S. 2718: To amend the Community Development Banking and Financial Institutions Act of 1994 to provide for capitalization assistance to enhance liquidity.

The bill, known as S. 2718, proposes amendments to the Community Development Banking and Financial Institutions Act of 1994. Its main objective is to enhance the liquidity of community development financial institutions (CDFIs) by providing them with capitalization assistance. Here’s a breakdown of what the bill entails:

Capitalization Assistance

The bill allows a fund to provide financial support to various organizations that focus on community development. This support can take several forms:

- Purchasing loans that have been originated by CDFIs or through loan participations.

- Offering guarantees, reserves for loan losses, or other types of credit enhancement to promote liquidity for CDFIs.

- Implementing measures to otherwise improve the liquidity of these institutions.

Selection of Recipients

Organizations that can receive assistance must have a primary focus on promoting community development, but they do not need to be classified as CDFIs. The selection process and the amount of assistance are determined by the fund, based on specific criteria that prioritize organizations with:

- Experience in managing loan purchase structures or similar activities.

- The capacity to increase both the number and volume of loan originations, leveraging any awards with private capital.

- Plans to support CDFIs that cover broad geographic areas or serve underserved borrowers.

Funding Limits and Regulations

The bill increases the maximum amount of funds that can be awarded from $5 million to $20 million. Additionally, it grants the Secretary of the Treasury the authority to create regulations necessary to implement the provisions of the bill.

Emergency Capital Investment Funds

The bill modifies how funds related to purchases made by the Secretary are handled. Such funds, which include interest and dividends, are directed to be deposited into the fund and used for:

- Providing financial assistance to eligible organizations.

- Offering financial and technical assistance, with some regulatory waivers.

Reporting Requirements

Within one year of the initial assistance being provided under the new provisions, the Secretary of the Treasury must submit a written report to Congress. The report will detail:

- The total amounts of loans and guarantees related to CDFIs.

- The overall competitiveness of these institutions as a result of the fund's actions.

- The impact on liquidity for CDFIs from the purchases and guarantees made.

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

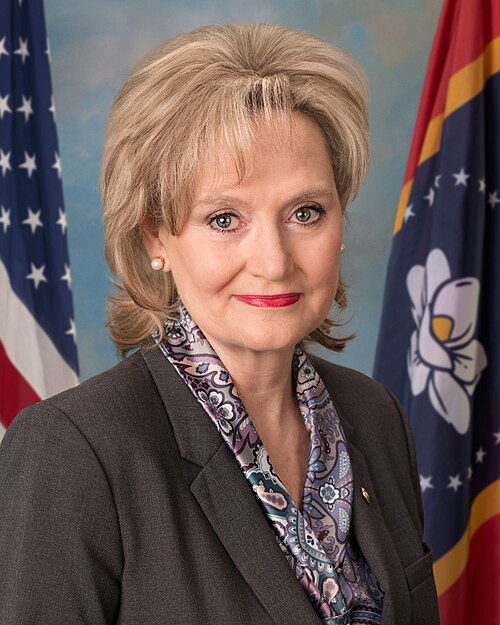

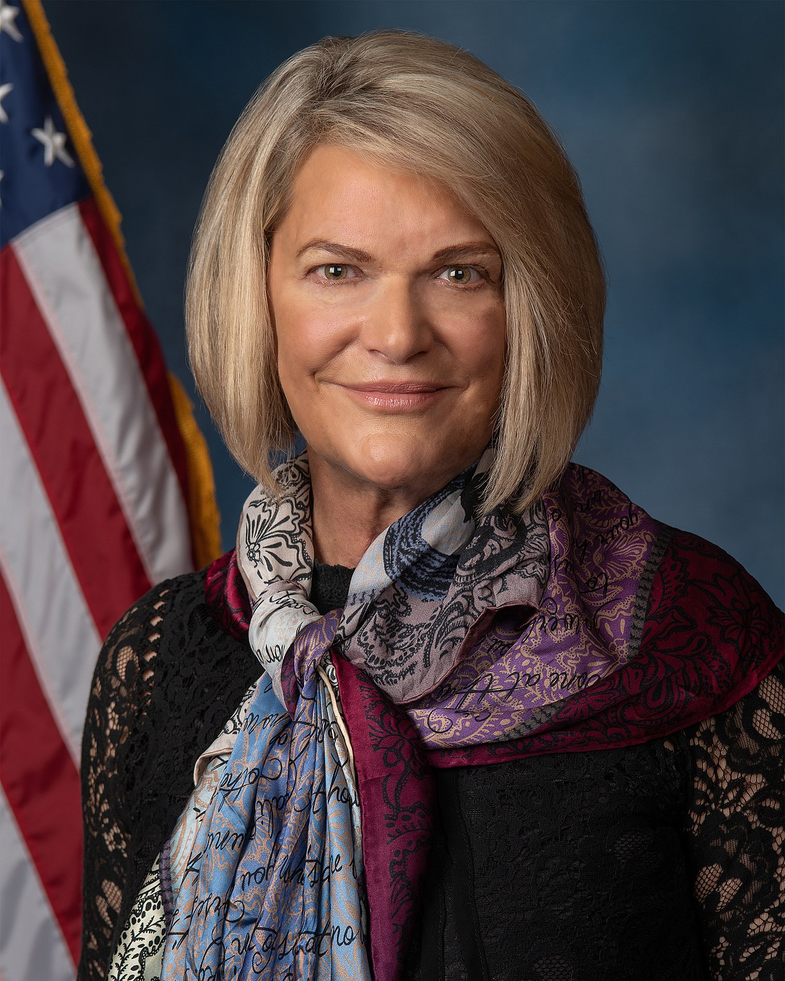

Sponsors

7 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 04, 2025 | Introduced in Senate |

| Sep. 04, 2025 | Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.