S. 3126: Fair Credit for Farmers Act of 2025

The Fair Credit for Farmers Act of 2025 is designed to support farmers, especially those facing financial hardships or who are categorized as veterans, beginning farmers, or socially disadvantaged. The bill introduces several key measures aimed at reforming the farm loan system and providing financial relief to eligible borrowers.

Loan Reforms

The bill proposes reforms to farm loans that would include:

- Deferring Payments: Eligible borrowers would have the option to defer repayment of their loans, which can help provide short-term relief during difficult financial periods.

- Modified Interest Rates: The legislation aims to adjust interest rates on loans to make them more manageable for farmers in financial distress.

- Fee Waivers: The bill includes provisions to waive certain fees associated with obtaining or maintaining farm loans, further alleviating the financial burden on farmers.

Targeted Assistance

Particular focus is given to certain groups of farmers:

- Veteran Farmers: Special provisions are set to assist those who have served in the military and are now engaged in farming.

- Beginning Farmers: The bill recognizes the unique challenges faced by new entrants in agriculture and aims to provide them with the necessary support.

- Socially Disadvantaged Farmers: Farmers categorized as socially disadvantaged will receive targeted assistance to help level the playing field in the agricultural sector.

Appeals Process Enhancement

The Act also seeks to enhance the National Appeals Division process, which handles appeals related to farm loan applications and decisions. Improvements in this process are intended to make it more accessible and efficient for farmers seeking recourse.

Overall Impact

The Fair Credit for Farmers Act of 2025 is aimed at strengthening the financial resilience of farmers who may be struggling or belong to specific groups that face additional barriers. By reforming loan terms, offering deferments, modifying interest rates, and enhancing the appeals process, the Act seeks to provide a more supportive environment for farmers across various sectors.

Relevant Companies

- CDE - Coeur Mining, Inc.: As a company that operates in agricultural regions, changes in farm loan policies could impact operations or community relations.

- DE - Deere & Company: As a major manufacturer of agricultural equipment, shifts in farmer financing could affect demand for their products.

This is an AI-generated summary of the bill text. There may be mistakes.

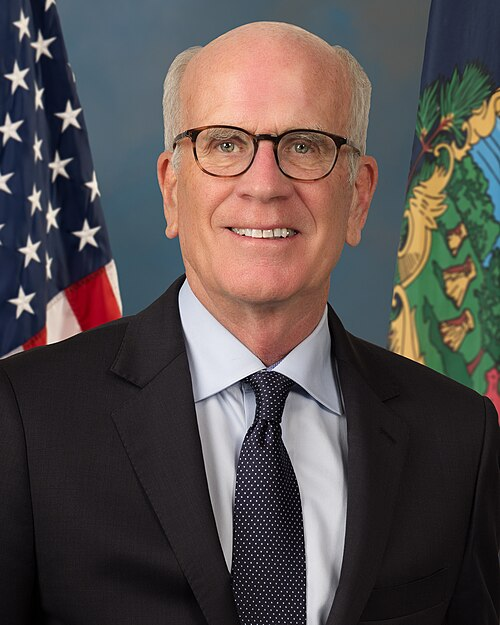

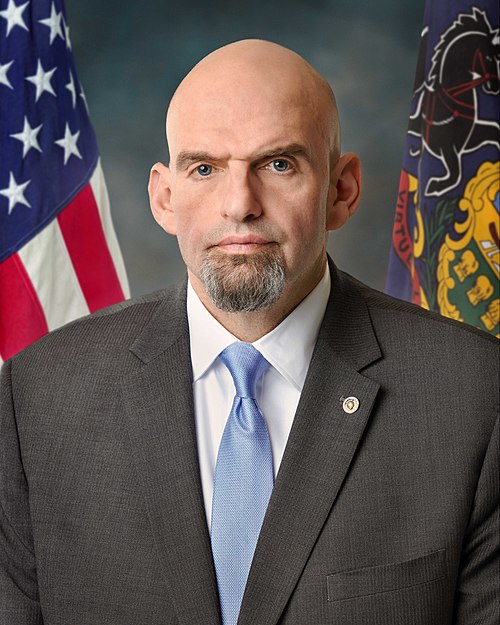

Sponsors

3 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Nov. 06, 2025 | Introduced in Senate |

| Nov. 06, 2025 | Read twice and referred to the Committee on Agriculture, Nutrition, and Forestry. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.