S. 3295: To amend the Internal Revenue Code of 1986 to establish a credit for adult child caregivers.

This bill proposes to introduce a new tax credit for individuals who provide care to qualified relatives in a multigenerational household. Here are the main components:

Purpose of the Bill

The aim of the bill is to support caregivers who are adult children taking care of older relatives, particularly those who might require assistance due to age, health issues, or disabilities. It recognizes the benefits of multigenerational living, such as reduced need for formal care and improved emotional and cognitive health for older adults.

Multigenerational Home Caregiver Credit

- Tax Credit Amount: Eligible individuals can receive a credit of $2,000 for each qualified relative they are caring for.

- Eligibility Criteria:

- Must be at least 18 years old, or 16 years old and legally emancipated.

- Must be a U.S. citizen.

- Must live with a qualified relative for at least 6 months of the taxable year.

- Must provide at least 10 hours of assistance per week to the qualified relative.

- Must include a signed statement from a licensed healthcare provider affirming that the relative meets the necessary care requirements.

Definition of Qualified Relative

A "qualified relative" is defined as someone who:

- Is at least 55 years old.

- Cannot perform at least one activity of daily living (like bathing or eating) without substantial assistance, and requires help with three instrumental activities of daily living (such as managing finances or shopping).

- Has required this level of care for at least 180 days or for the individual's lifetime, whichever is shorter.

Limitations on the Credit

- If a taxpayer’s adjusted gross income exceeds $75,000 (or $150,000 for joint filers), the credit amount will be reduced by 1% for each $1,000 over those limits.

- Only one taxpayer can claim the credit for a given qualified relative in a taxable year.

- A maximum of two qualified relatives can be claimed for the credit in any taxable year.

- Married couples must file jointly to qualify for the credit.

- The credit available may be reduced by any amount received under the Child and Dependent Care Credit for the same relatives.

Effective Date

The provisions of this bill will apply to taxable years starting after December 31, 2026, meaning it would not take effect until 2027 or later.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

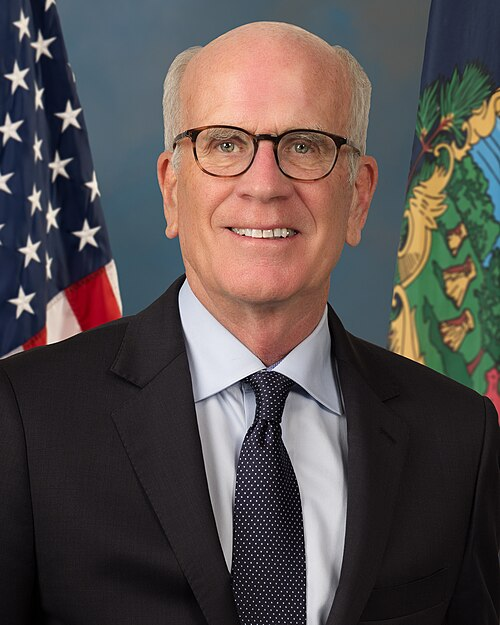

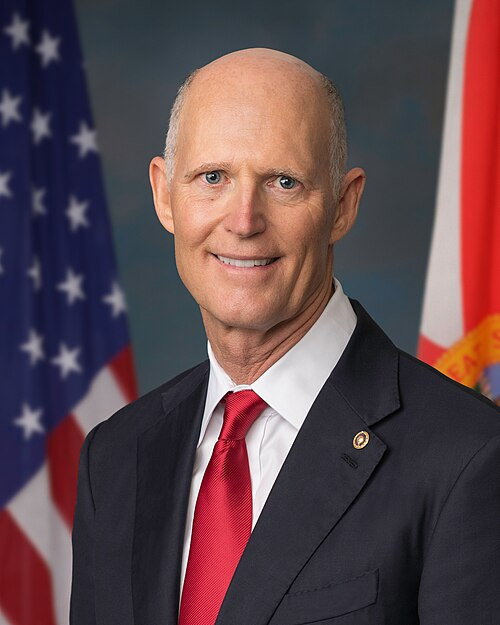

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Dec. 02, 2025 | Introduced in Senate |

| Dec. 02, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.