S. 2840: Financial Exploitation Prevention Act of 2025

This legislation, known as the Financial Exploitation Prevention Act of 2025, aims to amend the Investment Company Act of 1940 to provide additional protections for certain adults, particularly in the context of financial exploitation. Here are the key elements of the bill:

1. Postponement of Redemption

The bill allows registered open-end investment companies and transfer agents acting on their behalf to postpone the payment date for redeemable securities if they suspect that the redemption request comes from a specified adult who may be experiencing financial exploitation. This postponement can last:

- Up to 15 business days initially after the redemption request.

- Possibly extended by an additional 10 business days if further exploitation is suspected.

2. Definition of Specified Adults

“Specified adults” are defined as individuals who are either:

- At least 65 years of age, or

- At least 18 years old and believed to have a mental or physical impairment that makes it difficult for them to protect their interests.

3. Requirements for Companies

To exercise these postponement powers, investment companies and transfer agents must:

- Request and document the contact information of at least one trusted individual designated by the customer.

- Notify this designated individual if there are concerns regarding possible financial exploitation.

- Conduct internal reviews to assess claims of exploitation and document these assessments.

4. Establishing Procedures

Registered investment companies must adopt procedures to:

- Identify and report cases of financial exploitation.

- Decide when to release or reinvest redeemed funds that are in dispute.

- Clearly define who within the company has the authority to make decisions regarding redemption postponements.

5. Record Retention and Reporting

Investment companies are required to retain records of all postponements and decisions made regarding suspected exploitation. These records must be made available to the relevant regulatory authorities upon request.

6. Recommendations to Congress

The bill also mandates that within one year of its enactment, the Securities and Exchange Commission (SEC) must report to Congress with recommendations for further regulatory or legislative actions to enhance protections against the financial exploitation of specified adults.

7. Consultation with Other Agencies

In preparing the report, the SEC must consult with various regulatory bodies, including the Commodity Futures Trading Commission and the Bureau of Consumer Financial Protection, among others.

Relevant Companies

- Vanguard - As a major provider of open-end mutual funds, they would be significantly affected by the operational changes required to comply with the postponement and reporting rules.

- Franklin Templeton - Similarly, their operations in managing investment funds will need adjustments to implement the proposed procedures and protections for specified adults.

This is an AI-generated summary of the bill text. There may be mistakes.

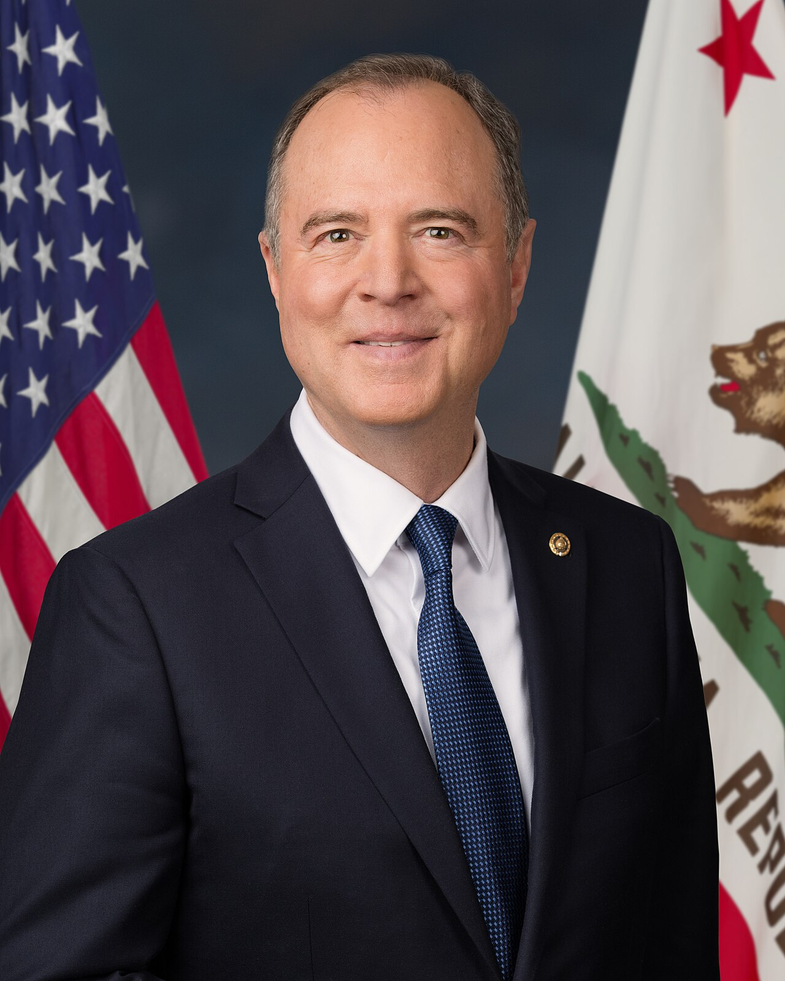

Sponsors

6 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 17, 2025 | Introduced in Senate |

| Sep. 17, 2025 | Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.