S. 2552: PRC Broker-Dealers and Investment Advisers Moratorium Act

This bill, titled the PRC Broker-Dealers and Investment Advisers Moratorium Act, proposes changes to U.S. securities laws regarding brokers and investment advisers with connections to the People's Republic of China (PRC). The main objectives include introducing prohibitions on the membership of certain brokers and dealers as well as restricting investment advisers from registering with the Securities and Exchange Commission (SEC) if they have affiliations with PRC entities. Below are the key components of the bill:

Prohibitions on Broker-Dealer Membership

The bill amends the Securities Exchange Act of 1934 to include specific restrictions on broker-dealers:

- A broker or dealer cannot be a member of a national securities association if:

- It is controlled by a PRC entity or a national of the PRC who resides there.

- It has an affiliate in the PRC providing essential services, like software or customer support.

- This includes definitions for important terms such as "affiliate," "control," and "U.S. person" to clarify which entities are affected.

- National securities associations will have the authority to examine compliance with these new rules, which may extend to broker-dealers located outside of the U.S.

Prohibitions on Investment Adviser Registration

The bill also outlines similar prohibitions for investment advisers under the Investment Advisers Act of 1940:

- A person is prohibited from registering as an investment adviser if:

- They are controlled by a PRC entity or a national residing in the PRC.

- They have an affiliate within the PRC that provides essential support services.

- The SEC will have the authority to examine investment advisers to ensure adherence to these restrictions.

Termination Clause

Both sets of prohibitions—including those for broker-dealers and investment advisers—will automatically terminate five years after the bill is enacted. This means the restrictions may be temporary, potentially allowing for reassessment of the situation at that future point.

Examination Authority

The bill grants examination authority to both national securities associations and the SEC to ensure compliance with these new regulations. This authority is crucial, as it empowers these bodies to check whether affected entities adhere to the prohibitions set forth by the bill.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

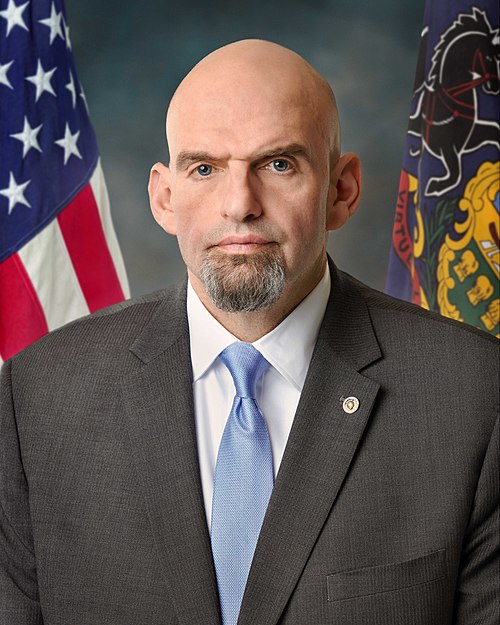

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 30, 2025 | Introduced in Senate |

| Jul. 30, 2025 | Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.