S. 2794: Deactivating and Eliminating Cards Linked to Inactive or Nonexistent Employees Act

This bill, referred to as the Deactivating and Eliminating Cards Linked to Inactive or Nonexistent Employees Act or the DECLINE Act, aims to improve the management of charge cards issued to federal employees who are leaving their jobs. Here’s a summary of its main provisions:

Charge Card Definitions

The bill defines several key terms:- Agency: A federal agency as defined in the relevant United States Code.

- Charge Card: Any purchase, travel, or payment card issued by a federal agency assigned to an employee.

- Covered Individual: An employee who is separating from the agency (due to discharge, retirement, etc.), including those in certain high-level positions.

Policy Establishment

Within 30 days after the bill becomes law, each agency's chief financial officer, in collaboration with the human resources officer, must establish a policy that requires:- The covered individual to return their charge card to the agency.

- Agency personnel to physically secure the charge card.

- The covered individual to remove the charge card from any digital wallets or electronic devices.

- Agency personnel to immediately deactivate the charge card and close or suspend the associated account.

- Reporting the charge card as invalid to the issuing financial institution.

Compliance Review

The bill requires the Government Accountability Office (GAO) to conduct annual reviews of compliance, which will include:- The number of charge cards issued and deactivated by each agency.

- How well agencies monitor charge card usage and prevent misuse or fraud.

- The status of the implementation of the new policies by agencies.

- The total amount spent on late fees related to charge cards over the past year.

- How agencies report required management data to their banking partners.

Timeframe for Implementation

The law mandates that agencies develop and implement these policies promptly to ensure there are clear processes for handling charge cards as employees leave, which helps prevent potential misuse of these cards after an employee has separated from the agency.Potential Impact on Federal Operations

The bill intends to strengthen internal controls over charge card usage within federal agencies, which can lead to better financial practices and reduce the possibility of fraud related to unused or improperly managed cards.Relevant Companies

None found.This is an AI-generated summary of the bill text. There may be mistakes.

Show More

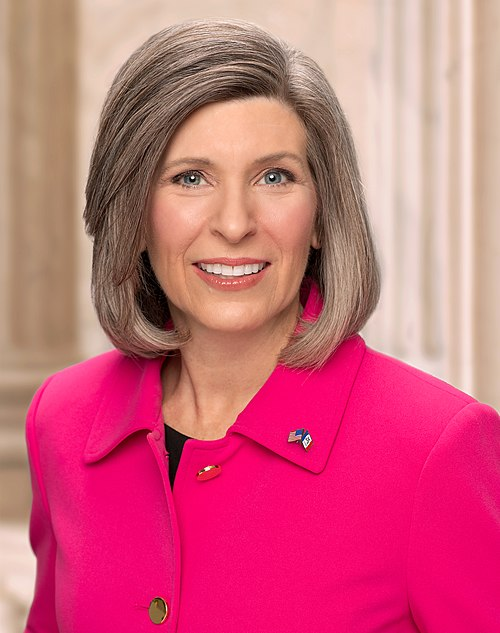

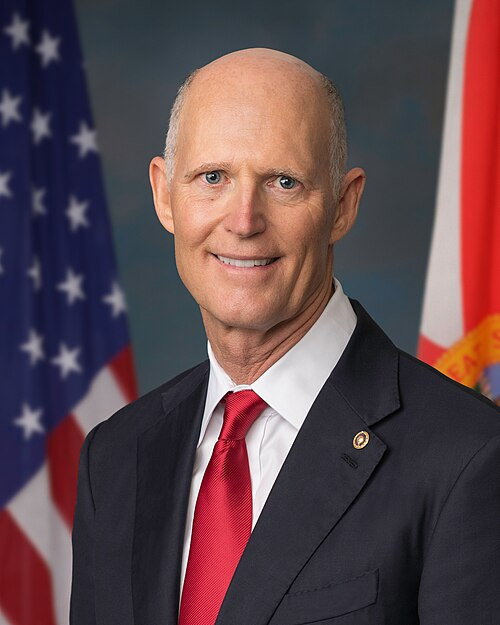

Sponsors

4 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 11, 2025 | Introduced in Senate |

| Sep. 11, 2025 | Read twice and referred to the Committee on Homeland Security and Governmental Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.