S. 2779: Tax Cut for Striking Workers Act of 2025

This bill, titled the Tax Cut for Striking Workers Act of 2025, proposes to amend the Internal Revenue Code in a way that affects how certain financial compensation is taxed during labor disputes. Here’s a breakdown of its main points:

Key Provisions

-

Change in Tax Treatment

The bill aims to exclude what are termed qualified strike benefits from being counted as gross income for tax purposes. This means that when workers receive compensation while on strike, that money won’t be taxed as income.

-

Definition of Qualified Strike Benefits

Qualified strike benefits are defined as compensation provided to a union member by their labor organization (which is a nonprofit under U.S. law) as partial replacement for lost wages due to a strike, lockout, or work stoppage related to labor disputes or rail labor issues.

-

Impact on Earned Income Tax Credit

The bill also seeks to amend the provisions concerning the Earned Income Tax Credit (EITC). It proposes that compensation received under this new section (related to strikes) should be taken into account when calculating eligibility for the EITC.

-

Administrative Updates

The bill includes clerical changes to update the U.S. tax code, specifying where this new section fits within existing laws.

-

Effective Date

If passed, the changes would apply to any compensation received after December 31, 2025.

Overall Impact

The main goal of this bill is to provide financial relief to workers who face income loss due to engaging in strikes or related labor actions. By classifying strike benefits as non-taxable income, the intention is to support workers during times of financial hardship in labor disputes.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

11 bill sponsors

-

TrackRuben Gallego

Sponsor

-

TrackTammy Baldwin

Co-Sponsor

-

TrackRichard Blumenthal

Co-Sponsor

-

TrackCory A. Booker

Co-Sponsor

-

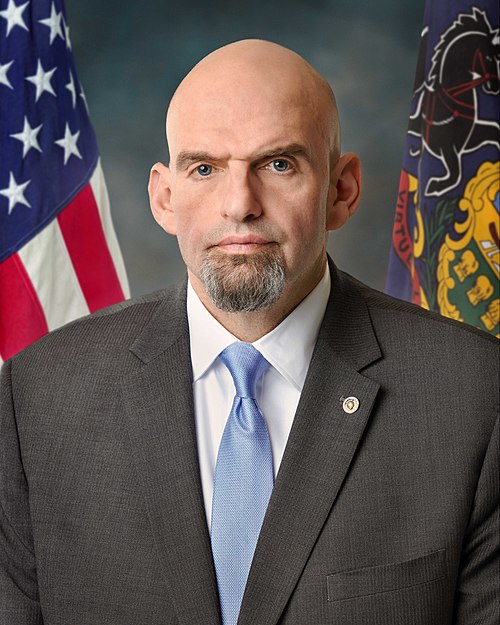

TrackJohn Fetterman

Co-Sponsor

-

TrackKirsten E. Gillibrand

Co-Sponsor

-

TrackJeff Merkley

Co-Sponsor

-

TrackBrian Schatz

Co-Sponsor

-

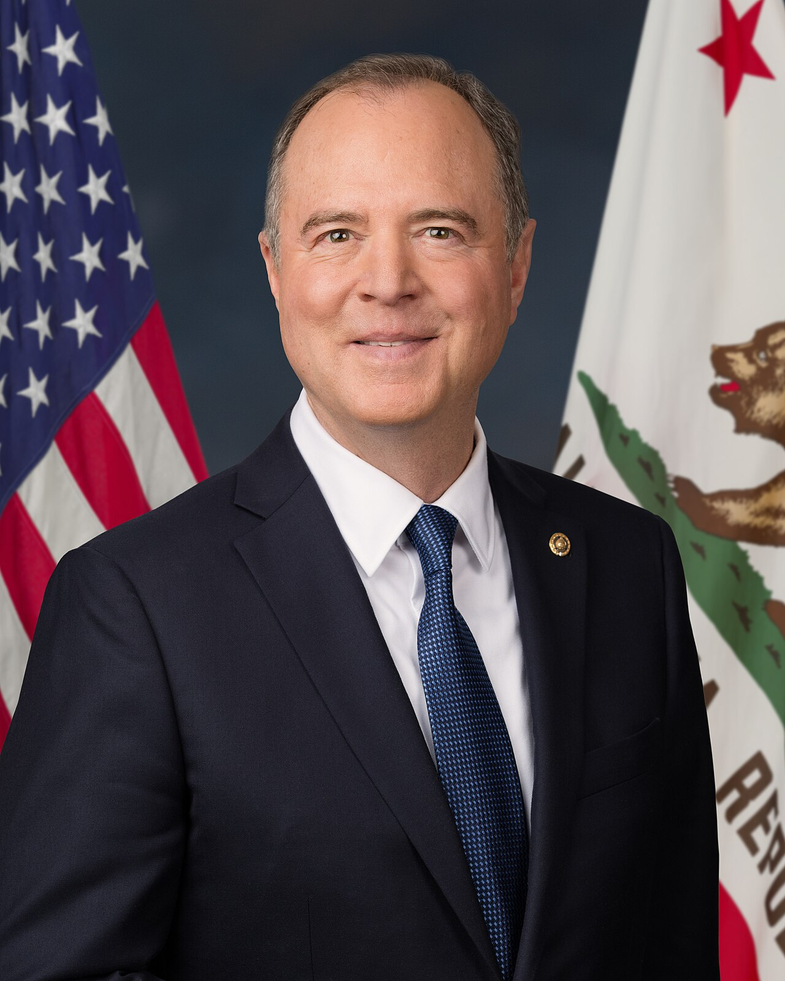

TrackAdam B. Schiff

Co-Sponsor

-

TrackChris Van Hollen

Co-Sponsor

-

TrackRon Wyden

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 11, 2025 | Introduced in Senate |

| Sep. 11, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.