S. 3078: Social Security Emergency Inflation Relief Act

This bill is titled the Social Security Emergency Inflation Relief Act. Its primary objective is to provide additional financial support to individuals receiving certain government benefits during a specified timeframe. Here is a breakdown of the main provisions of the bill:

Economic Recovery Payments

The bill authorizes the Secretary of the Treasury to issue monthly payments of $200 to eligible individuals starting from January 1, 2026, until June 30, 2026. The following groups are eligible for these payments:

- Recipients of Social Security benefits.

- Individuals receiving Supplemental Security Income (SSI).

- Those with Railroad Retirement benefits.

- Veterans receiving disability compensation or pension benefits.

Eligibility Criteria

To qualify for the $200 monthly payment, individuals must:

- Reside in one of the 50 States, the District of Columbia, Puerto Rico, Guam, the U.S. Virgin Islands, American Samoa, or the Northern Mariana Islands.

- Be entitled to the aforementioned benefits during the period specified in the bill.

Payments Limitations and Regulations

The bill stipulates that:

- Individuals can receive only one payment per month, even if they qualify for multiple benefit programs.

- No payments will be made to those whose benefits were not payable or were reduced under specific provisions of the Railroad Retirement Act or related veteran benefits during the applicable period.

- If an individual passes away before the payment is certified, they will not receive any benefits under this bill.

Payment Administration

The Commissioner of Social Security, along with other relevant agencies, is responsible for certifying monthly payments. Payments will begin no later than 30 days after the bill is enacted and will be delivered electronically if possible. Eligible individuals will be notified of their eligibility, payment amounts, and delivery methods.

Tax and Program Considerations

The additional payments will not be considered income for tax purposes and will not affect eligibility for other federal assistance programs. This ensures that the receipt of $200 per month will not reduce individuals' eligibility for other benefits or be counted as income.

Use of Payments

Payments made under this act will be directed to the appropriate recipient's representative payee or fiduciary if applicable. The entire payment will be used solely for the benefit of the individual entitled to it.

Funding Appropriation

The bill allocates funding for the implementation of these payment provisions. This includes:

- Sums needed for disbursing payments to eligible individuals.

- Specific amounts for administrative costs for various agencies, including the Social Security Administration, the Railroad Retirement Board, and the Department of Veterans Affairs.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

