating their responsibility and oversight under existing financial laws. By exempting non-controlling developers from becoming classified as money transmitters, the act seeks to ease the operational burden on these entities.

Relevant Companies

- COIN - Coinbase Global, Inc. may be affected as it operates in the digital asset space and provides services that could include non-controlling elements.

- BLK - BlackRock, Inc. has interest in blockchain technologies and investing in digital assets; clarification in regulatory treatment might influence its strategy.

- RIOT - Riot Blockchain, Inc. focuses on bitcoin mining and could be impacted by clearer regulations regarding digital assets.

This is an AI-generated summary of the bill text. There may be mistakes.

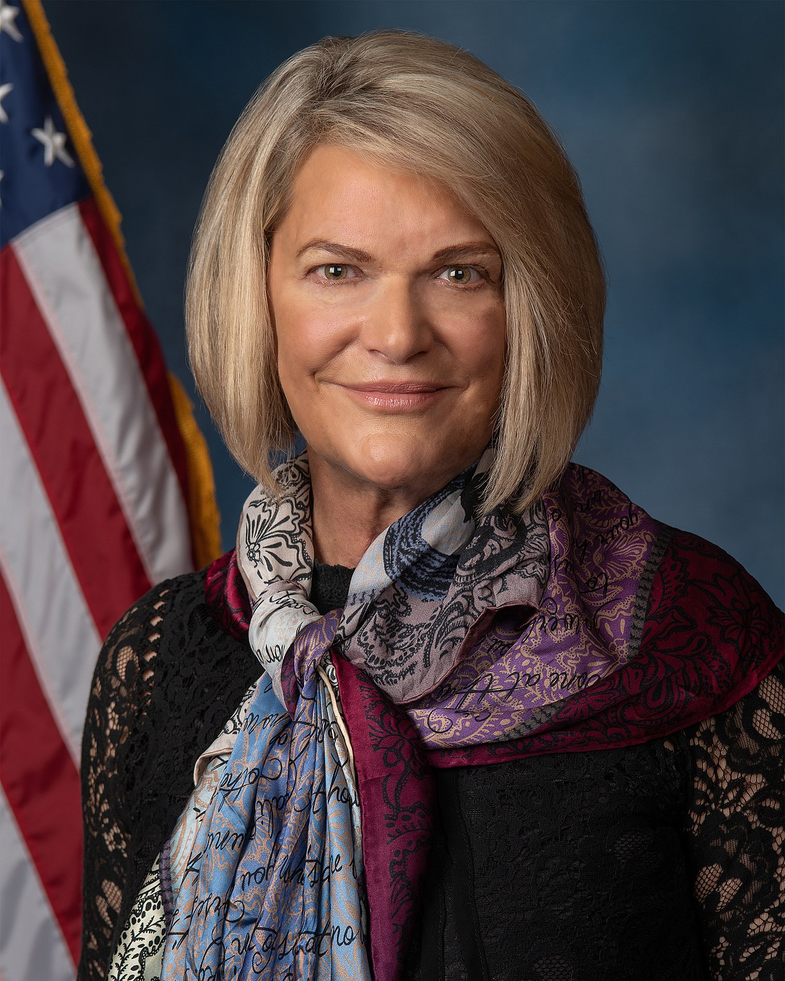

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jan. 12, 2026 | Introduced in Senate |

| Jan. 12, 2026 | Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.