S. 2845: Billionaires Income Tax Act

The "Billionaires Income Tax Act" is designed to ensure that billionaires pay annual taxes by eliminating specific tax strategies and loopholes that have allowed them to minimize their tax obligations. The bill proposes changes to more than 30 provisions within the Internal Revenue Code.

Ownership Transfers and Tax Obligations

The bill sets forth criteria regarding transfers that might impact ownership. It defines terms like "applicable grantor trust" and provides exemptions for spousal transfers and charitable contributions. Additionally, it outlines guidelines regarding taxpayer status and how assets are valued, especially for non-tradable assets, which will influence tax obligations during transfers or upon death of the owner.

Asset Basis and Reporting Requirements

There are new regulations for applicable entities regarding adjustments to asset basis, partner ownership interest valuation, and mandates for the Secretary to create regulations to ensure compliance. The legislation introduces definitions for significant terms, including "applicable transfer" and "applicable savings plan," and establishes reporting requirements that will take effect after December 31, 2025.

Changes to Life Insurance and Annuity Contracts

This bill also modifies tax regulations related to life insurance and annuity contracts for applicable taxpayers. It introduces a 10% additional tax on withdrawals from certain types of contracts and repeals existing exclusions for death benefits pertaining to specific contracts. New reporting requirements will also be enforced following December 31, 2025.

Summary of Key Changes

- Elimination of tax deferral strategies for billionaires.

- New definitions and criteria related to ownership transfers.

- Guidelines for asset valuation impacting tax liabilities.

- Modification of regulations affecting life insurance and annuity contracts.

- New reporting requirements set to begin after December 31, 2025.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

22 bill sponsors

-

TrackRon Wyden

Sponsor

-

TrackAngela Alsobrooks

Co-Sponsor

-

TrackTammy Baldwin

Co-Sponsor

-

TrackRichard Blumenthal

Co-Sponsor

-

TrackTammy Duckworth

Co-Sponsor

-

TrackJohn Fetterman

Co-Sponsor

-

TrackMartin Heinrich

Co-Sponsor

-

TrackMazie K. Hirono

Co-Sponsor

-

TrackBen Ray Lujan

Co-Sponsor

-

TrackEdward J. Markey

Co-Sponsor

-

TrackJeff Merkley

Co-Sponsor

-

TrackChristopher Murphy

Co-Sponsor

-

TrackPatty Murray

Co-Sponsor

-

TrackJack Reed

Co-Sponsor

-

TrackBernard Sanders

Co-Sponsor

-

TrackBrian Schatz

Co-Sponsor

-

TrackAdam B. Schiff

Co-Sponsor

-

TrackTina Smith

Co-Sponsor

-

TrackChris Van Hollen

Co-Sponsor

-

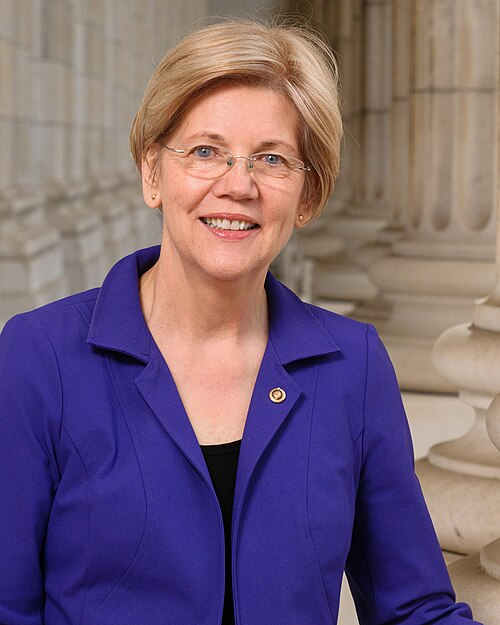

TrackElizabeth Warren

Co-Sponsor

-

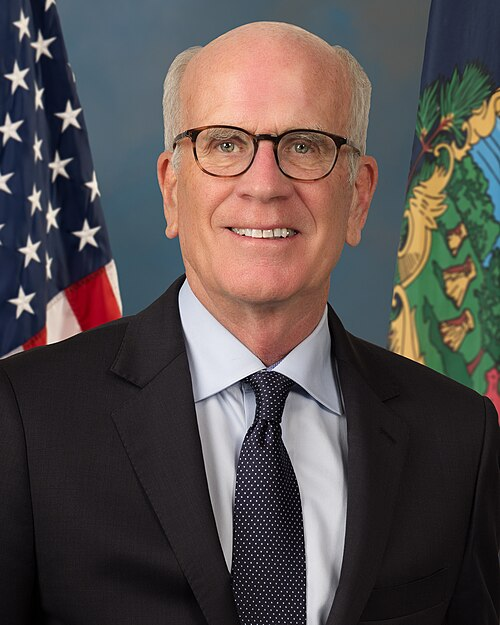

TrackPeter Welch

Co-Sponsor

-

TrackSheldon Whitehouse

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 17, 2025 | Introduced in Senate |

| Sep. 17, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.