12 bill sponsors

-

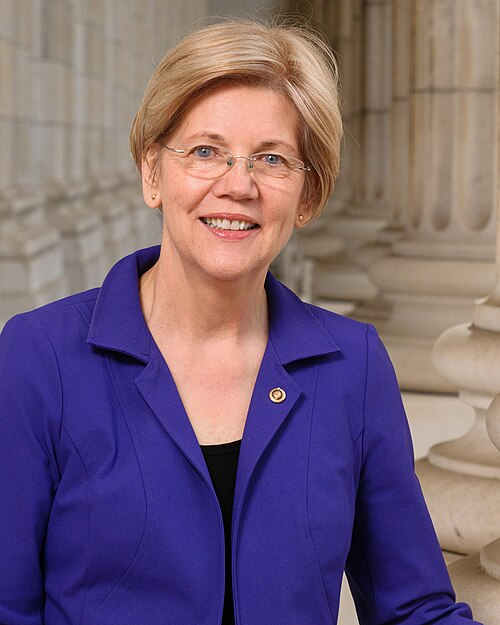

TrackElizabeth Warren

Sponsor

-

TrackAngela Alsobrooks

Co-Sponsor

-

TrackTammy Duckworth

Co-Sponsor

-

TrackKirsten E. Gillibrand

Co-Sponsor

-

TrackMark Kelly

Co-Sponsor

-

TrackAmy Klobuchar

Co-Sponsor

-

TrackAlex Padilla

Co-Sponsor

-

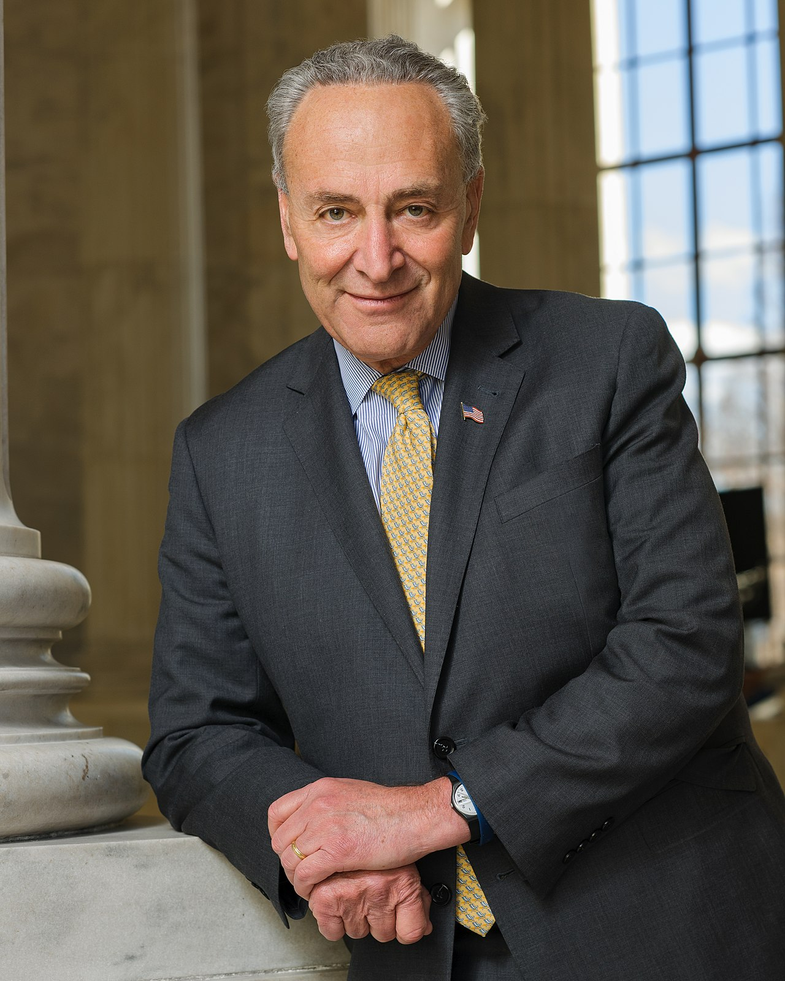

TrackCharles E. Schumer

Co-Sponsor

-

TrackTina Smith

Co-Sponsor

-

TrackChris Van Hollen

Co-Sponsor

-

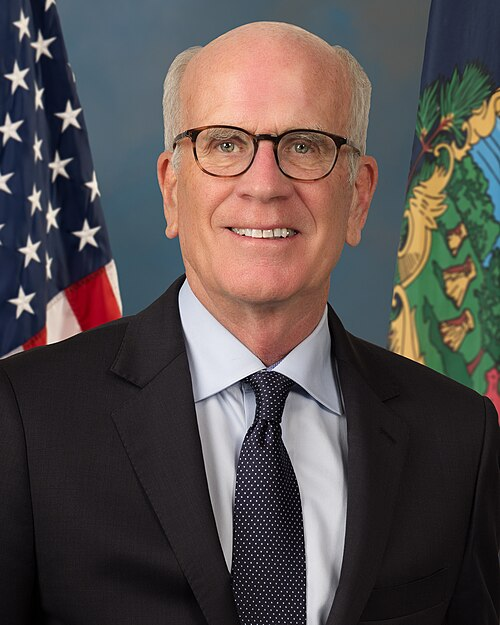

TrackPeter Welch

Co-Sponsor

-

TrackRon Wyden

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Oct. 30, 2025 | Introduced in Senate |

| Oct. 30, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.