S. 3384: Fraud Risk Assessment of Obamacare Subsidies Accountability Act

This bill, titled the Fraud Risk Assessment of Obamacare Subsidies Accountability Act, aims to enhance the oversight and accountability of the advance premium tax credits provided under the Affordable Care Act (often referred to as Obamacare). Here’s a breakdown of the main components of the bill:

Fraud Risk Assessment Requirement

The bill mandates that the Secretary of Health and Human Services (HHS), in collaboration with the Secretary of the Treasury, must complete a fraud risk assessment related to advance determinations of premium tax credits by December 31, 2025, and annually thereafter. This evaluation needs to cover the following:

- The advance premium tax credits that individuals may claim under Section 36B of the Internal Revenue Code.

- A detailed report outlining the controls and procedures that the HHS employs to prevent fraudulent claims regarding these tax credits.

Submission of Assessments

Once each fraud risk assessment is completed, it must be submitted to several key entities, including:

- The Inspector General of the Department of Health and Human Services.

- The Senate's Committee on Finance, Committee on the Budget, and Committee on Health, Education, Labor, and Pensions.

- The House of Representatives' Committee on Ways and Means, Committee on the Budget, and Committee on Energy and Commerce.

Compliance with Existing Guidelines

All fraud risk assessments conducted under this bill must follow the principles outlined in a specific report by the Comptroller General of the United States, titled "A Framework for Managing Fraud Risks in Federal Programs," which was issued in July 2015. This ensures that the assessments are thorough and adhere to established standards for evaluating fraud risks in federal programs.

Overall Objectives

The primary objective of this legislation is to ensure that there are robust measures in place to prevent fraud related to the distribution of premium tax credits, thereby safeguarding federal resources and ensuring that benefits are provided only to those who are eligible.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

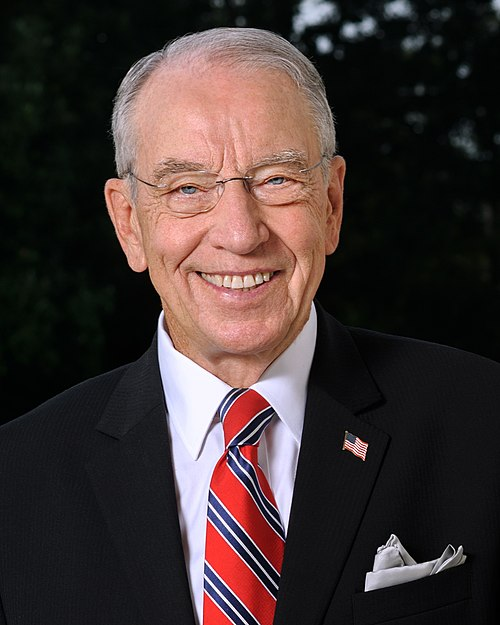

Sponsors

1 sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Dec. 08, 2025 | Introduced in Senate |

| Dec. 08, 2025 | Read twice and referred to the Committee on Health, Education, Labor, and Pensions. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.