S. 2874: To provide for the reliquidation of certain entries of golf cart tires.

The bill aims to manage the customs duties related to specific imported tire products, particularly the K389 Hole-N-One golf cart tires. It instructs the U.S. Customs and Border Protection (CBP) to take the following actions:

Duty Reassessment and Refund

The bill mandates that CBP reevaluate previously paid duties on K389 Hole-N-One golf cart tires. This reassessment will involve reliquidating the duty-paid entries at a specified duty rate, which may differ from the rate originally applied. Notably, this process is applicable regardless of the original liquidation date of the entries.

Documentation of Import Activities

The bill includes comprehensive records related to the importation of these tires, focusing on:

- Entry Numbers: Unique identifiers for each shipment.

- Dates: The timeline of the import activities, covering various periods from December 2010 through April 2016.

- Ports of Entry: Specific ports, including Savannah, Atlanta, Cleveland, Chicago, and Baltimore, where these tires were imported.

- Importers: Key importers such as Americana Development Inc., doing business as Monitor, are highlighted in these records, showing their involvement in the importation of these tires during the specified periods.

Impact on Trade and Recordkeeping

The inclusion of various entries from multiple importers and periods underlines the bill's intention to provide clarity and accountability in import transactions concerning these specific products. By stipulating the detail and associated dates of these trade activities, the bill emphasizes the historical context of customs duties related to these imports.

Regulatory Actions

This bill aims to refine and clarify the processing of customs duties and refunds, thus ensuring equitable treatment regarding past imports of the K389 Hole-N-One golf cart tires.

Relevant Companies

Americana Development Inc. (no publicly available ticker), as it is directly mentioned in the documentation and may experience changes in duty repayments or adjustments as a result of this legislation.

This is an AI-generated summary of the bill text. There may be mistakes.

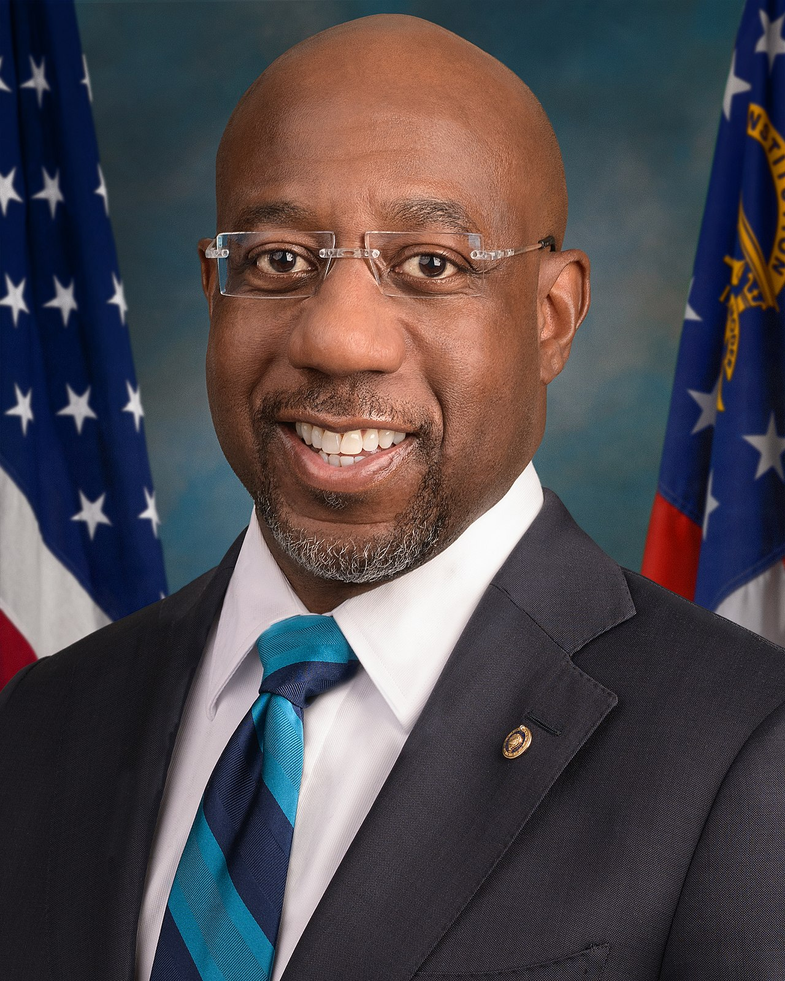

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 18, 2025 | Introduced in Senate |

| Sep. 18, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.