S. 2629: Taxpayer Notification and Privacy Act of 2025

This bill, titled the Taxpayer Notification and Privacy Act of 2025

, proposes changes to the Internal Revenue Code that would require the IRS to provide taxpayers with more detailed notices when seeking information from third parties, such as banks or employers. The main points of the bill include:

Key Provisions

- Specificity in Notices: The IRS must specify each item of information it intends to obtain from other parties. This means that if the IRS is looking for information that a taxpayer could reasonably provide themselves, it has to be clear about what that information is.

- Time for Response: Taxpayers will be given at least 45 days to respond to the IRS before the IRS can contact any third parties for the same information. If the taxpayer requests more time and has a valid reason, this period can be extended.

- Conditions for Contacting Third Parties: The IRS can only bypass the notification process if it determines that the information from third parties is absolutely necessary, even if the taxpayer could provide it. This would emphasize the need for the IRS to justify its actions.

- Effective Date: These changes would go into effect 12 months after the bill is enacted. This gives taxpayers time to understand their rights and the new procedures that would be implemented.

The bill seeks to improve transparency and communication between the IRS and taxpayers, while also offering taxpayers opportunities to provide information themselves. It emphasizes that taxpayers should be informed and given time to respond before the IRS takes further steps to collect information from third parties.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

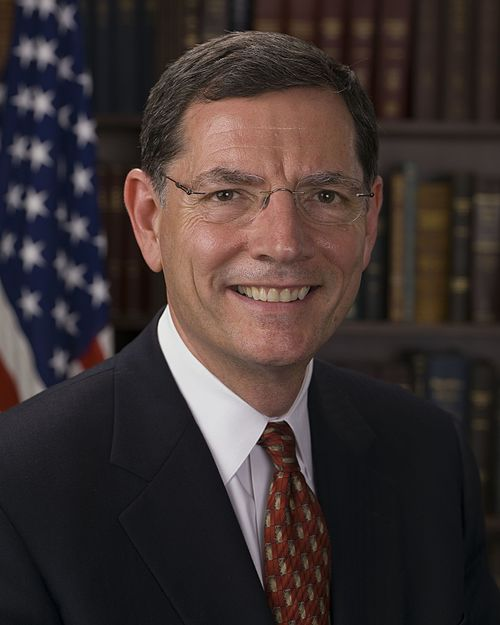

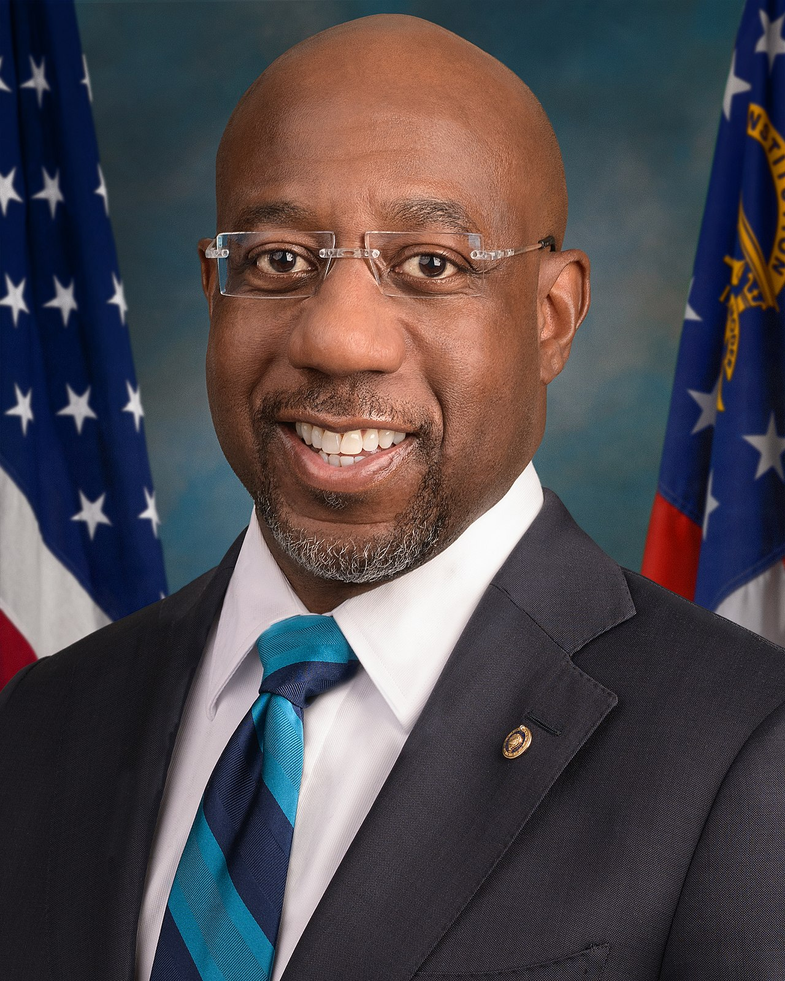

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 31, 2025 | Introduced in Senate |

| Jul. 31, 2025 | Read twice and referred to the Committee on Finance. (text: CR S5000-5001: 2) |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.