S. 2868: India Shrimp Tariff Act

This bill, called the India Shrimp Tariff Act, aims to increase the import duties on shrimp brought into the United States from India. The proposed changes would be implemented in phases over several years, starting from January 1, 2026. Here are the key points of the bill:

Objectives

The main goal of the bill is to protect U.S. shrimp producers from foreign competition, particularly from India, where shrimp production is supported by government subsidies and lower regulatory standards. It seeks to increase the tariffs applied to shrimp products imported from India, thereby making U.S. shrimp more competitive in the market.

Proposed Changes to Tariffs

The bill outlines a schedule for increasing duties on shrimp imported from India as follows:

- Effective January 1, 2026:

- General duty rate: 10%

- Column 2 rate: $0.25/kg

- Effective January 1, 2027:

- General duty rate: 20%

- Column 2 rate: $0.50/kg

- Effective January 1, 2028 and thereafter:

- General duty rate: 40%

- Column 2 rate: $1/kg

Valuation and Inspection Requirements

The bill also states that shrimp imported from India should be valued for duties based on the average market price of U.S. shrimp at the time of export. Additionally, it mandates that the revenues generated from the increased duties be used to fund inspections of imported shrimp and catfish to ensure safety and compliance with food standards.

Labeling and Definitions

Changes in labeling requirements for shrimp and crawfish products are proposed to ensure that consumers have accurate information about the origin of these items. The bill aims to modify the definition of processed food items to clarify that certain shrimp and crawfish products are included.

Additional Duties and Trade Agreements

In addition to the proposed increases in import duties, the bill allows for an additional duty of $0.10 per kilogram on specified shrimp products. The bill requires that these measures be implemented in accordance with the United States' existing international trade obligations.

Rationale and Congressional Findings

Citing concerns around the underpricing of imported shrimp due to foreign subsidies and variable environmental and labor standards, the bill highlights the necessity for these tariff increases. It notes that U.S. shrimp producers have faced significant challenges due to a surge in heavily subsidized shrimp imports, particularly from India. Congress emphasizes that phasing in these duties will protect sustainable shrimp harvesting in the U.S. and align with broader trade goals.

Relevant Companies

- Tyson Foods Inc. (TSN) - As one of the major producers of shrimp and seafood products, an increase in tariffs could affect their costs and pricing strategies, potentially impacting their competitive position in the market.

- Clearway Energy, Inc. (CWST) - Depending on their involvement in aquaculture and partnership with shrimp suppliers, they could see an impact due to changes in import duties and market dynamics.

This is an AI-generated summary of the bill text. There may be mistakes.

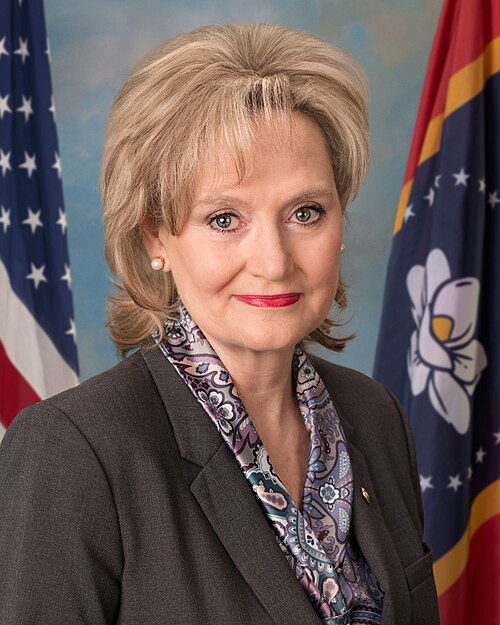

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 18, 2025 | Introduced in Senate |

| Sep. 18, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.