S. 3129: Preventing Foreign Interference in American Elections Act

This bill, known as the Preventing Foreign Interference in American Elections Act, aims to strengthen existing laws that prohibit foreign entities from participating in U.S. elections, particularly in financing political activities.

Modifications to Foreign Money Ban

The bill proposes to amend the Federal Election Campaign Act of 1971, introducing additional restrictions on contributions from foreign nationals. Key changes include:

- Clarifying that foreign contributions cannot be made for activities such as voter registration, ballot collection, voter identification, get-out-the-vote activities, or any public communication referring to a specific political party.

- Extending the ban on foreign contributions to include funds used for local and state ballot initiatives and elections.

Prohibition on Aiding Violations

It would be illegal for any person to help or facilitate violations of the rules regarding foreign contributions, ensuring tighter enforcement against attempts to circumvent the law.

Indirect Contributions

The bill also addresses indirect contributions, defining actions that may be considered indirect contributions to prevent loopholes. For instance, if a person provides funds to another person or organization that are then used for prohibited purposes, it will be treated as an indirect contribution.

Enforcement Provisions

There are enhanced enforcement measures to ensure compliance, including:

- Allowing individuals accused of violations to submit a certification that no violation occurred as part of their defense.

- Limiting the scope of investigations to only the facts necessary to determine if a violation has occurred.

Reporting Requirements

The bill requires political committees and parties to include a certification under penalty of perjury in their financial reports, ensuring they have adhered to the restrictions on foreign contributions.

Protecting Privacy of Donors to Tax-Exempt Organizations

Additionally, the bill proposes rules regarding donor information for tax-exempt organizations, including:

- Federal entities will not be allowed to collect or disclose information identifying donors to these organizations unless specific exceptions apply, such as required disclosures for tax purposes.

- Violations by federal employees regarding donor information could lead to severe penalties including fines and imprisonment.

Definitions and Exceptions

The bill also clarifies what constitutes a foreign national, federal, state, or local election, explicitly including state or local ballot initiatives in the definition of elections subject to these regulations. Some exceptions to donor privacy rules are specified for lawful activities by government bodies, ensuring that certain necessary disclosures can still occur.

Relevant Companies

None found.This is an AI-generated summary of the bill text. There may be mistakes.

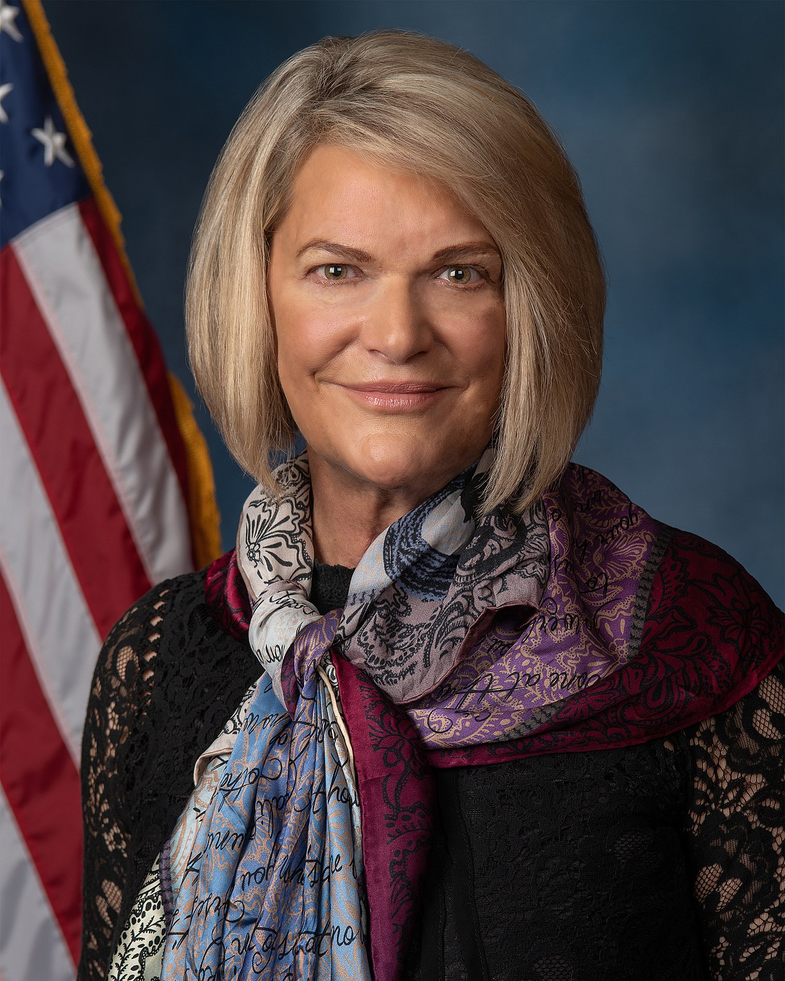

Sponsors

8 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Nov. 06, 2025 | Introduced in Senate |

| Nov. 06, 2025 | Read twice and referred to the Committee on Rules and Administration. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.